One Platform. Every Investment.

Total Control.

Stop juggling separate systems for public markets, alternatives, insurance, and managed accounts. Your advisors deserve a unified investment experience that actually works.

Built for modern investment management.

- The Problem

Your Investment Universe Is Fragmented

Advisor building a client portfolio:

Public equities in one system. Alternatives in another. Insurance products somewhere else. SMAs in a fourth platform.

Client asks:

“How’s my overall allocation looking?”

Advisor thinks:

“Give me 20 minutes to pull data from four different places.”

Your investment management feels like investment chaos.

- What's Actually Broken

Silos Don’t Build Portfolios

Platform Proliferation

Every product category lives in its own system. No unified view. No holistic management.

Analytics Anarchy

Different performance data from different sources. Nothing reconciles. Nothing makes sense together.

Experience Fragmentation

Advisors learn six different interfaces to do one job. Clients see disconnected pieces, not portfolios.

Operational Overhead

More systems mean more complexity, more training, more things that break.

Your investment platform should unite, not divide.

- What We Fix

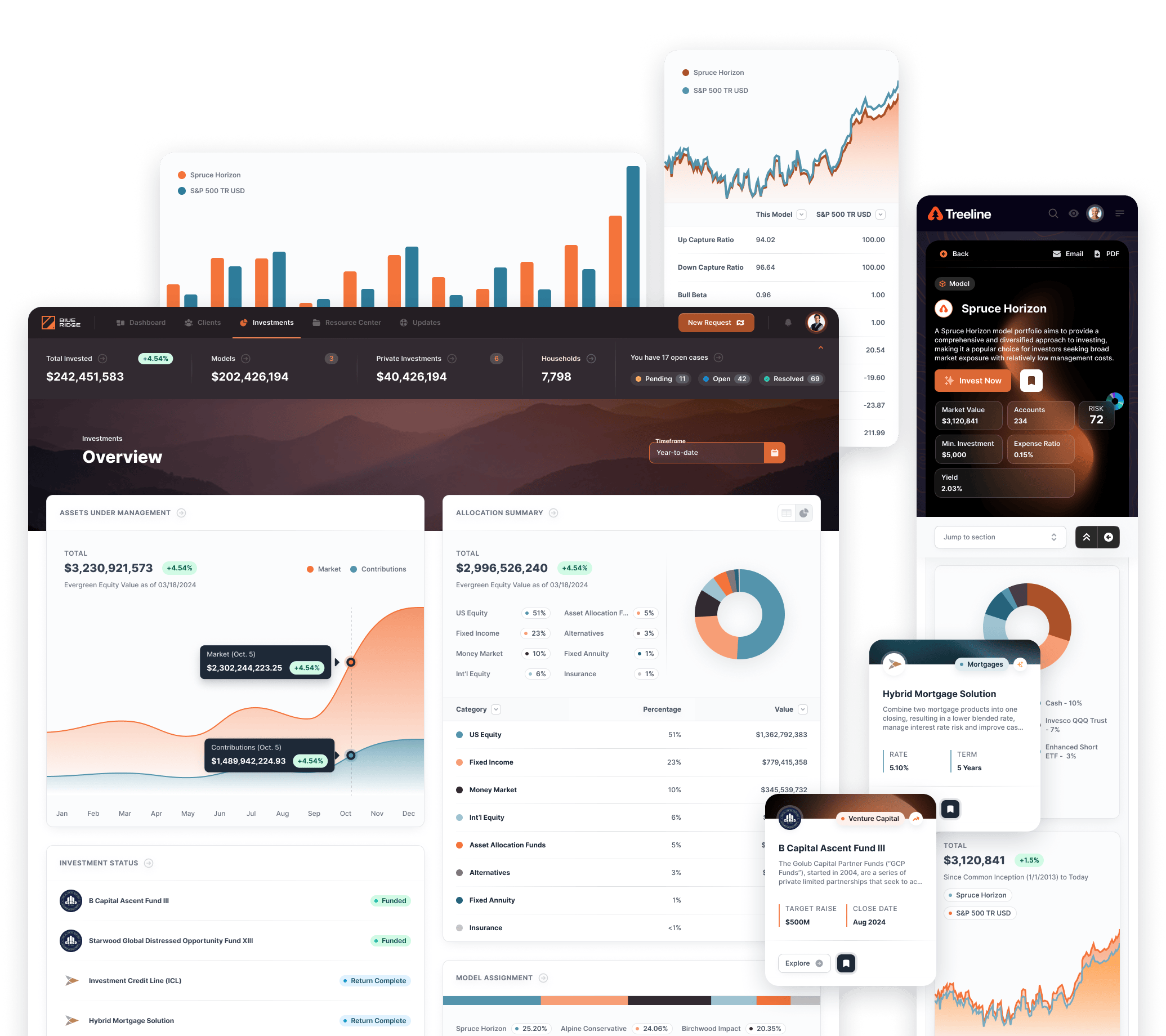

The Unified Investment Experience

You’ve Been Waiting For

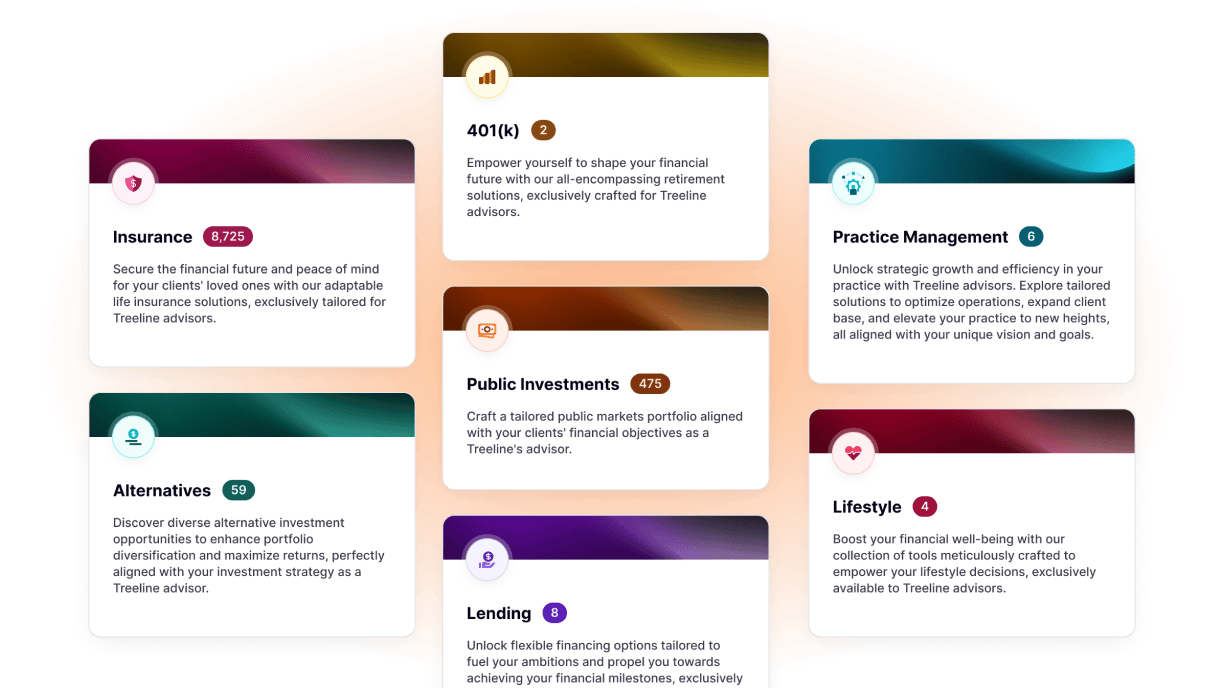

Everything in One Place

Public markets, alternatives, insurance, 401(k)s, donor-advised funds—unified in a single, streamlined experience.

