Trading.

Without the Trading Software Nightmare.

Your advisors want to rebalance portfolios and submit trades. Your trading platform wants them to become software engineers first.

Skip the complexity. Get to the trade.

- The Problem

Your Trading Platform

Wasn't Built for Advisors

Advisor needs to rebalance 12 accounts.

Logs into trading system. 47 buttons. 23 drop-downs. Zero intuition about what anything does.

20 minutes later:

Still trying to figure out how to submit a simple allocation change.

Client calls:

“When will my rebalancing be done?” Advisor has no idea.

Your trading platform is a barrier, not a bridge.

- What's Actually Broken

Complexity That Kills Productivity

Interface Insanity

Trading platforms built for traders, forced on advisors. Everything requires three clicks and a PhD.

Validation Voodoo

System rejects trades for mysterious reasons. No clear explanation. No guidance on how to fix it.

Status Blackouts

Trade submitted. Then what? No visibility. No updates. No confidence.

Error Explosion

One mistake breaks everything. Start over. Hope for better luck next time.

Your advisors avoid trading because trading software is terrible.

- What We Fix

Trading That Actually

Works for Advisors

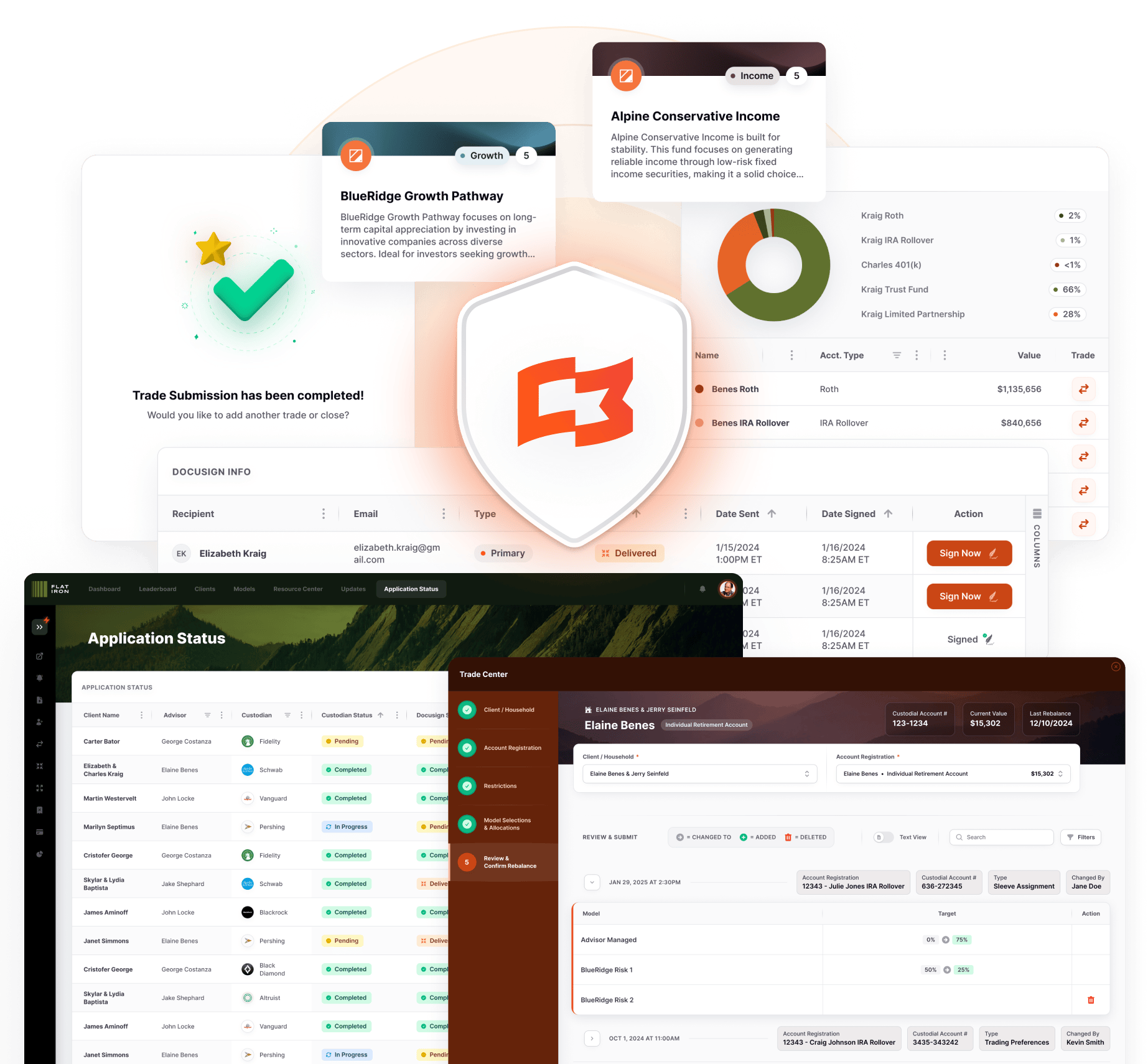

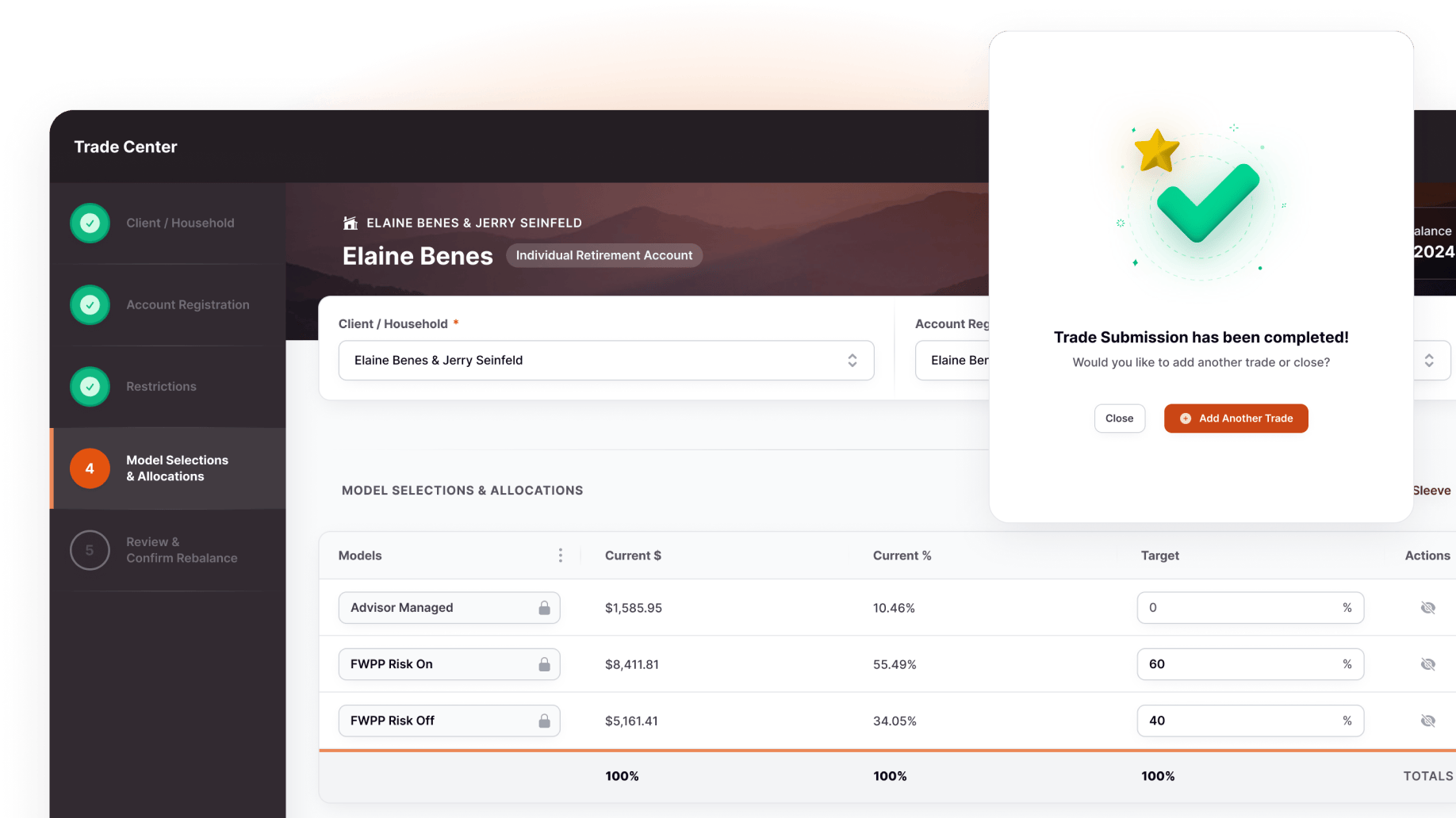

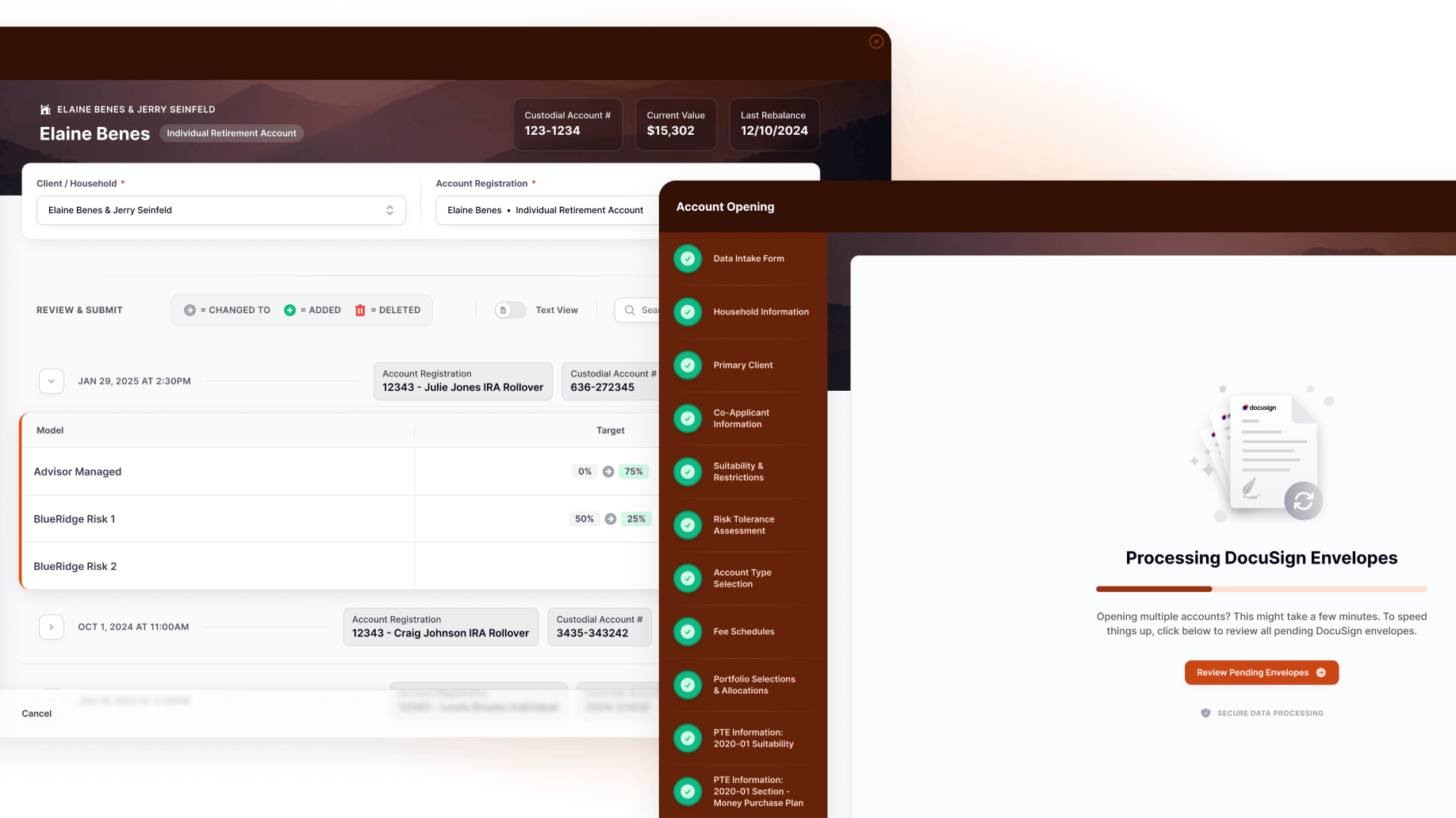

Simplified Interface

Clean, intuitive design that makes sense to advisors. Submit trades without a manual.

Smart Validations

System checks everything before submission. Clear error messages with actionable fixes.

