- Milemarker™ Solutions

- I Want To

- Raise Capital

Your Numbers Tell a Story.

Make Sure It's the Right One.

Turn due diligence into competitive advantage.

- The Capital Challenge

When Investors Call, Are You Ready to Answer?

Monday morning. Your phone rings.

“We’re interested in discussing an investment. Can you send over your financials?”

Panic mode: Export from six systems. Build spreadsheets. Hope the numbers tell a coherent story.

Finally send a patchwork data room that raises more questions than it answers.

Two weeks later:

Investors question your operational sophistication before they even evaluate your growth potential.

The result:

Your opportunity shouldn’t die in data preparation.

- What Investors Actually See

Data Chaos Signals Operational Risk

Inconsistent Metrics

Which advisors are expanding wallets vs. just collecting assets? Your CRM knows, but can’t tell you.

Manual Processes

Spreadsheet-dependent operations scream “can’t scale.” Investors see operational bottlenecks before they see growth potential.

Black Box Reporting

When you can’t explain how you calculate key metrics, investors assume you don’t understand your own business.

Delayed Responses

Every “let me get back to you” signals systems that can’t support rapid growth or investor oversight.

Your data chaos becomes their risk assessment.

- What We Build

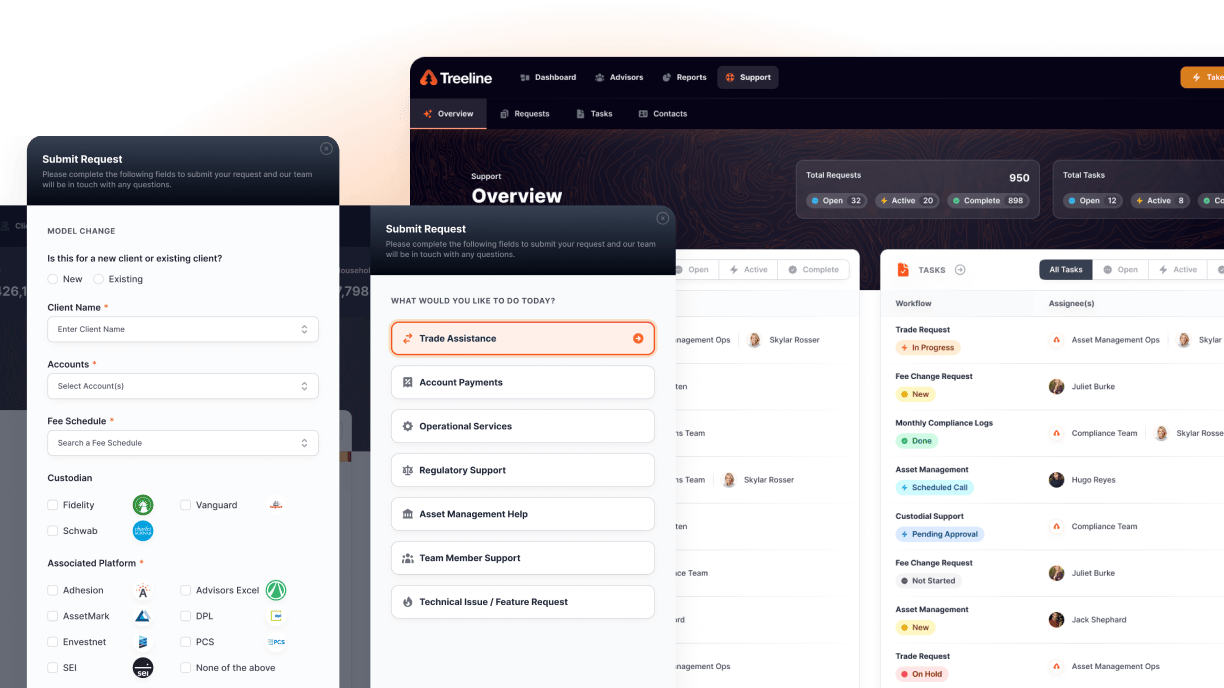

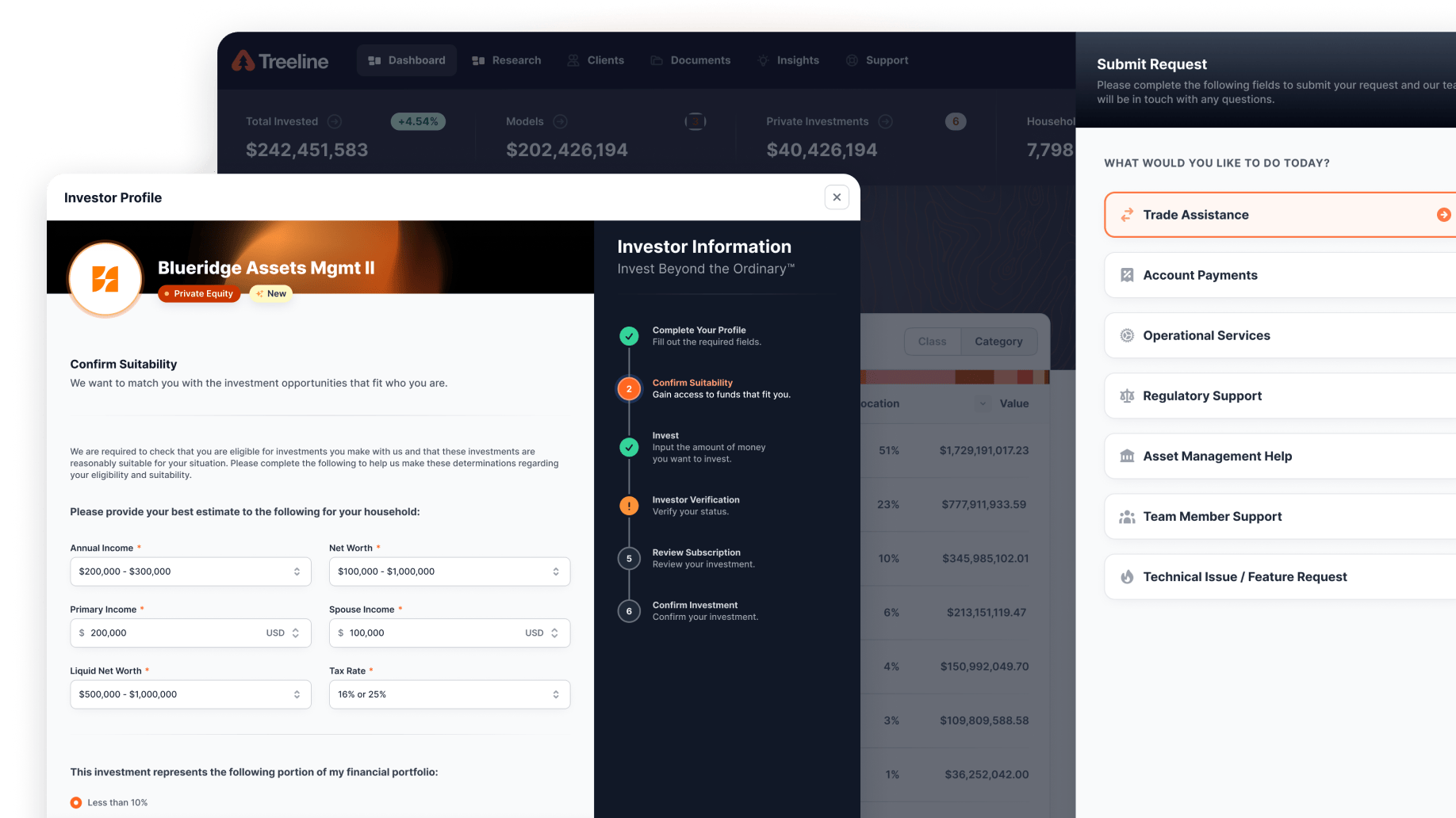

Investor-Grade Intelligence That Opens Doors

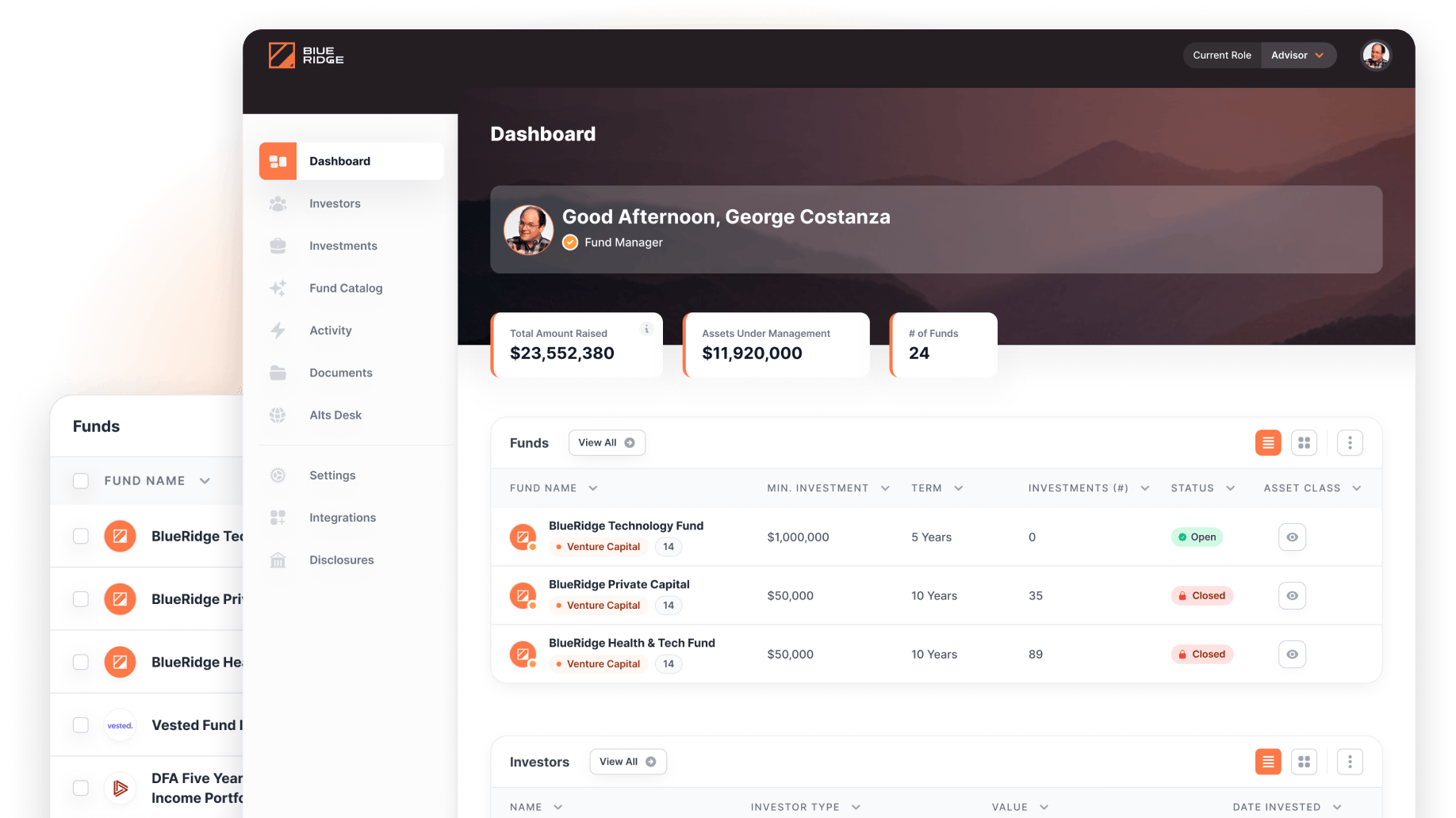

Real-Time Financial Clarity

Revenue, EBITDA, margins, and growth metrics that update automatically. No more scrambling to answer basic questions.

