- Solutions

- Milemarker™ For

- Fund Managers

Alternative Investments Shouldn't

Require Alternative Operations.

Streamline operations. Automate reporting. Modernize connectivity.

- The Fund Operations Reality

Your Investment Universe Is Fragmented

Administrative Chaos Disguised as Normal.

Monday morning. Quarterly reporting deadline approaching.

Wednesday. Investor calls asking for updates.

Friday. Fund administrator needs reconciliation.

Your fund operations are held together with digital duct tape.

- What's Actually Broken

The Administrative Complexity Problem

System Fragmentation

Manual Data Compilation

Reporting Nightmare

Connectivity Desert

Your fund exists in isolation. No integration with advisor platforms, limited connectivity with institutional systems, manual everything.

Operational Scaling Impossibility

Your operational complexity is your competitive disadvantage.

- What We Streamline

Unified Operations Infrastructure

Single Data Environment

Automated Reporting

Modern Connectivity

Operational Intelligence

What You Get

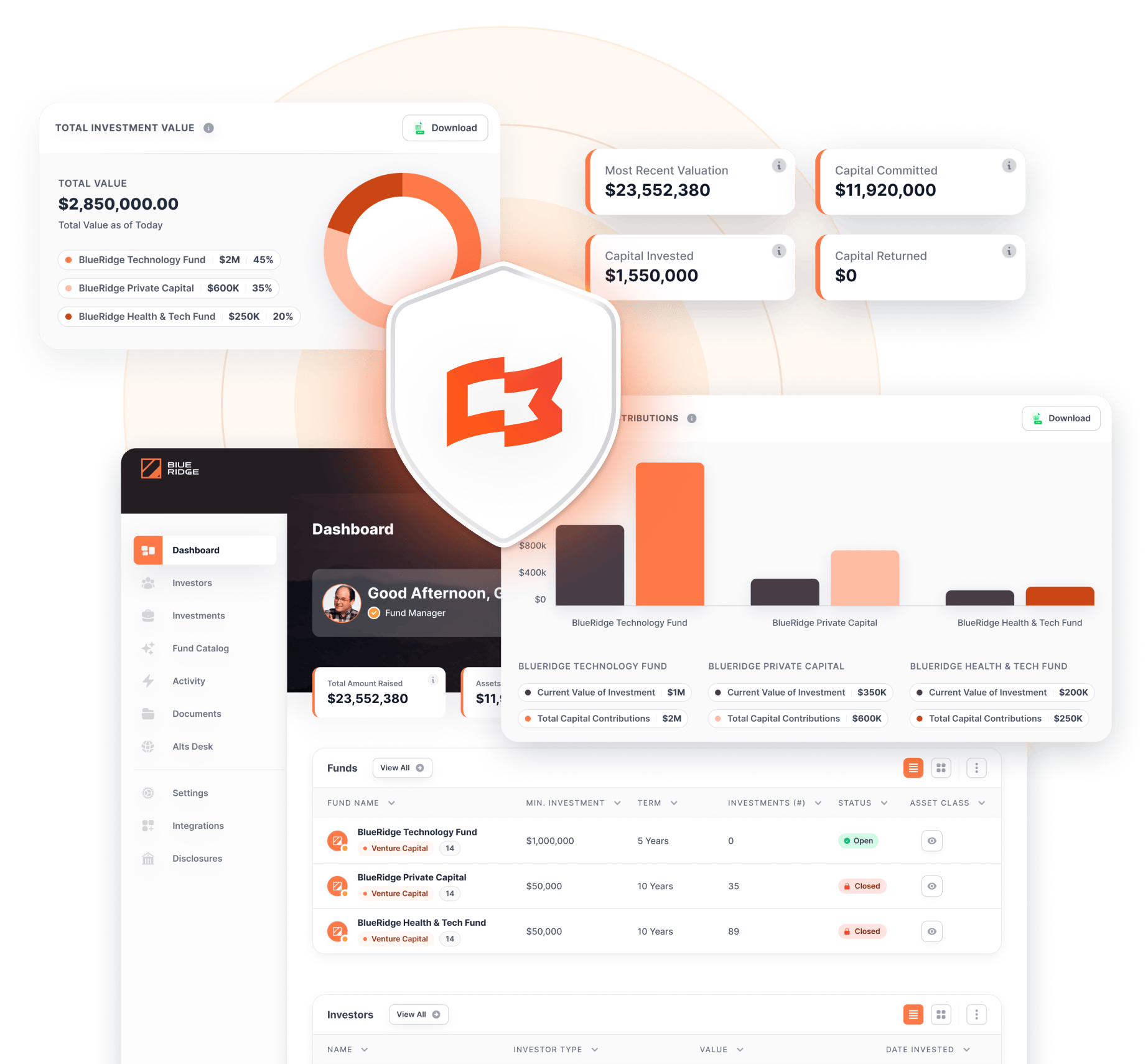

Unified Fund Operations

-

Complete investor lifecycle management from subscription to distribution

-

Automated capital call & distribution processing with investor notification

-

Real-time fund performance tracking integrated with accounting systems

-

Centralized document management with secure investor portal access

Automated Reporting Infrastructure

-

Quarterly investor reports generated automatically from unified data sources

-

Real-time LP dashboards with performance, allocation & distribution tracking

-

Regulatory reporting automation with compliance monitoring & audit trails

-

Custom reporting tools for different investor types & requirements

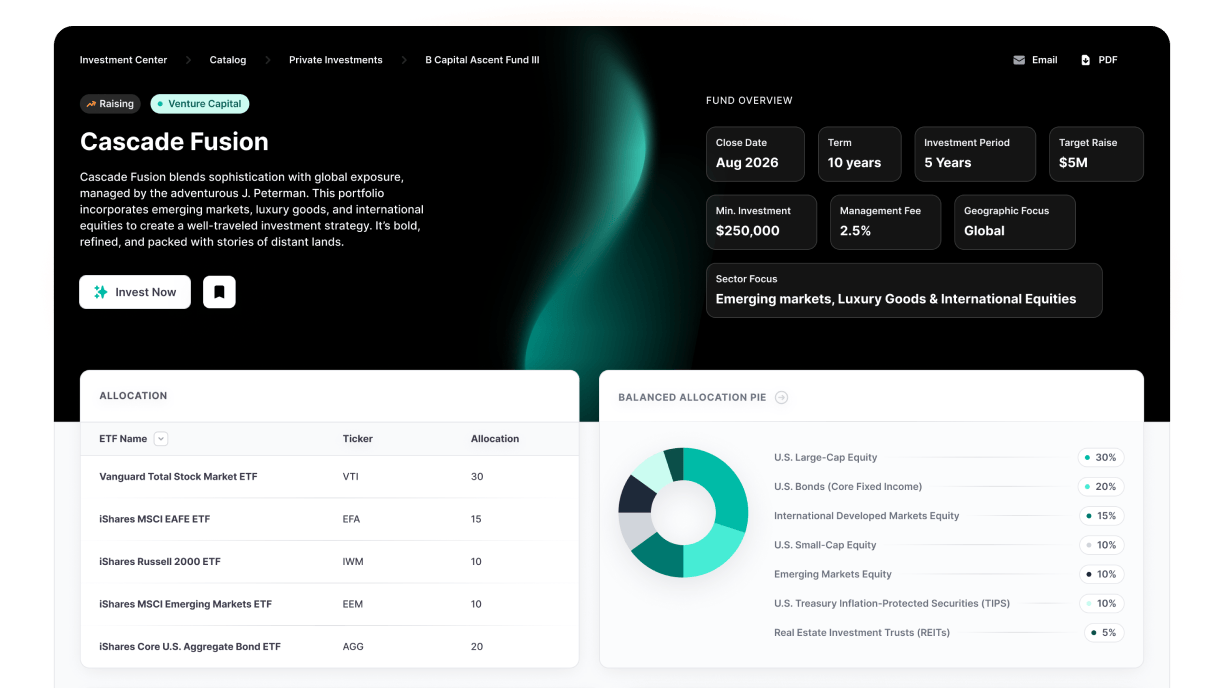

Modern Connectivity Platform

-

Direct integration with major wealth management platforms used by advisor intermediaries

