- Solutions

- Milemarker™ For

- Private Equity

Stop Managing

Wealth Management Investments in Isolation.

You’ve got RIAs, TAMPs, and broker-dealers across your portfolio. Each one reports differently. Your data lives in spreadsheets. You can’t see which strategies actually drive value creation.

Unify your wealth management portfolio. Accelerate your analysis. Optimize every investment.

- The Wealth Management PE Reality

Great Investments. Fragmented Intelligence.

Monday morning. Portfolio review meeting.

Wednesday. Investment committee.

Friday. LP reporting deadline.

Your wealth management intelligence is trapped in operational chaos.

- What's Actually Broken

The Portfolio Visibility Problem

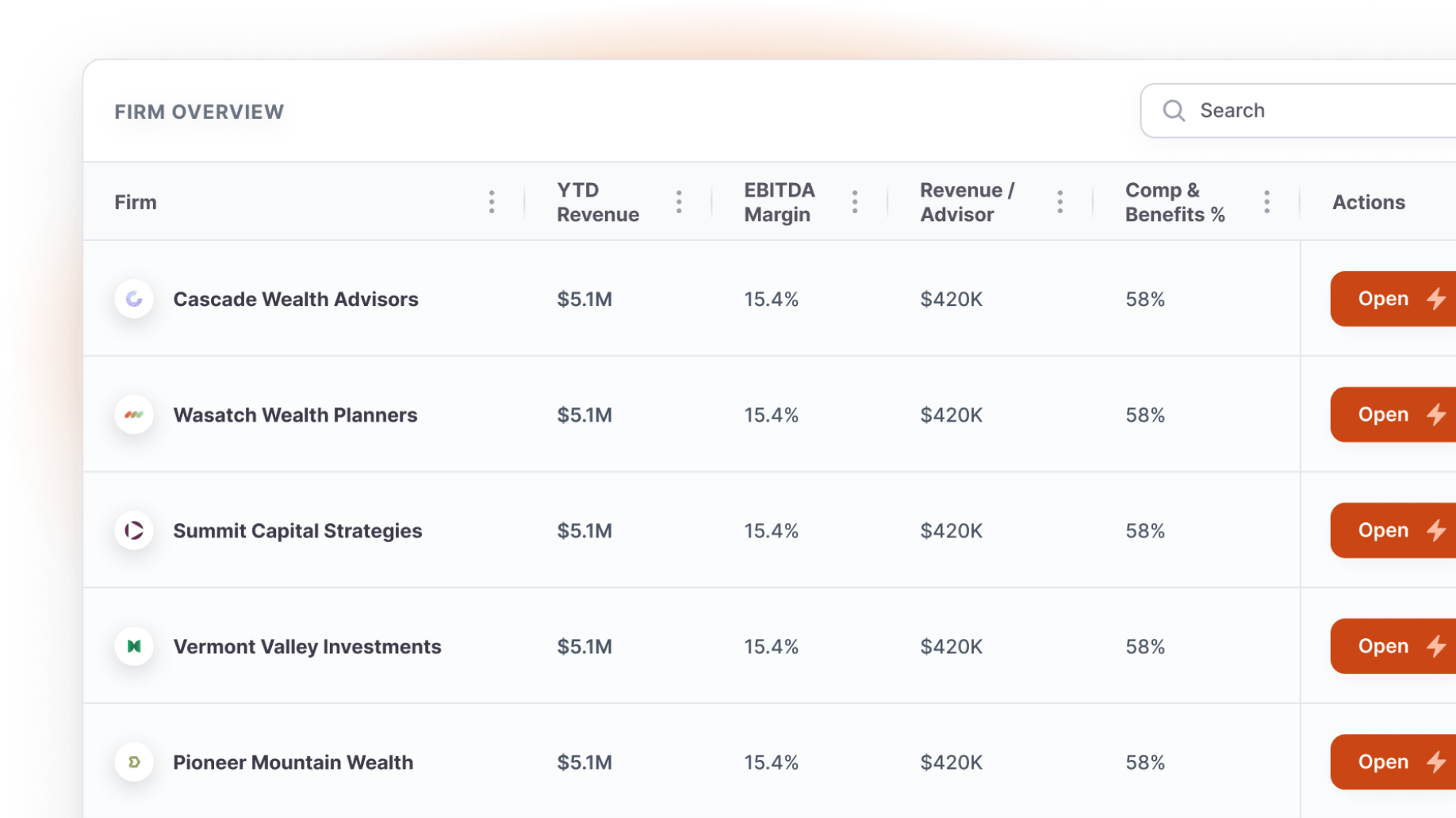

Data Fragmentation

Every RIA uses different CRMs, portfolio systems, and reporting formats. Your TAMPs track different KPIs than your broker-dealers.

Analysis Delays

By the time you compile advisor productivity data across firms, market conditions have changed. You’re always looking backward.

Inconsistent Metrics

Revenue per advisor calculated differently at each firm. AUM growth varying by methodology. Client retention that doesn’t compare.

Value Creation Blindness

You can’t see which operational improvements actually work. Best practices from successful RIAs never reach struggling firms.

Your wealth management investments depend on intelligence you don't have.