Operational Transparency

Predict which relationships are at risk before they walk. Spot wallet share opportunities hiding in plain sight.

Growth Intelligence

Cohort analysis, unit economics, and predictive metrics that show not just where you’ve been, but where you’re going.

Due Diligence Ready

Professional data rooms, audit-trail documentation, and institutional-grade reporting that accelerates deal timelines.

What You Get

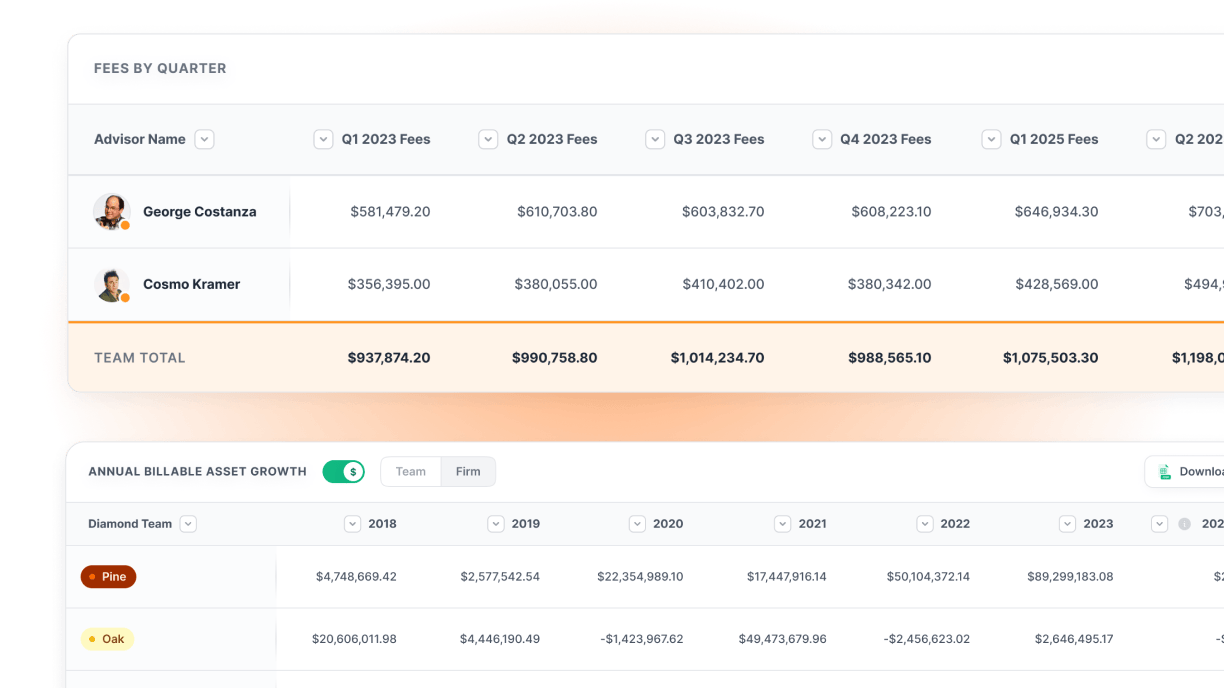

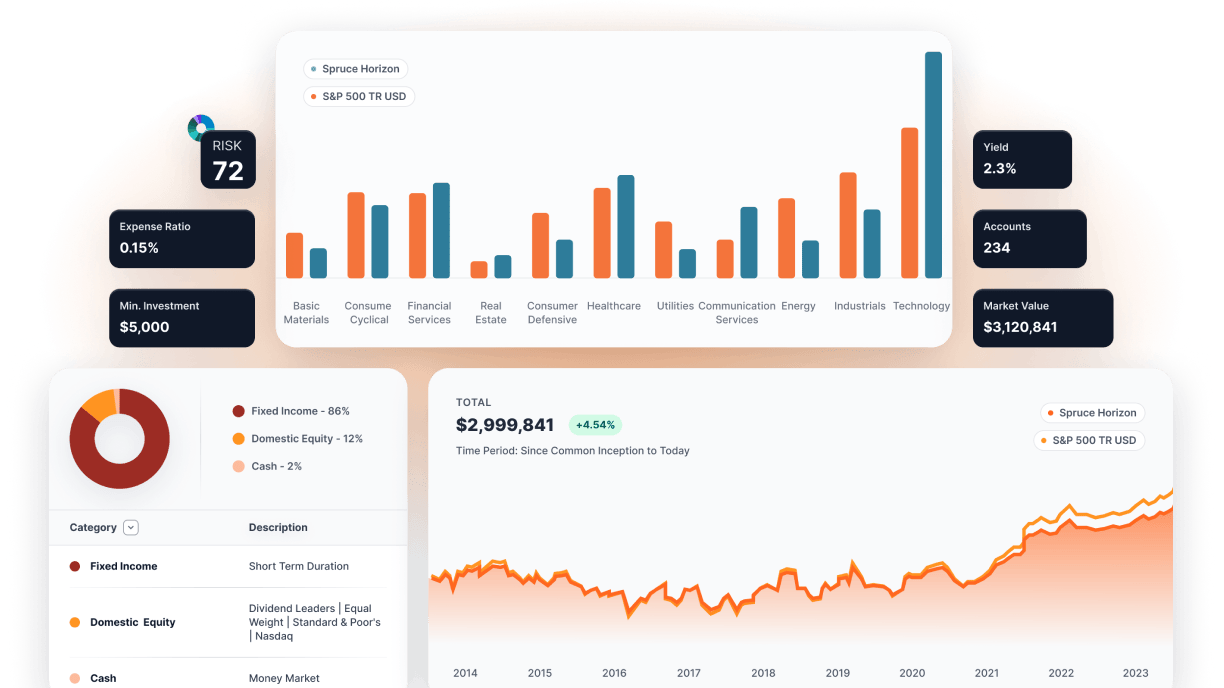

Financial Intelligence

-

Automated EBITDA calculations with transparent methodology

-

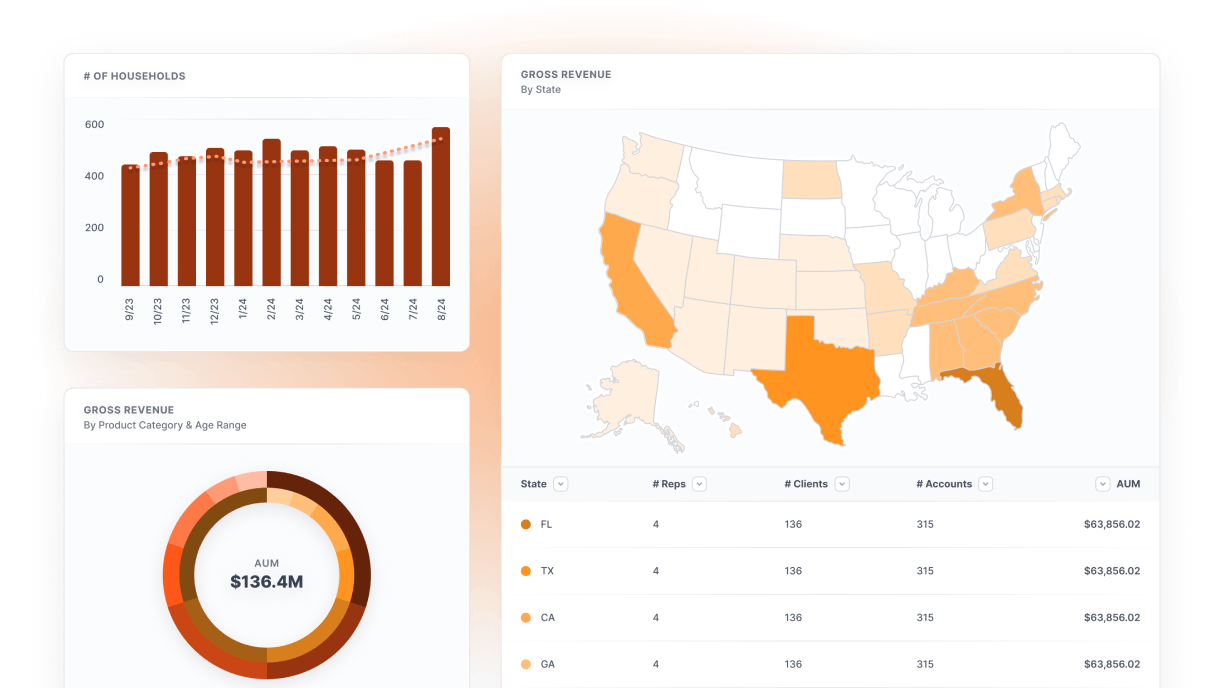

Margin analysis by business line & geographic region

-

Cost structure optimization & scalability modeling

-

Revenue predictability & recurring income analysis

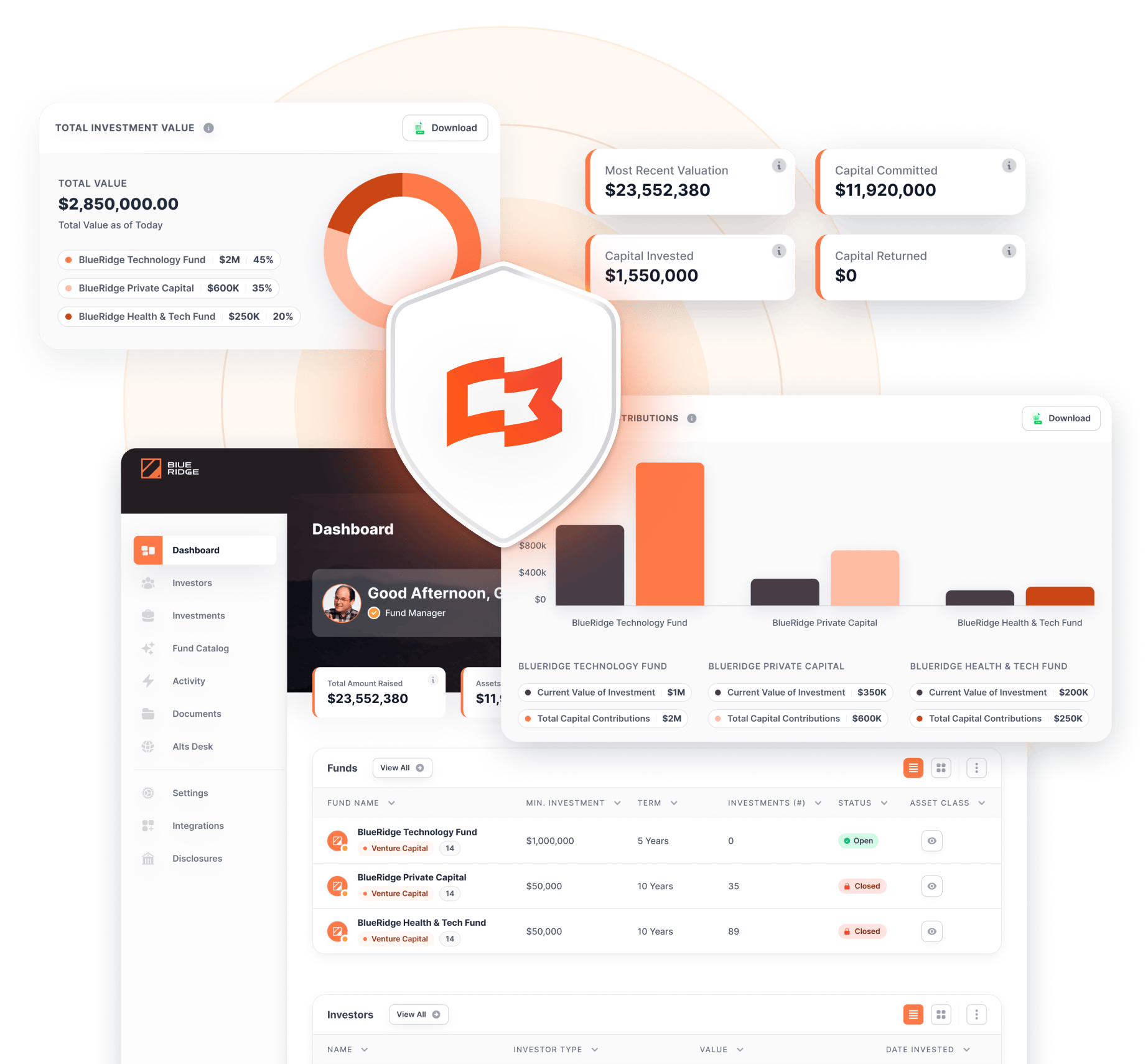

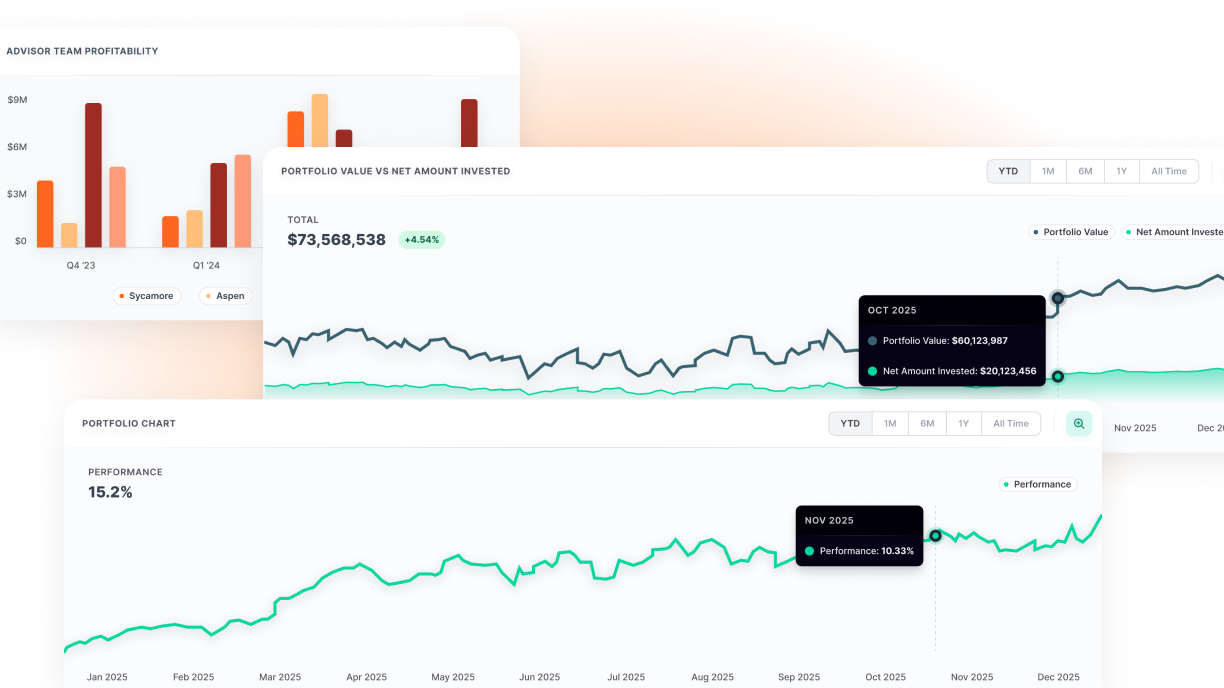

Investor Dashboard

-

Real-time firm valuation metrics & key performance indicators

-

Revenue trends by advisor, office, & service line with growth trajectories

-

Client acquisition costs, lifetime value, & retention analytics

-

Operational efficiency metrics that prove scalability

Growth Analytics

-

Advisor productivity trends & capacity modeling

-