-

Institutional investor system connectivity for seamless data exchange

-

Fund administrator integration eliminating manual data transfer & reconciliation

-

Third-party service provider connectivity streamlining operations workflows

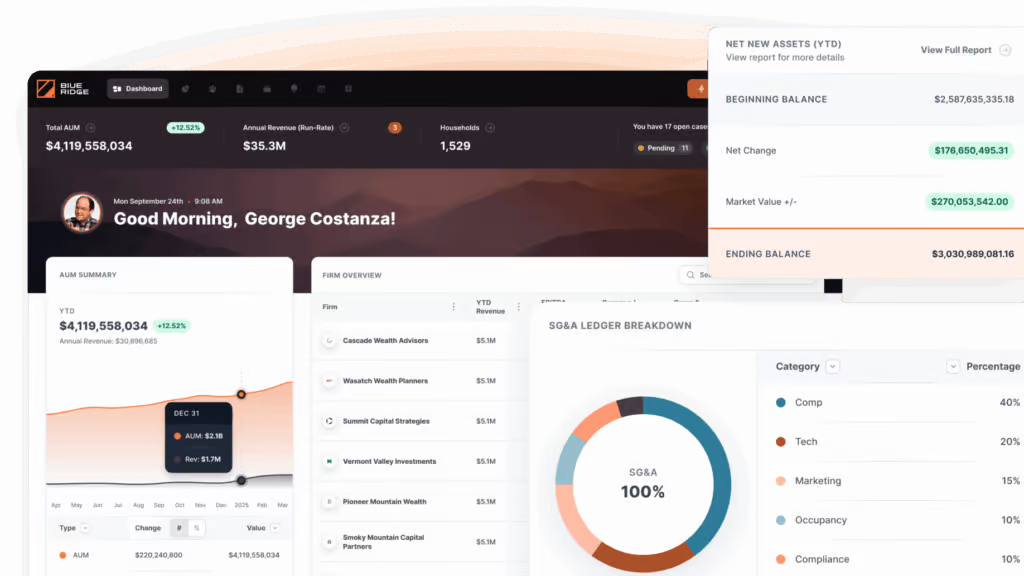

Operations Intelligence Dashboard

-

Complete visibility into fund administrative efficiency & bottleneck identification

-

Investor engagement analytics showing communication effectiveness & satisfaction

-

Operational cost tracking & optimization recommendations

-

Scalability assessment for fund growth & new product launches

Growing Network Advantage

-

Expanding ecosystem of fund manager connections creating network effects

-

Shared operational best practices & benchmark comparisons

-

Collaborative compliance & regulatory update sharing

-

Joint technology initiatives reducing individual implementation costs

The Operations

Transformation

- Before Streamlined Operations

-

Fund administration = manual data compilation across 20+ disconnected systems

-

Investor reporting = weeks of spreadsheet reconciliation & document generation

-

Platform connectivity = isolated fund with limited advisor accessibility

-

Operational scaling = hiring more people to handle manual administrative work

- After Streamlined Operations

Fund administration

unified platform with automated data synchronization

Investor reporting

real-time generation with automated distribution

Platform connectivity

integrated presence across advisor & institutional systems

Operational scaling

technology leverage allowing growth without proportional staffing

Real Results

There are enough closed-off vendors in this space that I think are opening themselves up to risk of disruption. Data lakes were my method to tackle the silo problem. And, why I continually refer people to Milemarker™ – they’ve been solving this problem for years. Great team.