- What We Unify

Complete Wealth Management Portfolio Intelligence

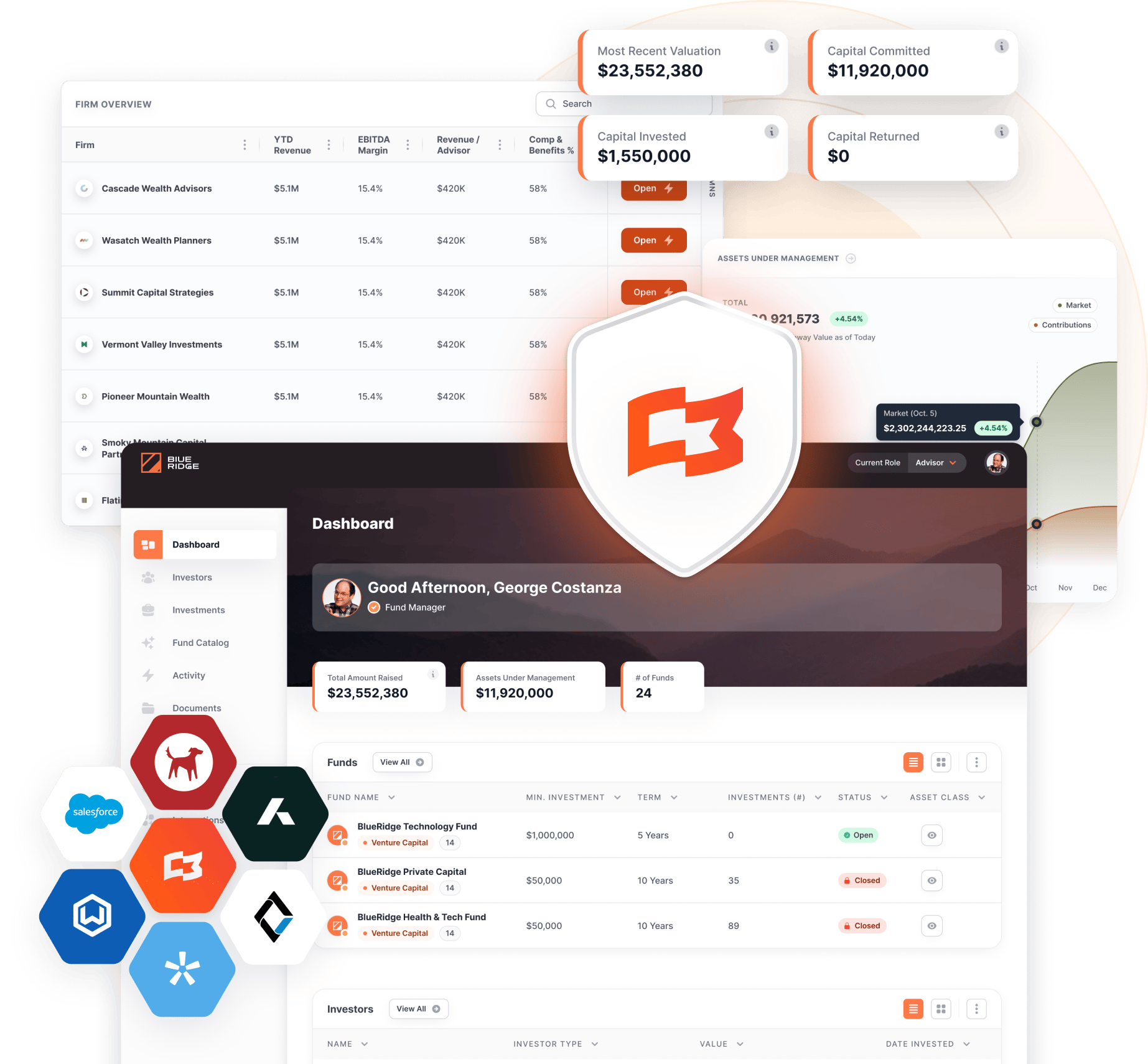

Unified Data Layer

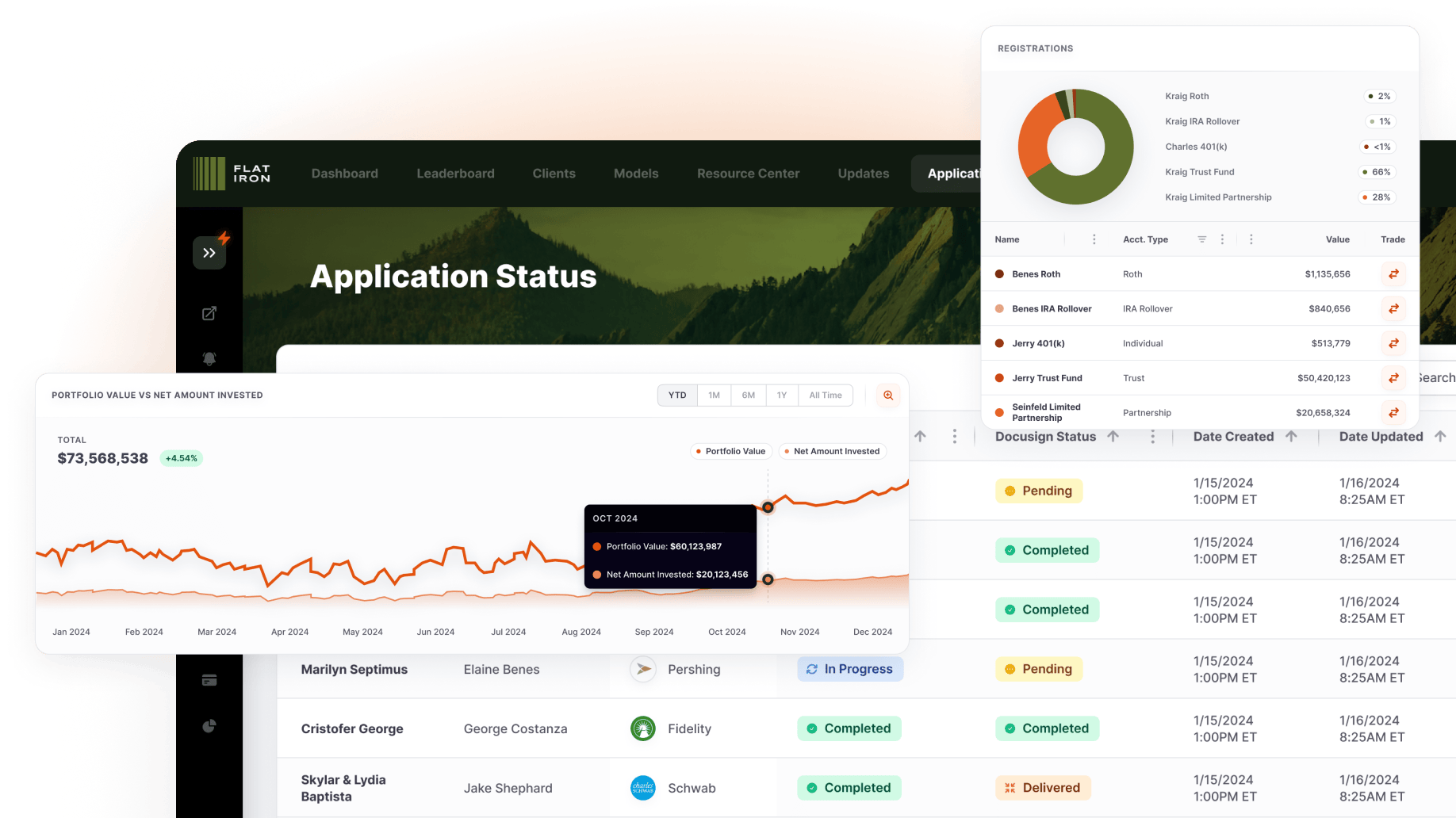

All portfolio company data flowing into one intelligent platform. Advisor metrics, client data, revenue tracking—normalized across RIAs, TAMPs, and BDs.

