- Milemarker™ Solutions

- I AM A

- CFO

Turn Financial Chaos

Into Crystal Clear Insight

Tired of spending weeks reconciling advisor payouts? Sick of building revenue reports from scratch every month? Ready to actually use your data instead of just managing it?

Milemarker™ automates the complex stuff so you can focus on strategy.

- The CFO Reality

Your Month-End Close Shouldn't Take a Month

Every month, the same nightmare:

Advisor payouts scattered across 6 systems.

Revenue data that doesn’t match.

Fee calculations you can’t explain.

Executives asking for numbers you don’t trust.

By the time you finish reconciling, the data's already old.

You're not a data entry specialist. You're a CFO.

- What Milemarker™ Fixes

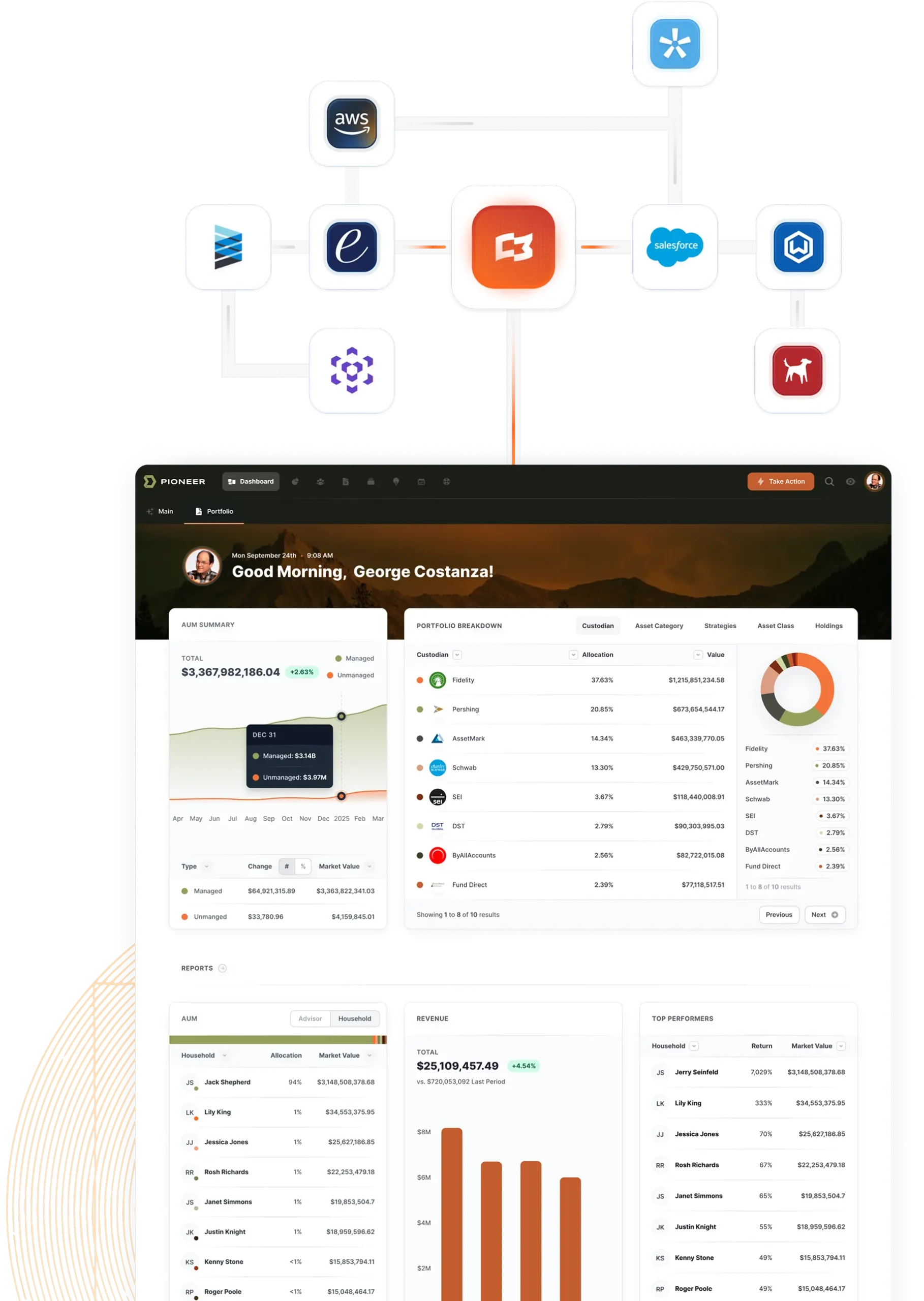

Automate Financial Chaos to Optimize Your Business

Optimize the Business.