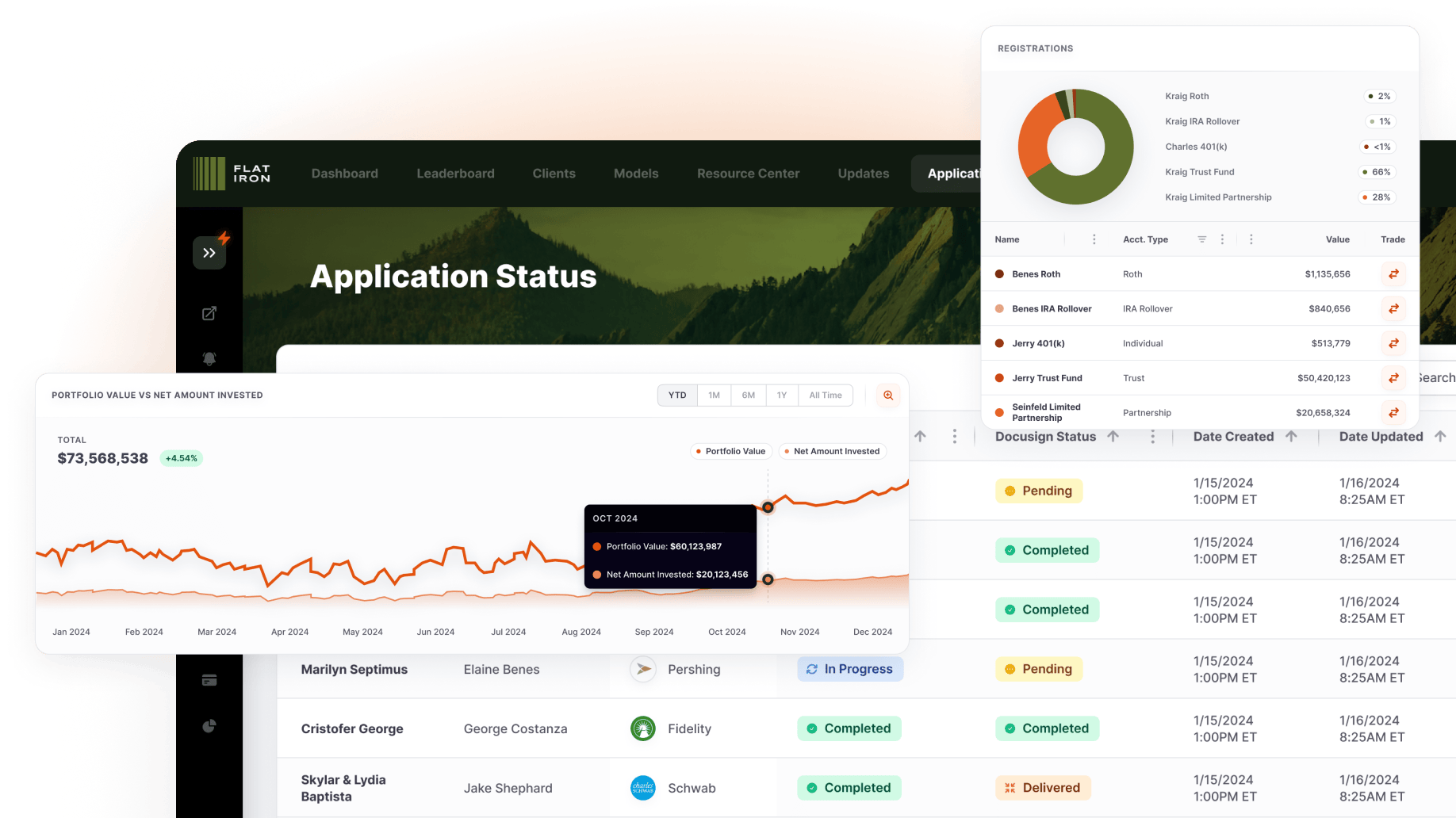

Real-Time Visibility

See your trades from submission to settlement. Know exactly what’s happening when.

Integration Intelligence

Works with your existing trading platform while hiding the complexity.