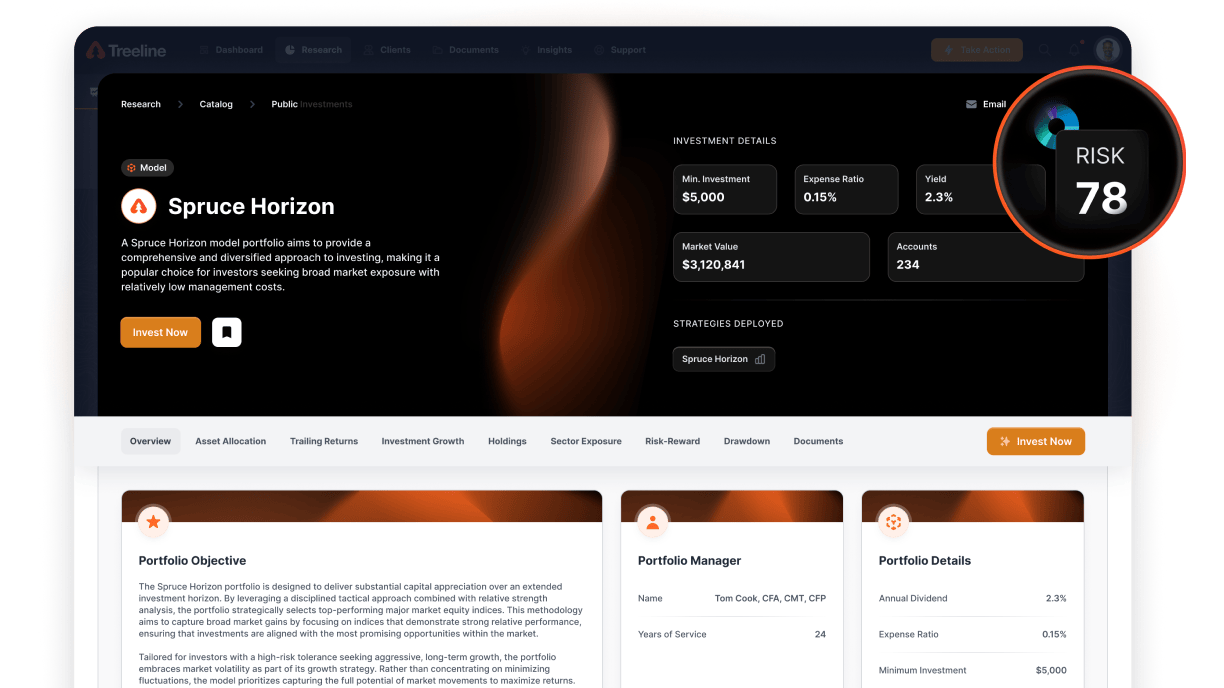

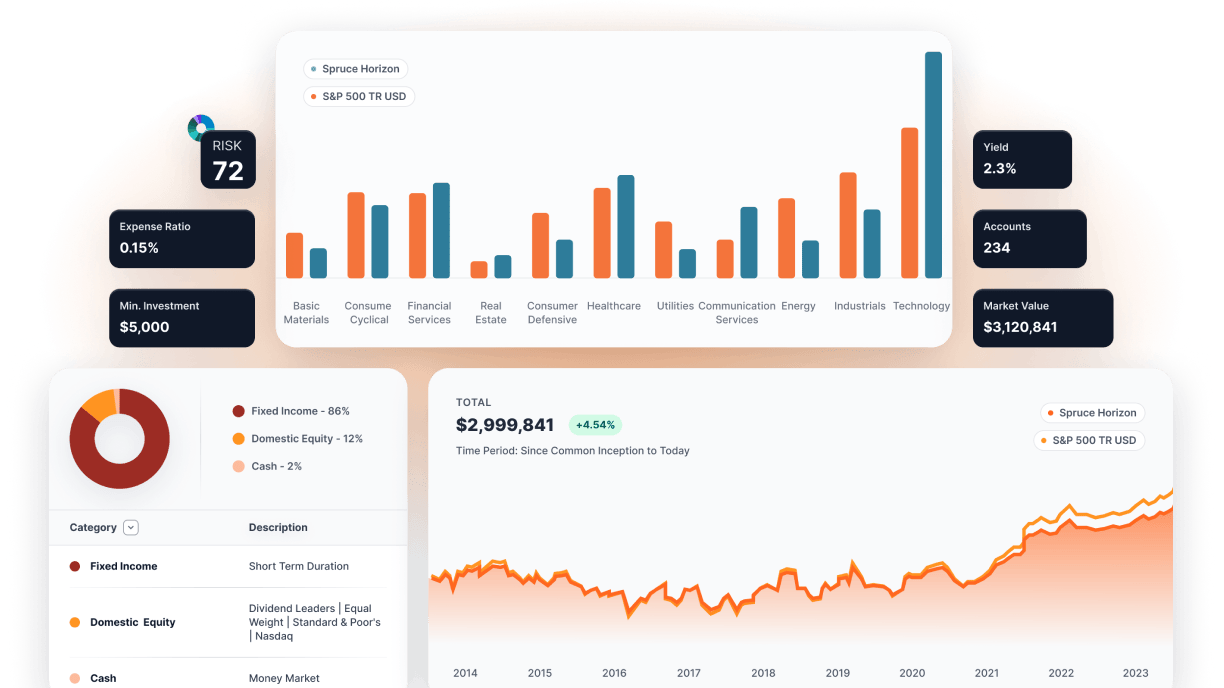

Analytics Integration

Works with your preferred analytics provider. Morningstar, FactSet, YCharts—your choice, our platform.

Advisor-Centric Design

Interface built for how advisors actually work. Portfolio construction that makes sense. Tools that help instead of hinder.

Client-Ready Presentation

Everything looks professional and cohesive. Your brand, your standards, unified experience.