Payout Automation

Complex advisor compensation calculated automatically. Grid schedules, overrides, bonuses—all reconciled in real time.

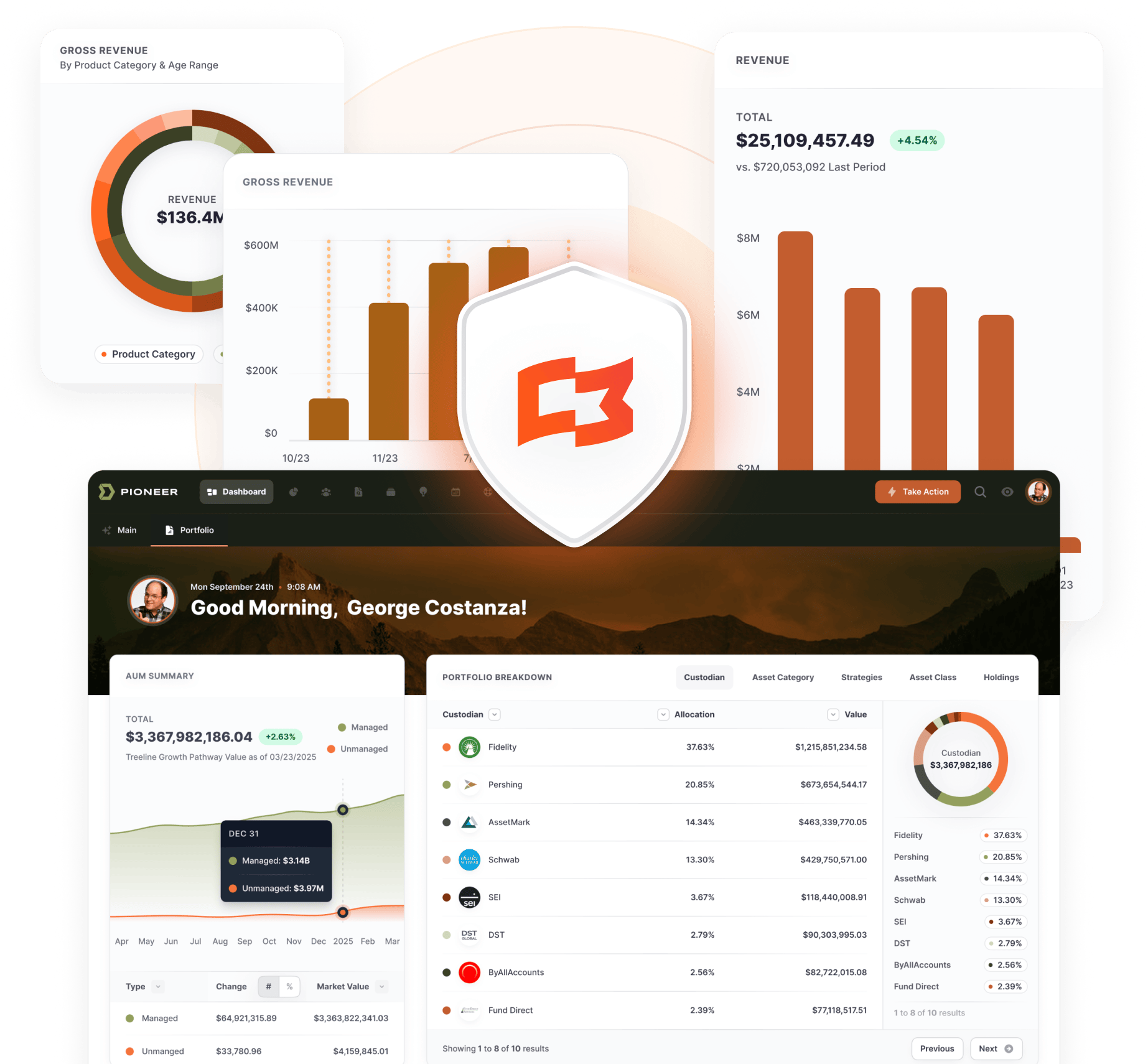