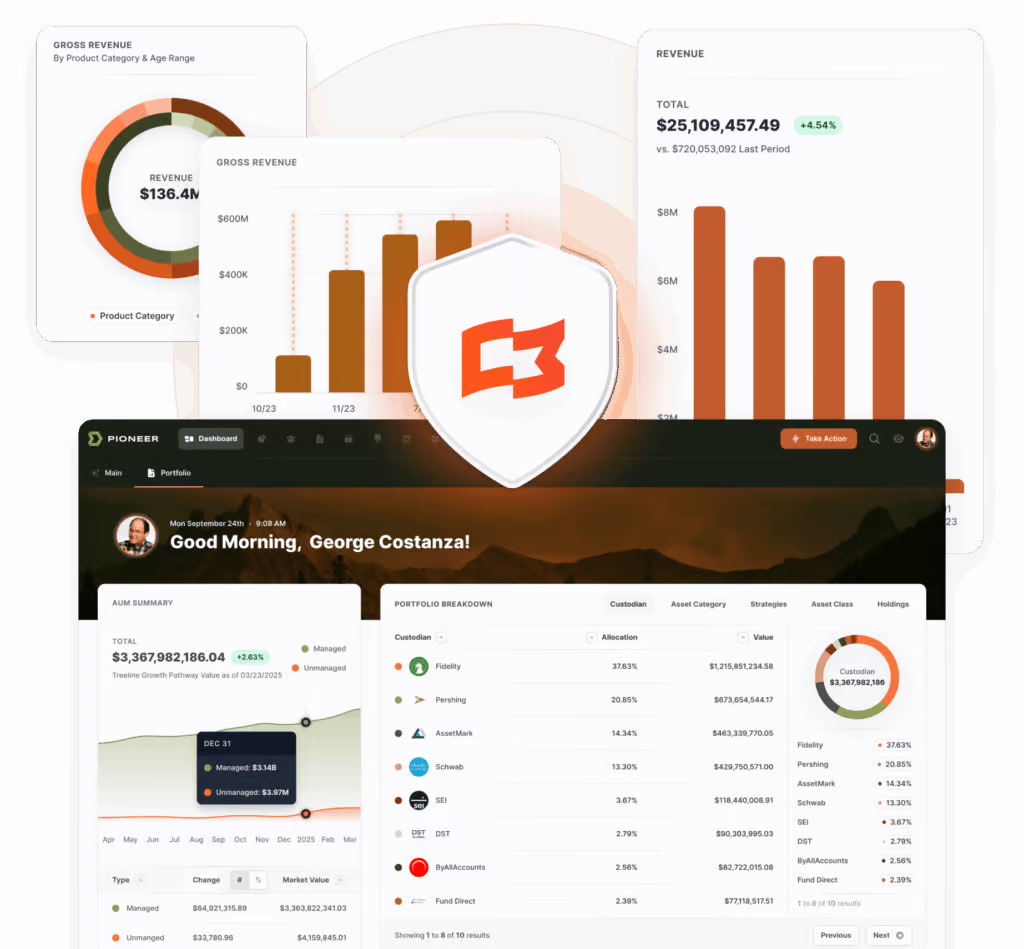

Real-Time Consolidation

Portfolio-wide performance tracking that updates as firms report. No more quarterly scrambles for wealth management data.

Cross-Firm Analytics

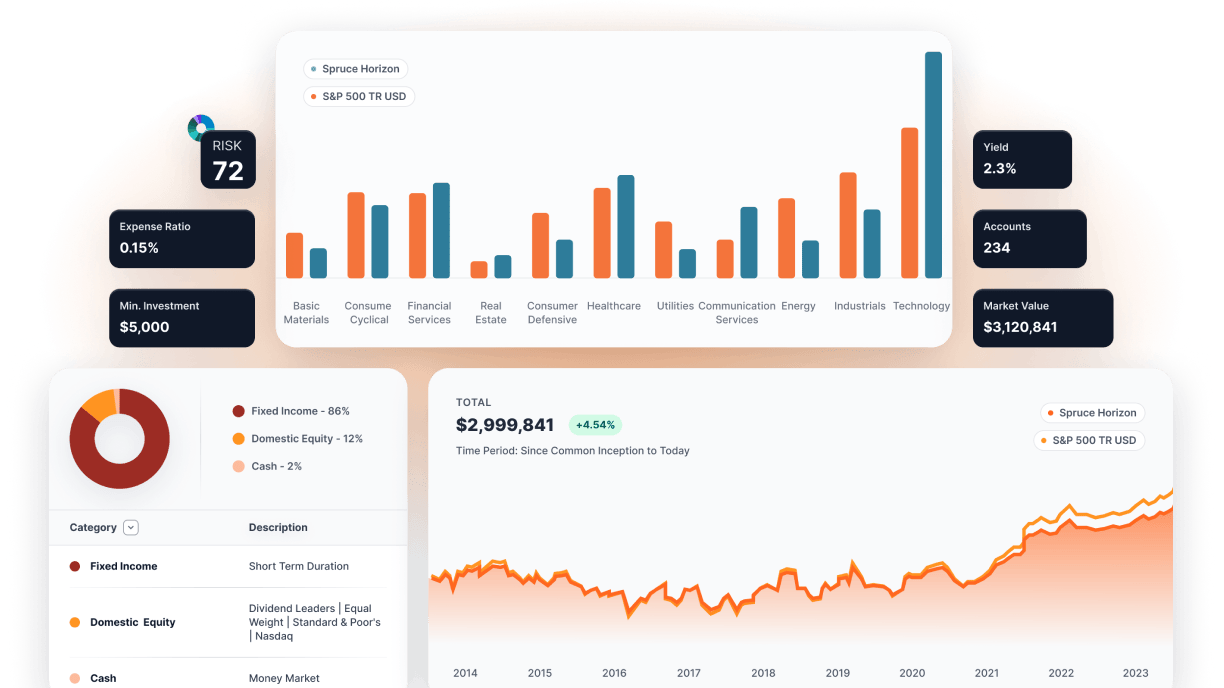

Identify patterns, benchmarks, and optimization opportunities across your entire wealth management portfolio instantly.

Value Creation Intelligence

See which strategies work, which firms need support, and where to deploy resources for maximum wealth management returns.