What You Get

Unified Investment Universe

-

Public markets, alternatives, insurance in one view

-

401(k) rollovers & donor-advised funds integrated

-

Complete portfolio visibility across all asset classes

-

Seamless navigation between investment types

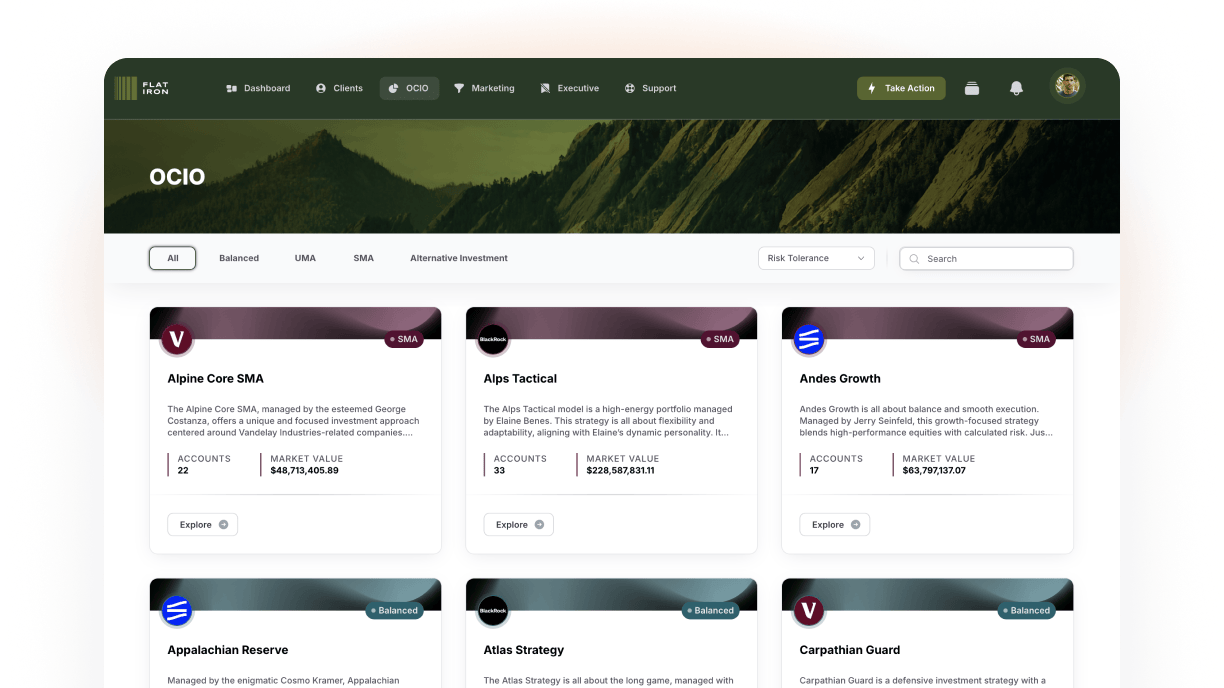

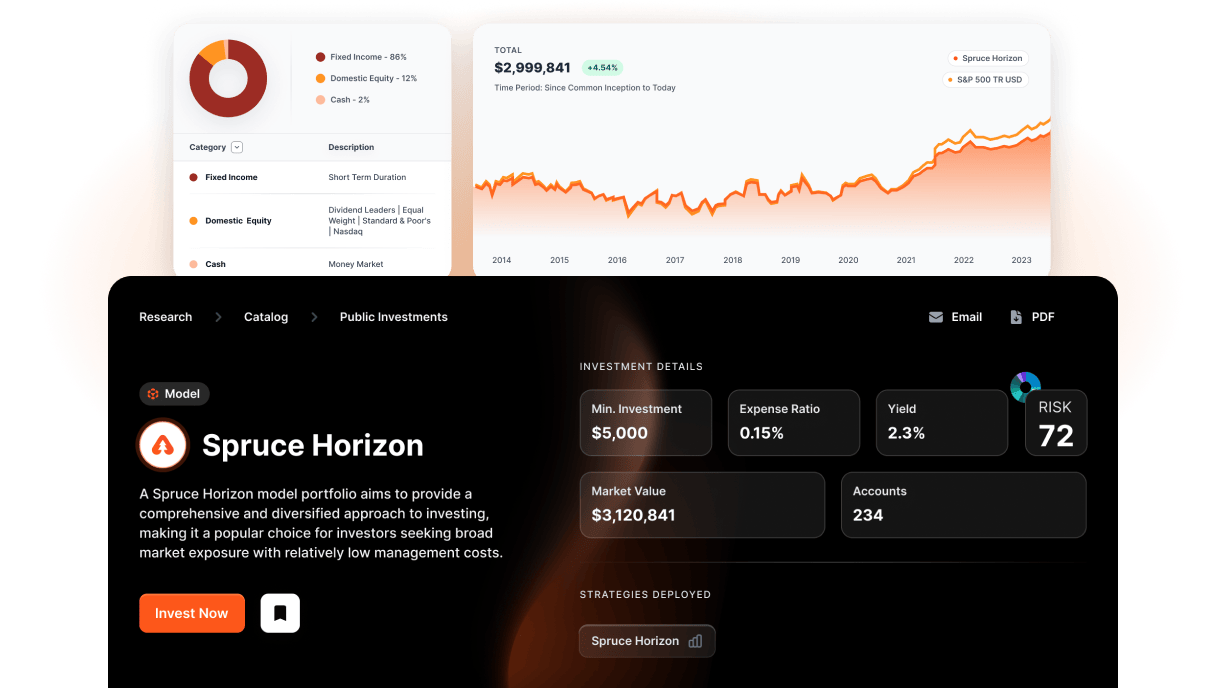

Model Integration

-

Manage model portfolios across custodians & platforms

-

Seamless integration with your existing model management

-

Custom allocation tools with real-time validation

-

Drift monitoring & rebalancing alerts

Analytics Integration

-

Connect your preferred analytics provider

-

Unified performance reporting across all investments

-

Custom dashboards tailored to your investment process

-

Risk analytics & attribution reporting