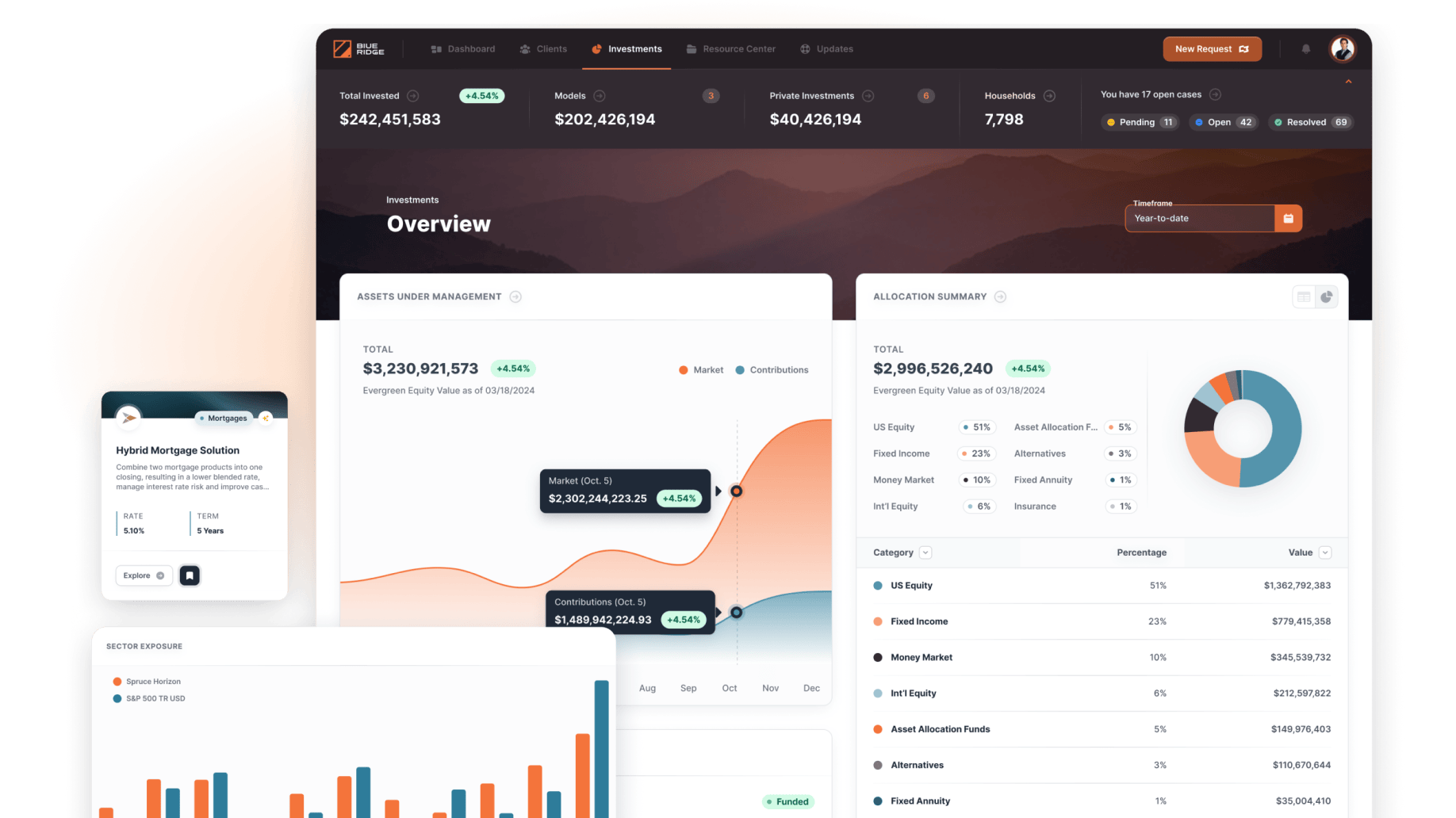

Revenue Clarity

Multi-custodial fee data, billing reconciliation, and revenue attribution across advisors, offices, and products.

