- Milemarker™ Platform

- Command Center

- Compensation Management

Stop Calculating Payouts.

Start Automating Trust.

Your advisor comp is a nightmare of spreadsheets, special deals, and “wait, what was their grid again?”

Turn payout chaos into automated precision. Your advisors get transparency. You get your life back.

- The Problem

Your Compensation Is Compensating for Nothing

Month-end is coming. Time to calculate advisor payouts.

Smith gets 90% on everything over $10K. Unless it’s insurance. Then it’s 75%. But not on renewals. Those are 85%. Unless he hit his quarterly bonus threshold. Then it’s different.

Johnson has a different grid.

Plus overrides on her team’s production. Plus a retention bonus that vests monthly. Plus that one-off deal you made last year.

Williams just joined.

New grid structure. Transition bonuses. Draw against future commissions. None of your formulas work.

By the time you figure it out, it’s next month.

- What's Really Broken

Every Exception Breaks Your System

Grid Chaos

Forty advisors, forty different compensation plans. Stored in your head, scattered across spreadsheets, buried in contract folders.

Manual Everything

Calculate each payout by hand. Double-check the math. Triple-check the exceptions. Still get it wrong.

Transparency Zero

Advisor calls asking why their check is different. You scramble to reconstruct your logic. Neither of you trust the answer.

Scale Impossible

Every new advisor means more complexity. More exceptions. More manual work. More mistakes.

Your growth is strangled by your compensation complexity.

- What We Fix

All Your Rules. One System. Zero Exceptions.

Rule Consolidation

Every grid, override, bonus, and exception lives in one system. Complex logic handled automatically. No more hunting for that special deal.

Exception Mastery

Transition bonuses, retention deals, team overrides, draw arrangements—all configured once, calculated forever.

Automated Precision

System calculates every payout exactly right, every time. No more manual math. No more “close enough.”

Complete Transparency

Advisors see exactly how their compensation is calculated. Real-time preview of their next payout. Questions answered before they’re asked.