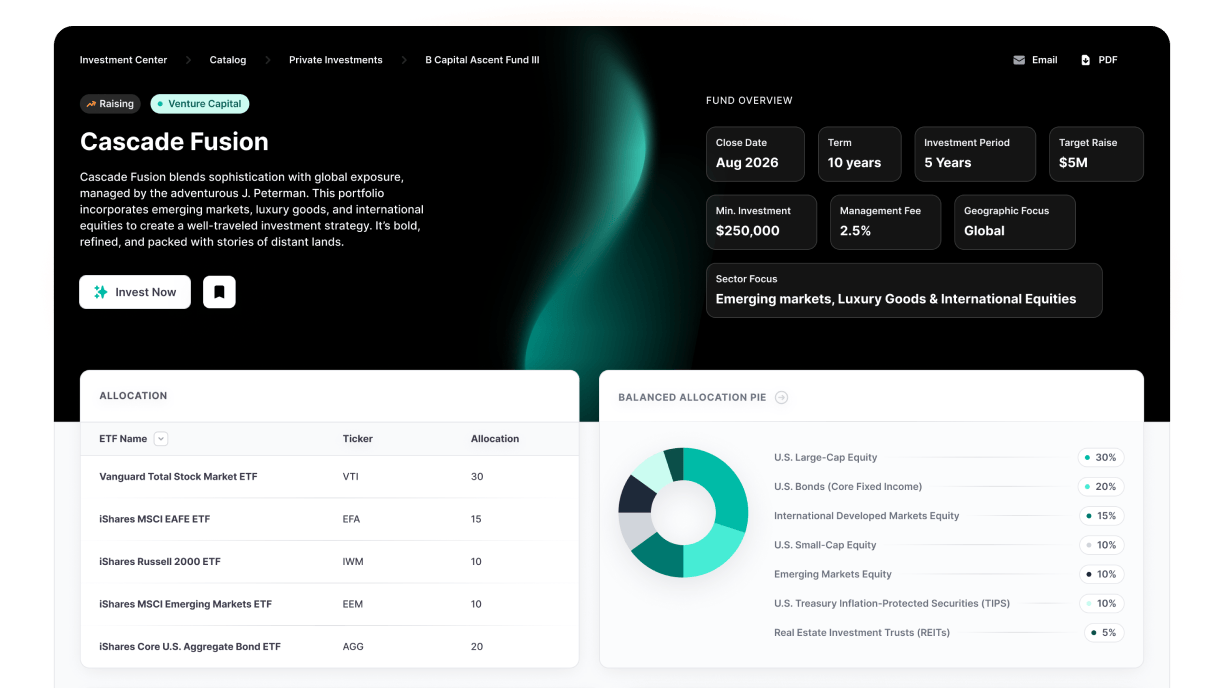

Fund Curation & Comparison

-

Filter strategies by values, fees, liquidity & metrics

-

Side-by-side comparison tools for alternatives

-

Due diligence workflows & documentation

-

Investment committee approval processes

Alternative Fund Integration

-

Private equity, real estate, venture funds included

-

Streamlined alternative onboarding workflows

-

Performance tracking for illiquid investments

-

Compliance-ready documentation & reporting

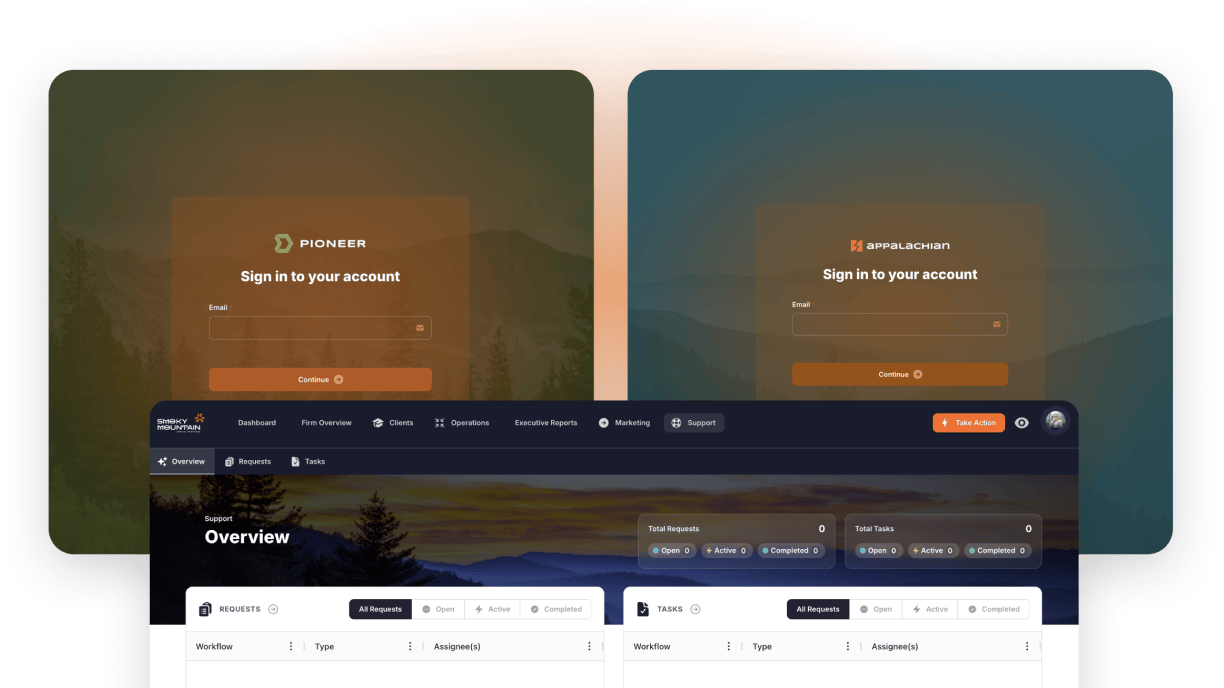

Customizable Investment UI/UX

-

Beautiful, branded experience across all touchpoints

-

Advisor-facing dashboards with your firm's design

-

Client-ready investment summaries & reports

-

White-labeled experience with zero vendor branding

The Transformation

- Before Investment Center

-