Financial Intelligence

Cost allocation, margin analysis, and profitability insights that actually help you optimize the business.

Audit-Ready Data

Complete transaction trails, automated reconciliation, and compliance reporting that makes audits painless.

The Transformation

- Before Milemarker™

- Month-end close = 15+ days

- Payout disputes = weekly headaches

- Revenue reports = manual Excel nightmares

- Board questions = "let me get back to you"

- After Milemarker™

Month-end close

3 days

Payout disputes

eliminated

Revenue reports

click a button

Board questions

answered instantly

Real CFO Results

Thanks to Milemarker™, our leadership team and advisors now have greater access to the data we need to effectively run our business.

Laura Hubbell

Chief Information Officer at SignatureFD

Automated

multi-custodial revenue reporting

Real-time

profitability by advisor/office

80%

faster month-end close

Zero payout

reconciliation errors

What CFOs Get

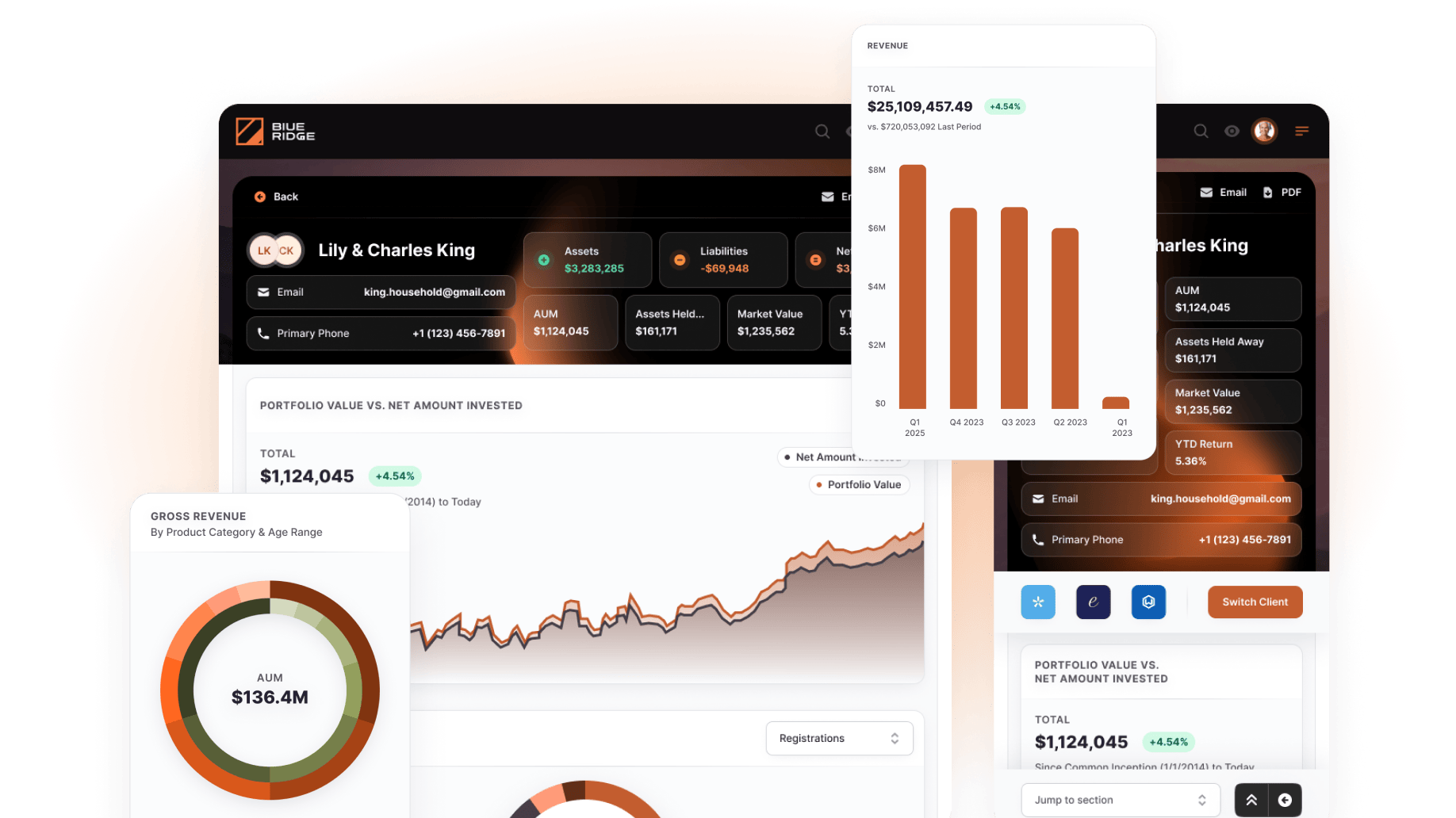