Market penetration analysis & expansion opportunities

-

Client wallet share progression & revenue expansion metrics

-

Acquisition integration success rates & synergy realization

Due Diligence Package

-

Automated financial reporting with institutional-grade accuracy

-

Complete operational documentation & process mapping

-

Historical performance analysis with forward-looking projections

-

Competitive positioning analysis based on comprehensive data

Operational Metrics

-

Technology ROI & automation effectiveness measurement

-

Process efficiency benchmarking & improvement tracking

-

Compliance monitoring with exception management analytics

-

Resource allocation optimization across all business functions

The Transformation

- Before Capital Readiness

-

Investor inquiries = weeks of data preparation panic

-

Due diligence = manual document compilation & spreadsheet reconciliation

-

Growth story = backward-looking metrics & hopeful projections

-

Valuation discussions = defensiveness about data quality

- After Capital Readiness

Investor inquiries

professional data room ready in hours

Due diligence

automated documentation & transparent analytics

Growth story

predictive intelligence & proven scalability

Valuation discussions

confidence backed by institutional-grade data

Real Results

Finally, someone is leveling up the data experience for advisors. What Milemarker™ is doing has been long overdue in the wealth management industry.

Torie Happe

Holistiplan Head of Partnerships

75%

reduction in due diligence preparation time

Real-time

investor reporting with institutional-grade accuracy

Predictive

analytics that support premium valuations

Operational

transparency that accelerates deal timelines

Capital

Readiness Features

Valuation Intelligence

-

Real-time firm valuation tracking with methodology transparency

-

Operational & financial metrics integrated into valuation models

-

Benchmark comparisons against industry standards & peer groups

-

Scenario modeling for different growth & market conditions

Growth Modeling

-

Advisor capacity analysis & expansion planning

-

Market opportunity sizing with data-driven assumptions

-

Revenue predictability scoring based on client & operational metrics

-

Acquisition integration modeling with historical success rates

Risk Assessment

-

Client concentration analysis & diversification metrics

-

Revenue stability measurement & recurring income tracking

-

Operational risk identification with mitigation documentation