Portfolio management = juggling six different systems

-

Analytics = hoping different data sources align

-

Client presentation = cobbled together from multiple platforms

-

Advisor efficiency = lost in system complexity

- After Investment Center

Portfolio management

unified view of everything

Analytics

consistent data from your preferred provider

Client presentation

professional, cohesive experience

Advisor efficiency

focused on advice, not software

Real Results

Abby Salameh

Chief Growth Officer, RFG Advisory

50%

reduction in time spent gathering investment data

Unified

analytics across all asset classes

Professional

client presentation for every investment

Single platform

training instead of multiple systems

Advanced Features

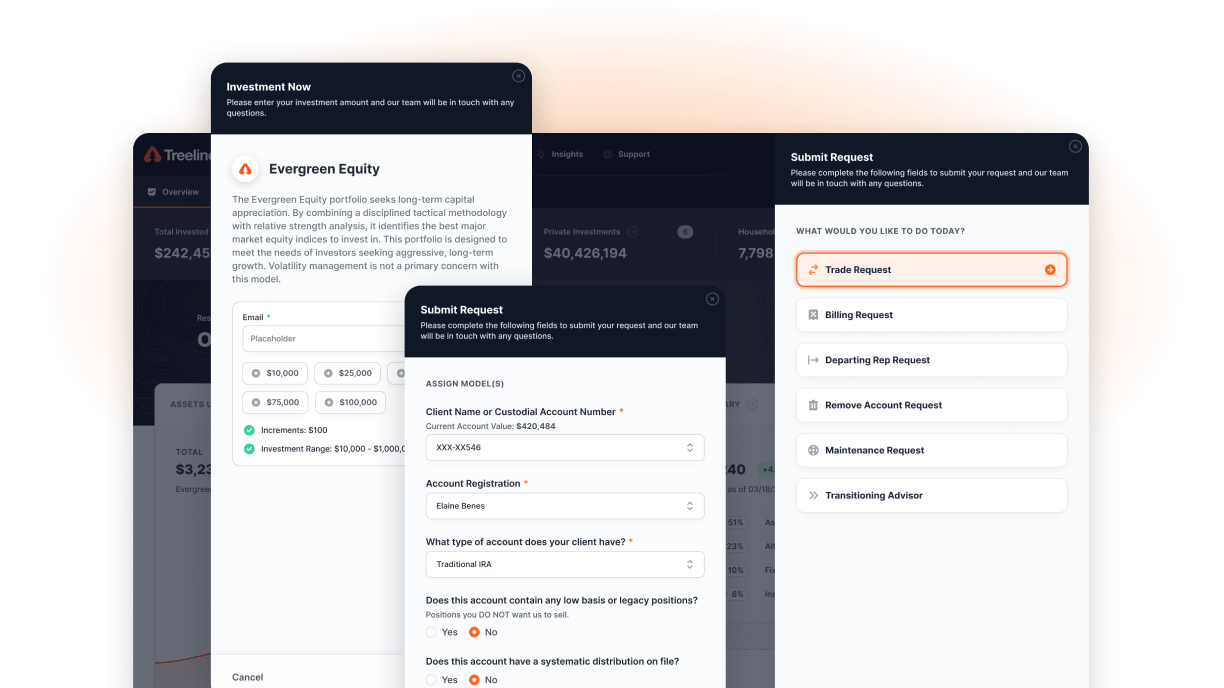

Trading Workflow Integration