Compensation Management

- Automated grid calculations and overrides

- Real-time payout previews for advisors

- Multi-tier commission structures

- Bonus and incentive tracking

Financial Reporting

- Revenue by advisor, office, and product

- Cost allocation and margin analysis

- Multi-custodial fee reconciliation

- EBITDA and profitability dashboards

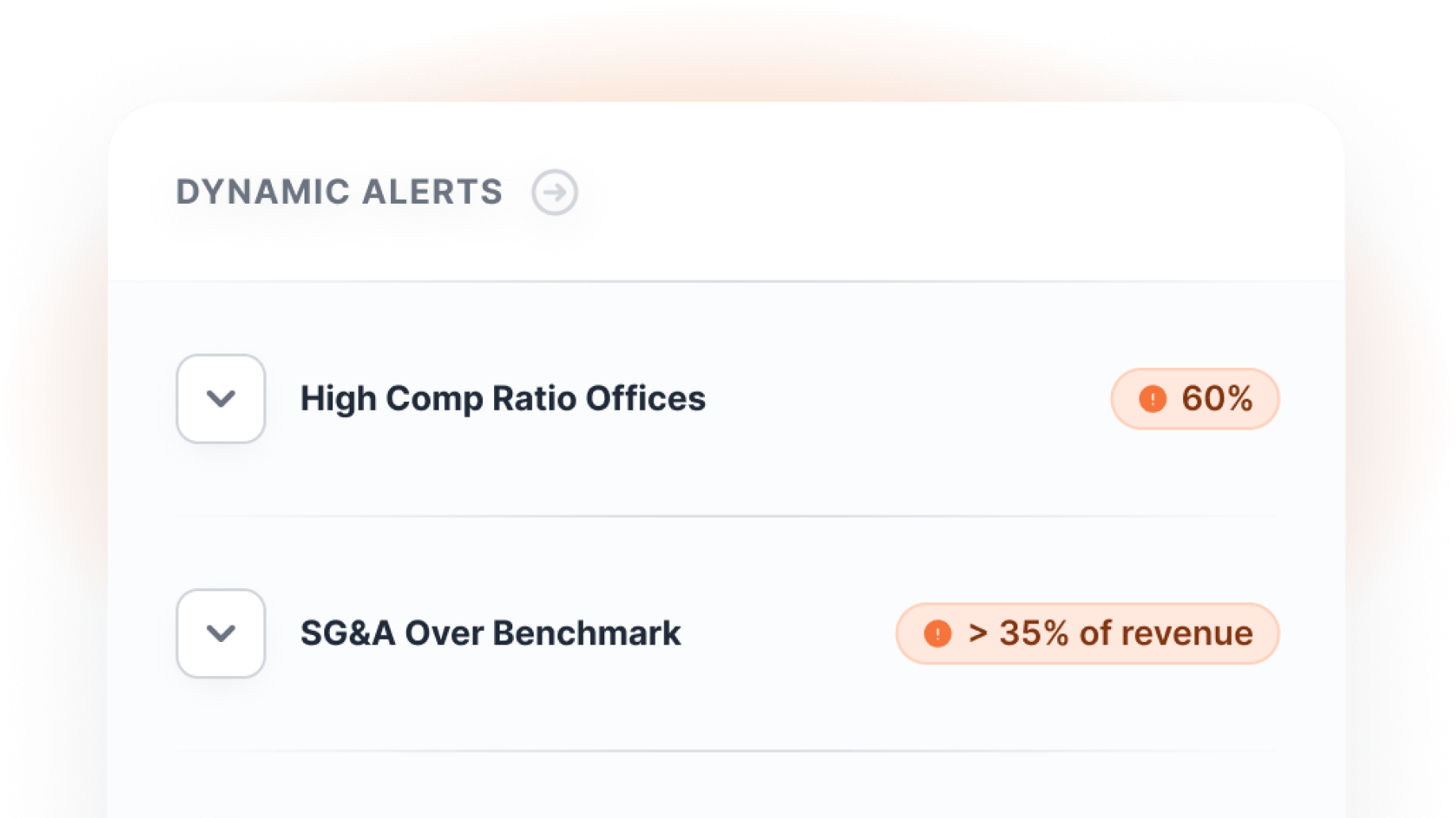

Optimization Insights

- Advisor productivity benchmarking

- Client profitability analysis

- Service line performance tracking

- Growth opportunity identification

Compliance & Audit

- Complete transaction audit trails

- Automated regulatory reporting

- SOC 2 compliant data handling

- Role-based access controls

Built For

CFO Workflows

Real-Time Dashboards

See your numbers update as transactions happen. No more waiting for month-end.

Exception Management

Get alerts when something’s off. Catch problems before they become headaches.

Automated Reports

Board decks, management reports, and compliance filings that build themselves.