What You Get

Unified Investment Universe

-

Wealth Management Portfolio Unification

-

Normalized advisor productivity, client metrics & revenue tracking across different firm types

-

Real-time consolidation of AUM growth, advisor retention & client satisfaction metrics

-

Single source of truth for all wealth management portfolio company performance

Advanced Cross-Firm Analytics

-

Benchmark analysis comparing advisor productivity across similar RIAs & market segments

-

Pattern recognition identifying successful wealth management strategies & operational improvements

-

Cohort analysis tracking performance by firm type, geography & investment vintage

-

Predictive modeling showing which firms are trending toward outperformance or operational challenges

Executive Intelligence Dashboard

-

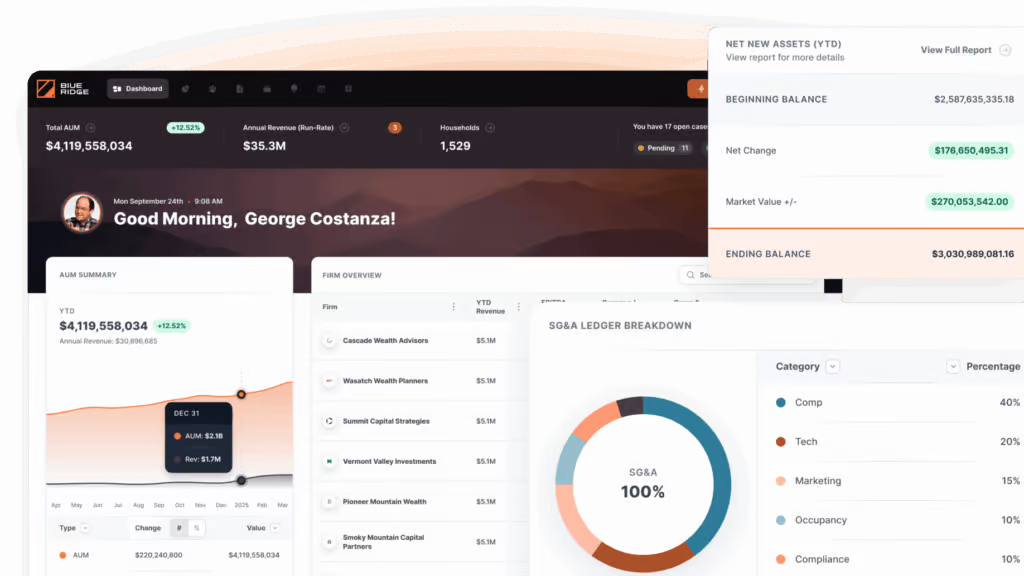

Real-time portfolio performance visibility with drill-down capabilities to individual firms & advisor teams

-

Exception monitoring alerting to firms requiring immediate attention, operational support, or additional investment

-

Investment thesis tracking showing how wealth management firms perform against original growth projections