-

Compliance monitoring with comprehensive exception management

Investor Relations

-

Automated board reporting with customizable metrics & insights

-

Real-time performance dashboards accessible to investor stakeholders

-

Quarterly business reviews with predictive analytics & trend analysis

-

Strategic planning support with data-driven scenario modeling

Built For

Institutional Standards

Audit-Grade Documentation

Every calculation, methodology, & data source fully documented for investor & auditor review.

Regulatory Compliance

SOC 2 Type II compliance & enterprise security standards that meet institutional investor requirements.

Scalability

Proof

Systems & processes that demonstrate ability to handle 10x growth without operational breakdown.

Transparency First

Complete visibility into operations, finances, & growth drivers that builds investor confidence.

Advanced

Capital Features

Strategic Intelligence

-

Market opportunity analysis based on current performance data

-

Competitive advantage identification & sustainable differentiation analysis

-

Acquisition target identification with integration success modeling

-

Strategic partnership evaluation & value creation assessment

Financial Performance Analytics

-

Margin analysis by business line, geography, & client segment

-

Cost structure optimization with scalability considerations

-

Working capital management & cash flow predictability analysis

-

Profitability trending with leading indicator identification

Predictive Intelligence

-

Revenue forecasting with confidence intervals based on historical performance

-

Client lifetime value modeling with retention & expansion analytics

-

Market share analysis & competitive positioning assessment

-

Growth scenario planning with resource requirement modeling

Operational Excellence Metrics

-

Process automation ROI & efficiency improvement tracking

-

Technology investment analysis & strategic infrastructure planning

-

Resource optimization across all business functions & geographies

-

Scalability assessment with bottleneck identification & resolution planning

Ready to Attract Capital?

Stop scrambling when opportunity calls

Stop defending your data quality instead of showcasing your growth potential.

Stop letting operational questions overshadow your strategic vision.

Why This Matters for Capital

Capital flows to businesses that can prove they’ll use it effectively. Investors back operations that can scale.