What You Get

Unified Trading Dashboard

-

View all trades, allocations & restrictions in one place

-

Clean interface designed for advisors, not traders

-

Real-time status updates from submission to settlement

-

Complete trade history & audit trail

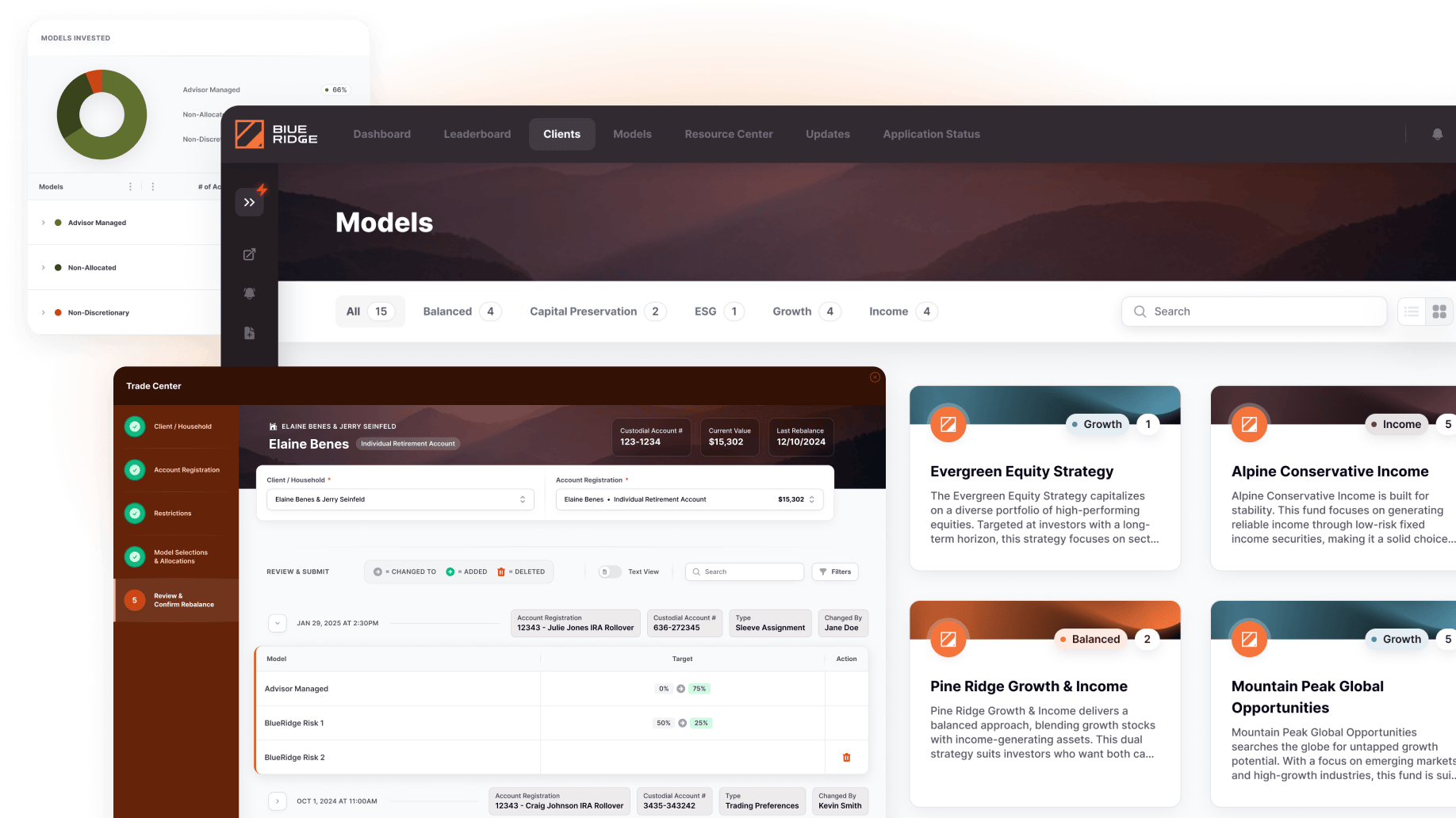

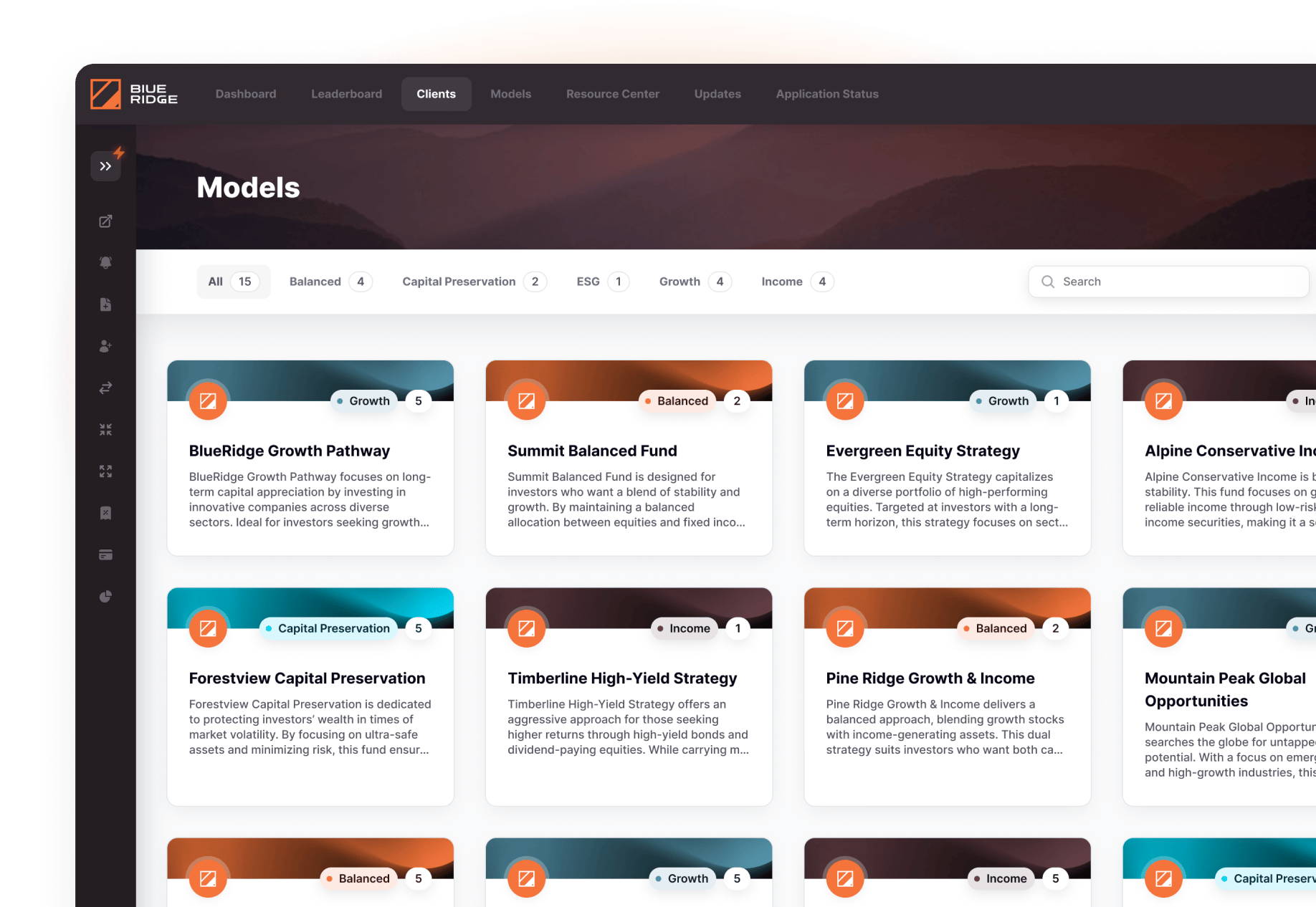

Model Management

-

Direct connection to Orion's trading platform

-

Leverage institutional-grade trade execution

-

Automatic trade routing & optimization

-

Real-time market data & pricing

Smart Validations

-

Auto-checks for trade timing & market holidays

-

100% allocation validation before submission

-

Unsettled trade detection & warnings

-

Custom restriction enforcement & flagging

New Funding Intelligence

-

Real-time alerts when deposits hit accounts

-

Automatic cash deployment based on models

-

Exception handling for unusual deposits

-

Integration with custodial cash management

FIX Trading Integration

-

Direct connection to Orion's trading platform

-

Leverage institutional-grade trade execution

-

Automatic trade routing & optimization