-

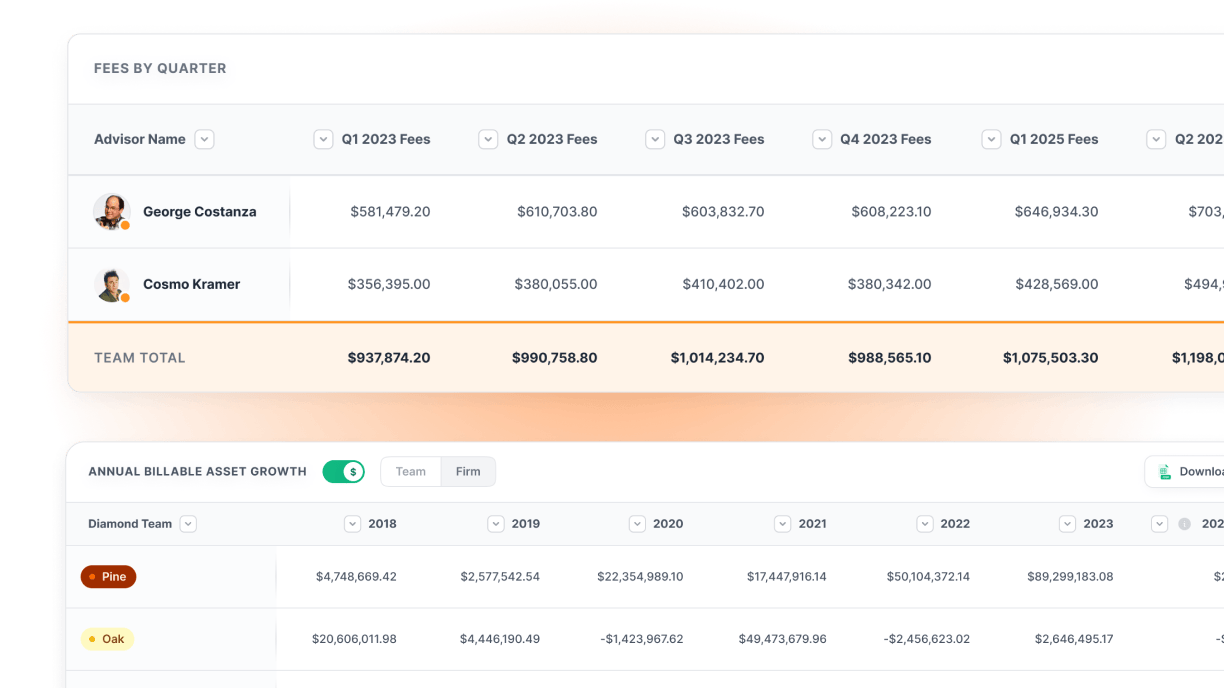

LP reporting automation with wealth management industry benchmarks & institutional-grade documentation

Wealth Management Value Creation

-

Best practice identification from top-performing RIAs & wealth management firms

-

Operational improvement opportunity mapping across advisor productivity, client experience & technology adoption

-

Strategic initiative tracking showing ROI of technology investments, acquisition strategies & operational changes

-

Resource allocation optimization based on wealth management-specific value creation potential

Cross-Portfolio Learning for Wealth Management

-

Success pattern analysis showing which value creation strategies drive the best returns in wealth management

-

Technology adoption insights identifying high-impact platforms & operational improvements across firms

-

M&A intelligence aggregated from portfolio company acquisition experiences & integration successes

-

Market positioning analysis showing competitive advantages & differentiation strategies that work

The Portfolio

Transformation

- Before Unified Intelligence

-

Portfolio analysis = manual data compilation from RIAs, TAMPs & BDs taking weeks

-

Value creation = intuition-based decisions with limited visibility into what actually works

-

Firm support = reactive responses to problems already impacting advisor productivity

-

LP reporting = quarterly scrambles with inconsistent wealth management metrics

- After Unified Intelligence

Portfolio analysis

real-time dashboards with instant drill-down across all wealth management firms

Value creation

data-driven strategies based on proven cross-portfolio wealth management patterns

Firm support

proactive intervention based on advisor productivity analytics and benchmarking

LP reporting

automated generation with real-time wealth management data and transparent methodologies

Real Results

There are enough closed-off vendors in this space that I think are opening themselves up to risk of disruption. Data lakes were my method to tackle the silo problem. And, why I continually refer people to Milemarker™ – they’ve been solving this problem for years. Great team.