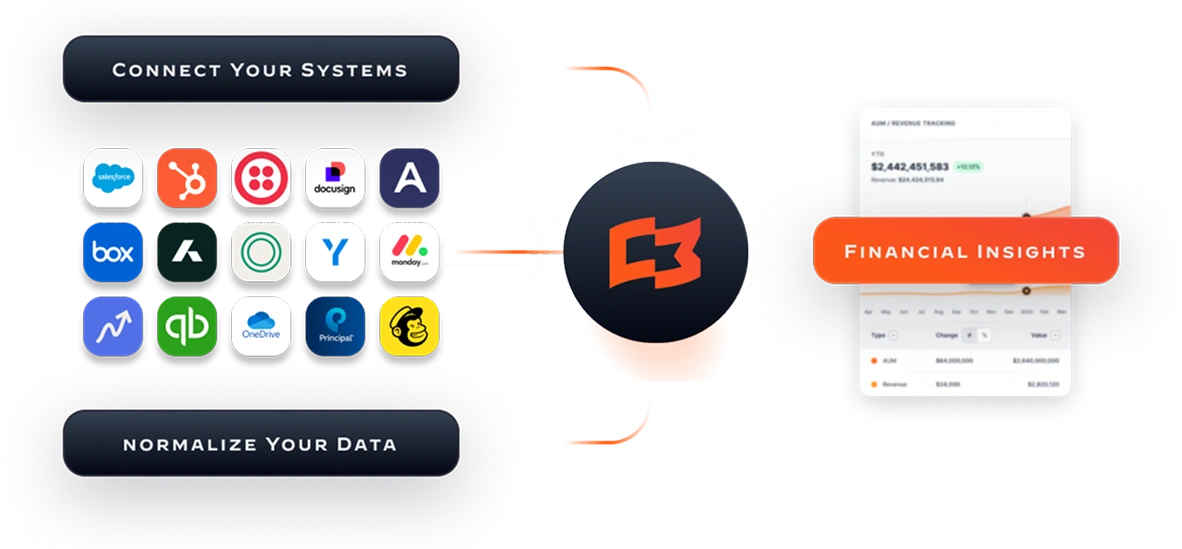

Integration Ready

Works with your existing accounting, payroll & ERP systems.

Implementation That Works

- Your auditors will love the clean data trails.

- Your advisors will love the payout transparency.

- You'll love having your life back.

Week 1:

Connect accounting and payout systems

Week 2:

Configure compensation rules and reporting

Week 3:

Validate numbers & train your team

Week 4:

Run your first automated close

Ready to Automate

Your Close?

Stop spending weeks on work that should take hours.

Quantify the time and cost savings.

See automated payouts and revenue reporting in action.

How other CFOs transformed their operations.

Stop Playing Defense

Move from reactive reconciliation to proactive optimization.

Trust Your Numbers

Automated calculations mean no more second-guessing your data.

Focus on Strategy

Spend time analyzing the business, not building spreadsheets.

Scale Without Breaking

Your financial infrastructure grows with your business.