Automate Advisor Payouts with Precision and Transparency

Universal Rule Engine

- Handle any compensation structure, no matter how complex

- Grid schedules, overrides, bonuses, draws — all automated

- Unlimited exception types & special arrangements

- Rules that adapt as your business grows

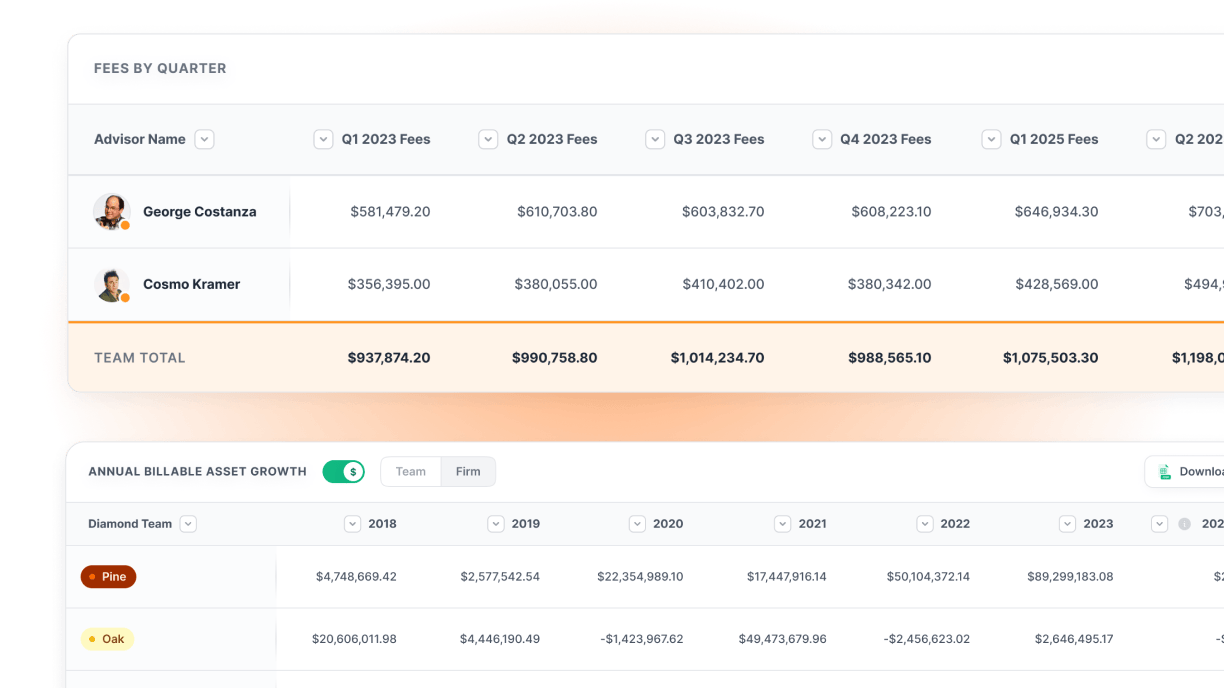

Real-Time Calculations

- Payouts calculate automatically as revenue flows in

- Advisors see live previews of their compensation

- No more month-end scrambling or calculation errors

- Instant impact analysis of compensation changes

Transparency Dashboard

- Advisors see exactly how their pay is calculated

- Detailed breakdowns of every component

- Historical payout tracking & trending

- Dispute resolution with complete audit trails

Exception Management

- Transition bonuses for new advisors

- Retention deals & vesting schedules

- Team-based overrides & splits

- One-off arrangements & special terms

Multi-Advisor Support

- Handle hundreds of unique compensation plans

- Team-based splits & hierarchical overrides

- Geographic & product-based variations

- Acquisition integration for new advisor terms

The Transformation

- Before Compensation Management

- Month-end payouts = 40 hours of spreadsheet hell

- Advisor questions = “let me check my calculations”

- New advisor onboarding = recreate compensation logic

- Compensation disputes = he-said-she-said arguments

- After Compensation Management

Month-end payouts

click calculate, review, approve

Advisor questions

“check your dashboard”

New advisor onboarding

configure rules once, calculate forever

Compensation disputes

complete transparency eliminates arguments

Real Results

Every conference I’ve gone to for the last 15 years same complaint the quality of the data where it’s located how it’s siled but Milemarker™ is working on something to help fix that for lots of RIAs.

Jason Pereira

Senior Partner at Woodgate Financial, Inc

90%

reduction in payout calculation time

95%

fewer advisor payout inquiries

Zero

compensation calculation errors

Complete

audit trail for every payment

Built For

Complex Firms

Acquisition Integration

Seamlessly integrate acquired advisors with their existing compensation terms. No disruption to their pay structure.

Multi-Entity Support

Handle different compensation structures across offices, regions, or business lines. Unified reporting with distributed rules.

Regulatory Compliance

Built-in compliance checks for compensation regulations. Automatic documentation for regulatory review.

Scalable Architecture

Add advisors, create new compensation plans, implement complex arrangements—all without breaking existing calculations.

Advanced

Features

Dynamic Grid Management

- Time-based grid changes & promotions

- Performance-based tier adjustments

- Automatic recalculation when grids change

- Historical grid tracking for audit purposes

Team-Based Compensation

- Hierarchical overrides & management bonuses

- Team production aggregation & splits

- Cross-team collaboration incentives

- Leadership compensation tied to team performance

Draw & Advance Management

- Draw against future commissions

- Advance repayment tracking & automation

- New advisor transition support

- Recovery scheduling & management

Integration

& Data Flow

CRM Integration

Pull advisor hierarchy, client assignments, and relationship data directly from your CRM system.

Revenue Systems

Connect to custodians, billing platforms, and trading systems for real-time revenue tracking.

Payroll Integration

Export calculated compensation directly to your payroll system. No manual entry required.

Accounting Sync

Automated journal entries and expense allocation for accurate financial reporting.

Ready to Automate Your Compensation?

Free analysis of your compensation complexity and automation opportunities.

Watch complex advisor payouts calculate automatically.

30 minutes to map better workflows for your firm.

Stop being the compensation bottleneck.

Stop explaining why the math is different every month.

Stop losing advisors to compensation confusion.

Why This Matters

Compensation disputes kill advisor relationships. Manual calculations kill your time. Complex exceptions kill your growth.