Brad Felix

Operating Partner Fireroad

75%

reduction in wealth management portfolio analysis & reporting time

60%

faster identification of firms needing operational support or technology investment

Real-time

visibility into advisor productivity, client metrics & operational efficiency across all firms

Systematic

value creation based on proven wealth management success patterns

PE-Specific Capabilities

Wealth Management

RIA & Wealth Management Integration

-

Seamless connectivity to CRM systems (Salesforce, Wealthbox, Redtail), portfolio platforms (Orion, Black Diamond) & custodial data

-

Automated advisor productivity tracking with normalized metrics across different firm types & business models

-

Client experience measurement & satisfaction tracking across portfolio companies

-

Technology adoption monitoring showing ROI of platform investments & operational improvements

Wealth Management Value Creation Analytics

-

Cross-firm benchmarking showing relative performance in advisor productivity, client retention & revenue growth

-

Best practice identification from successful operational improvements, technology deployments & acquisition strategies

-

Resource allocation optimization based on wealth management-specific value creation opportunities

-

Strategic initiative ROI analysis with success factor identification for technology, talent & operational investments

Investment Monitoring for Wealth Management

-

Real-time performance tracking against wealth management investment thesis & projected returns

-

Early warning systems for firms trending toward advisor attrition, client dissatisfaction, or operational challenges

-

Growth acceleration opportunity identification based on successful portfolio company expansion strategies

-

Exit readiness assessment with wealth management valuation optimization & market timing recommendations

Wealth Management LP Reporting

-

Automated quarterly reporting with wealth management industry benchmarks & competitive positioning

-

Customizable portfolio views showing advisor productivity, client metrics & operational efficiency across firms

-

Performance attribution analysis showing value creation sources specific to wealth management investments

-

Market intelligence based on aggregated portfolio company performance & competitive dynamics

Built For

Wealth Management PE Scale

Multi-Firm Architecture

Enable advisors to build bespoke models and implement unique strategies within your governance framework.

Wealth Management Integration

Seamless integration of private markets, real estate, and venture opportunities alongside traditional investments.

Industry

Expertise

Built specifically for wealth management metrics, workflows, and value creation strategies.

Broader PE Capability

While optimized for wealth management, platform supports any PE portfolio across industries with the same unified intelligence approach.

Advanced Wealth Management

Portfolio Intelligence

Predictive Wealth Management Analytics

-

Advisor productivity forecasting based on client metrics, market conditions & operational changes

-

Firm performance prediction identifying companies requiring immediate attention or additional investment

-

Growth opportunity scoring showing which wealth management firms have highest potential for acceleration

-

Market timing optimization for wealth management exits based on industry conditions & firm readiness

Cross-Portfolio Learning for Wealth Management

-

Success pattern recognition identifying operational strategies that consistently drive wealth management outperformance

-

Technology investment analysis showing which platforms & tools drive the best advisor productivity & client outcomes

-

M&A strategy insights based on portfolio company acquisition experiences & integration best practices

-

Market positioning intelligence providing competitive insights from wealth management portfolio company positions

Beyond Wealth Management

-

Resource allocation guidance maximizing impact across RIAs, TAMPs & broker-dealer investments

-

Operational improvement prioritization based on advisor productivity impact & implementation feasibility

-

Technology deployment strategies with success tracking & ROI optimization across portfolio companies

-

Strategic initiative management ensuring successful wealth management strategies reach all relevant firms

Wealth Management Value Creation Optimization

-

Platform capabilities extend to any PE portfolio across industries & business models

-

Same unified intelligence approach applies to healthcare, technology, industrial & service company investments

-

Cross-industry pattern recognition identifying value creation strategies that work across sectors

-

Comprehensive PE portfolio management regardless of industry focus or investment strategy

Other Solutions For:

- RIA's & Family Offices

Ready to Unify Your Wealth Management Portfolio?

Free analysis of data fragmentation and optimization opportunities across your wealth management investments.

Watch how unified data and cross-firm analytics transform wealth management PE portfolio management.

45 minutes to design the unified intelligence platform your wealth management portfolio deserves.

Stop managing RIAs & wealth management firms in isolation.

Stop accepting fragmented portfolio intelligence.

Stop limiting value creation to what you can see across spreadsheets.

Why Wealth Management Portfolio Unification Changes Everything

Your wealth management investments are only as strong as your ability to optimize them. Every missed operational pattern is a missed value creation opportunity.