-

Connect investment decisions to trade execution

-

Automatic allocation & rebalancing

-

Real-time funding alerts & cash management

-

Direct integration with your trading platform

Performance Analytics

-

Comprehensive performance tracking across all investments

-

Risk analytics & attribution reporting

-

Custom benchmarking & peer comparisons

-

Client-ready performance summaries

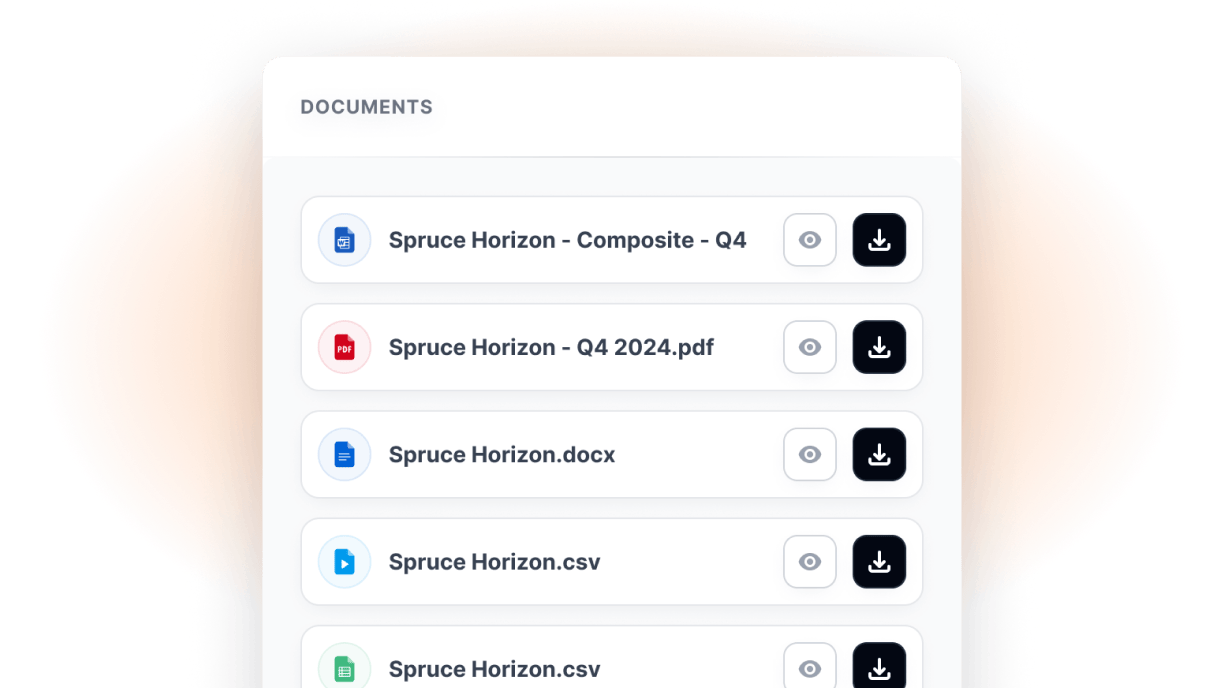

Document Management

-

Centralized storage for all investment documentation

-

Due diligence materials & committee decisions

-

Client investment summaries & reports

-

Compliance documentation & audit trails

Built For

Modern Investment Management

Rep as

PM Workflows

Enable advisors to build bespoke models and implement unique strategies within your governance framework.

Alternative

Investment Access

Seamless integration of private markets, real estate, and venture opportunities alongside traditional investments.

Compliance

Integration

Built-in approval workflows, suitability checks, and regulatory documentation for all investment types.

Multi-Tenant Architecture

Different advisors can have customized experiences while maintaining centralized oversight and control.

Ready to Unify Your Investment Experience?

Watch unified investment management in action.

30 minutes to design the investment experience your advisors need.

Stop fragmenting the investment experience.

Stop forcing advisors to become system integrators

Stop presenting disconnected pieces as portfolios.

Why This Matters

Your advisors are investment professionals. Their tools should reflect that.