-

Real-time market data & pricing

The Transformation

- Before Trading Overlay

-

Simple trade = 20 minutes of software wrestling

-

Trade status = "I think it went through"

-

Error handling = start over & pray

-

Advisor confidence = zero

- After Trading Overlay

Simple trade

click, validate, submit

Trade status

real-time visibility throughout

Error handling

clear guidance & quick fixes

Advisor confidence

total

Real Results

Finally, someone is leveling up the data experience for advisors. What Milemarker™ is doing has been long overdue in the wealth management industry.

Torie Happe

Holistiplan Head of Partnerships

75%

reduction in trade submission time

90%

fewer trade errors and rejections

100%

visibility into trade status & progress

Zero

advisor training required

Integration Power

Orion Eclipse Integration

Direct FIX connection for institutional-grade execution. Your trades, their infrastructure.

Custodial Connectivity

Real-time account data and cash positions. Trade with complete information.

Portfolio System Sync

Updates flow back to your portfolio management system automatically.

CRM Integration

Trade activity appears in client records. Complete relationship view.

Built For

Real Trading

Bulk Operations

Rebalance entire advisor books with a few clicks. Scale trading operations without adding complexity.

Exception Management

Handle unusual situations with clear workflows. Complex trades don’t break the system.

Custom Rules Engine

Built-in trade timing, holiday calendars, and ticker restrictions. Your rules, automatically enforced.

Audit Everything

Track every change by user, account, and timestamp. Complete regulatory trail for every trade.

Access Controls

Advisors only see models they’re approved to use. Compliance built into every interaction.

Ready to Simplify Trading?

Watch advisors submit trades without the complexity.

30 minutes to see how overlay works with your current platform.

Stop forcing advisors to become software experts.

Stop losing productivity to interface complexity.

Stop avoiding trades because the system is too hard.

Why This Matters

Trading platforms are tools. Your advisors shouldn’t need tool training to serve clients.