Brad Felix

Operating Partner Fireroad

60%

85%

faster quarterly reporting & investor communication

Real-time

Modern

connectivity increasing advisor adoption & accessibility

Fund Administration Excellence

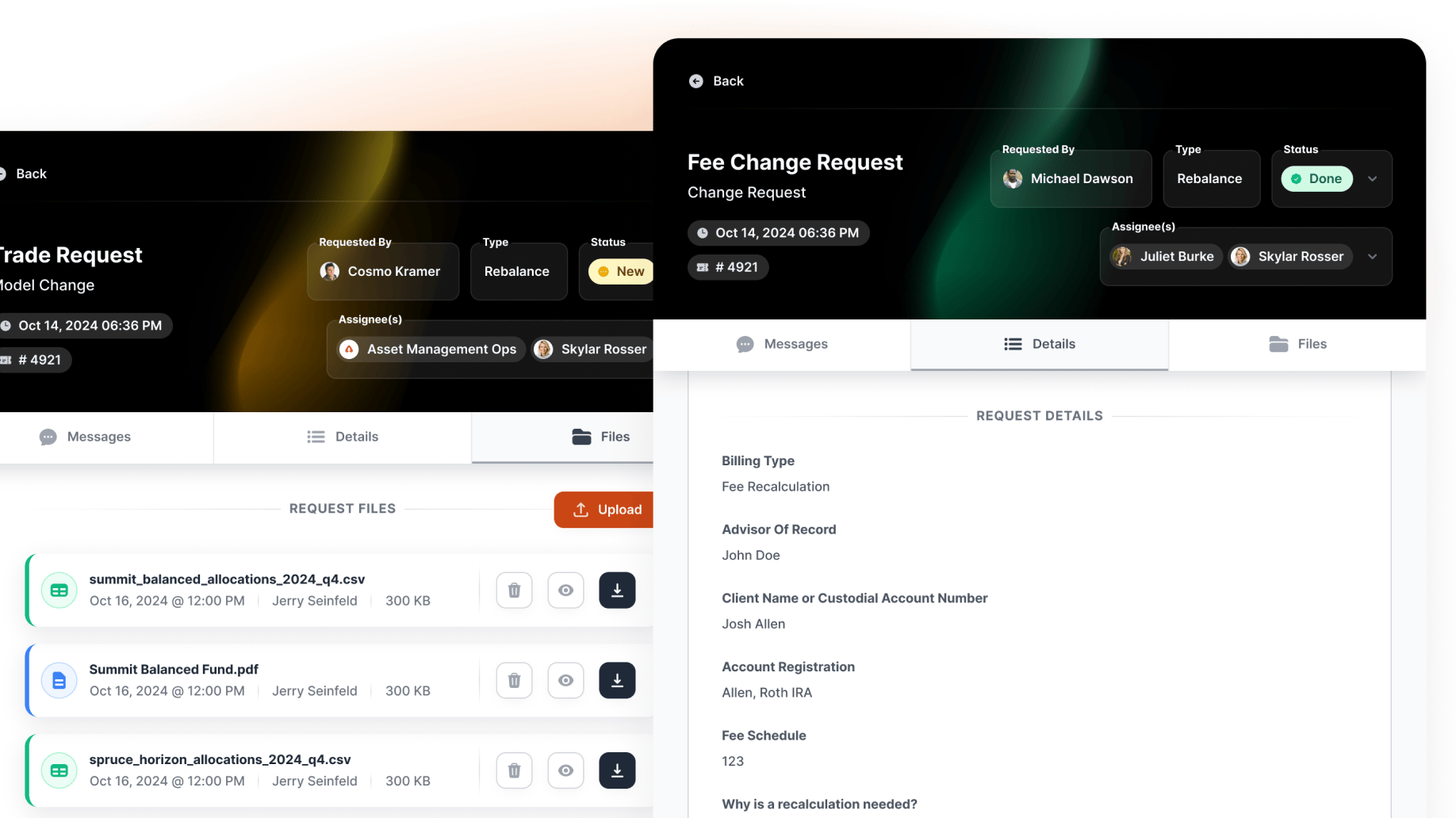

Investor Lifecycle Automation

-

Automated subscription processing with integrated compliance verification

-

Capital call management with investor notification & tracking systems

-

Distribution processing with tax documentation & investor reporting

-

Investor communication automation for updates, reports & regulatory notices

Performance & Accounting Integration

-

Real-time performance tracking integrated with fund accounting systems

-

Automated net asset value calculation & investor allocation tracking

-

Fee calculation automation with transparent methodology & audit trails

-

Expense management & allocation tracking across fund operations

Compliance & Regulatory Automation

-

Automated regulatory reporting with compliance monitoring & exception management

-

Investor accreditation tracking & ongoing qualification verification

-

Audit trail maintenance for all fund operations & investor interactions

-

Risk management integration with operational & investment oversight

Document & Communication Management

-

Centralized document repository with secure investor access & version control

-

Automated investor communication delivery with engagement tracking

-

Meeting coordination & investor relations management

-

Due diligence package generation & distribution automation

Built For

Fund Operations Scale

Multi-Fund Architecture

Fund Administrator Integration

Regulatory Compliance

Institutional Standards

Growing Network of

Fund Connections

Expanding Ecosystem

-

Growing network of fund managers sharing operational best practices & technology innovations

-

Collaborative development of fund-specific features & compliance automation

-

Shared infrastructure reducing individual technology implementation & maintenance costs

-

Joint initiatives for regulatory compliance & industry standard development

Modern Connectivity Standards

-

Direct integration capabilities with major advisor platforms increasing fund accessibility

-

Institutional investor system connectivity streamlining due diligence & ongoing reporting

-

Fund platform integration allowing advisors to access & allocate to your funds seamlessly

-

Real-time data transmission eliminating delays in performance reporting & investor communication

Operational Innovation

-

Continuous platform enhancement based on collective fund manager feedback & requirements

-

Industry-leading operational automation developed through collaborative innovation

-

Best practice sharing across fund types & strategies

-

Technology roadmap aligned with evolving fund industry needs & regulatory requirements

Other Solutions For:

- RIA's & Family Offices

Ready to Modernize Your Operations?

Free analysis of administrative efficiency and automation opportunities.

Watch how unified operations and automated reporting transform fund administration.

45 minutes to design the modern operational infrastructure your fund needs.

Stop accepting that alternative investments require alternative operations.

Stop losing efficiency to administrative complexity.

Stop limiting growth with manual processes.

Why Modern Operations Matter

Administrative complexity doesn’t add value—it destroys it. Every manual process is a scaling limitation. Every disconnected system is an operational risk.