Wealth Management: Milemarker Launches Firm Intelligence

Featured Published by Davis Janowski of WealthManagement.com

The firm, co-founded by serial entrepreneur Jud Mackrill, seeks to fill RIA firms’ need for business intelligence, data consolidation and integration.

Milemarker this week announced the launch of their Firm Intelligence platform.

“Firm Intelligence is a flagship offering,” said Milemarker co-founder and managing partner Jud Mackrill.

Founded in 2021, Milemarker has grown to 30 employees and has to date offered a mix of consulting, managed back-office services and a fractional chief data officer service.

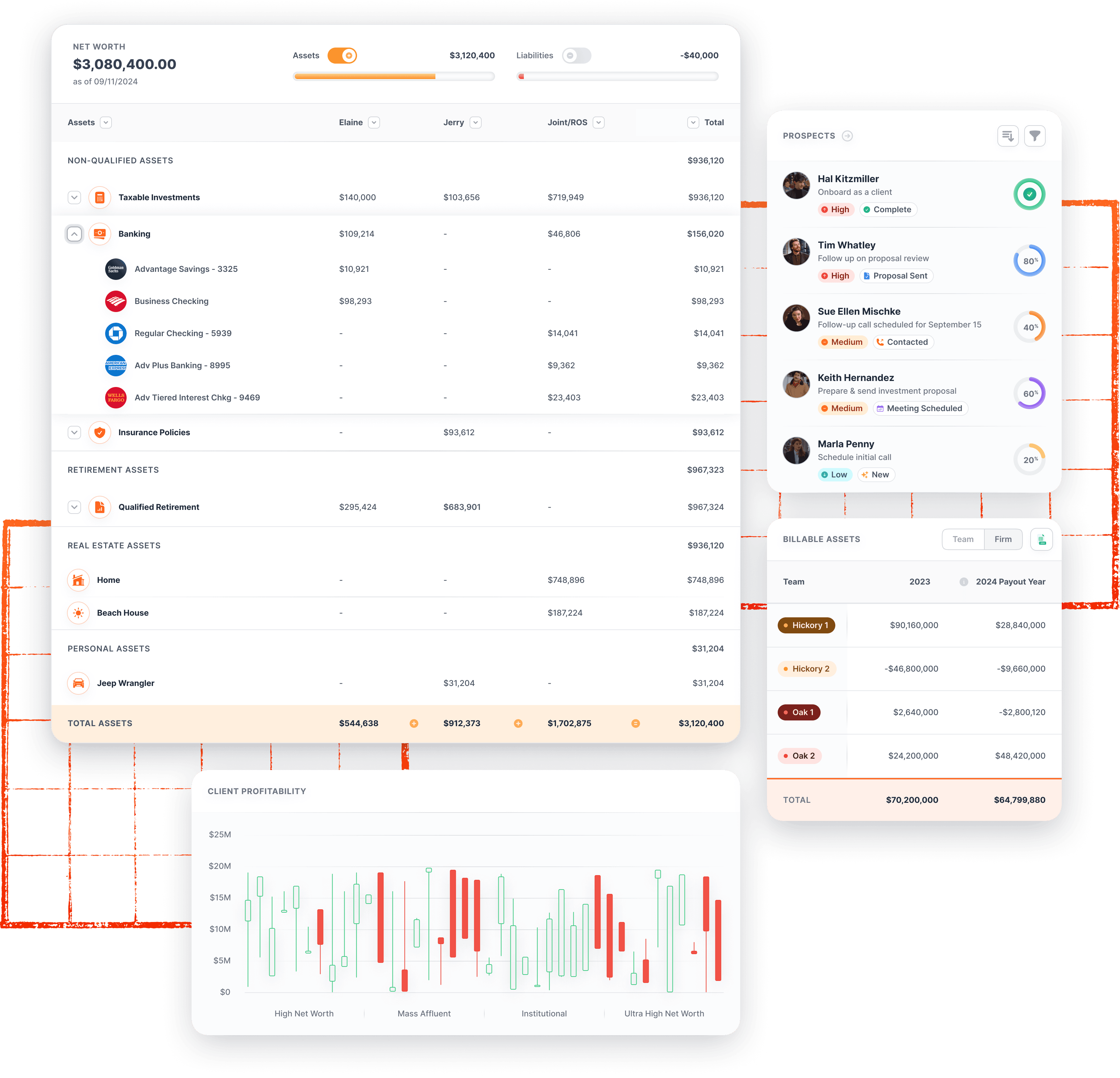

In addition, the company has offered several software-as-a-service products, including an Advisor Relationship Management platform, an Integration Suite, Data Analytics and Reporting for Wealth Management and the Milemarker Analytics Suite.

He said much of the latter SaaS technology has been consolidated and is now included in Firm Intelligence.

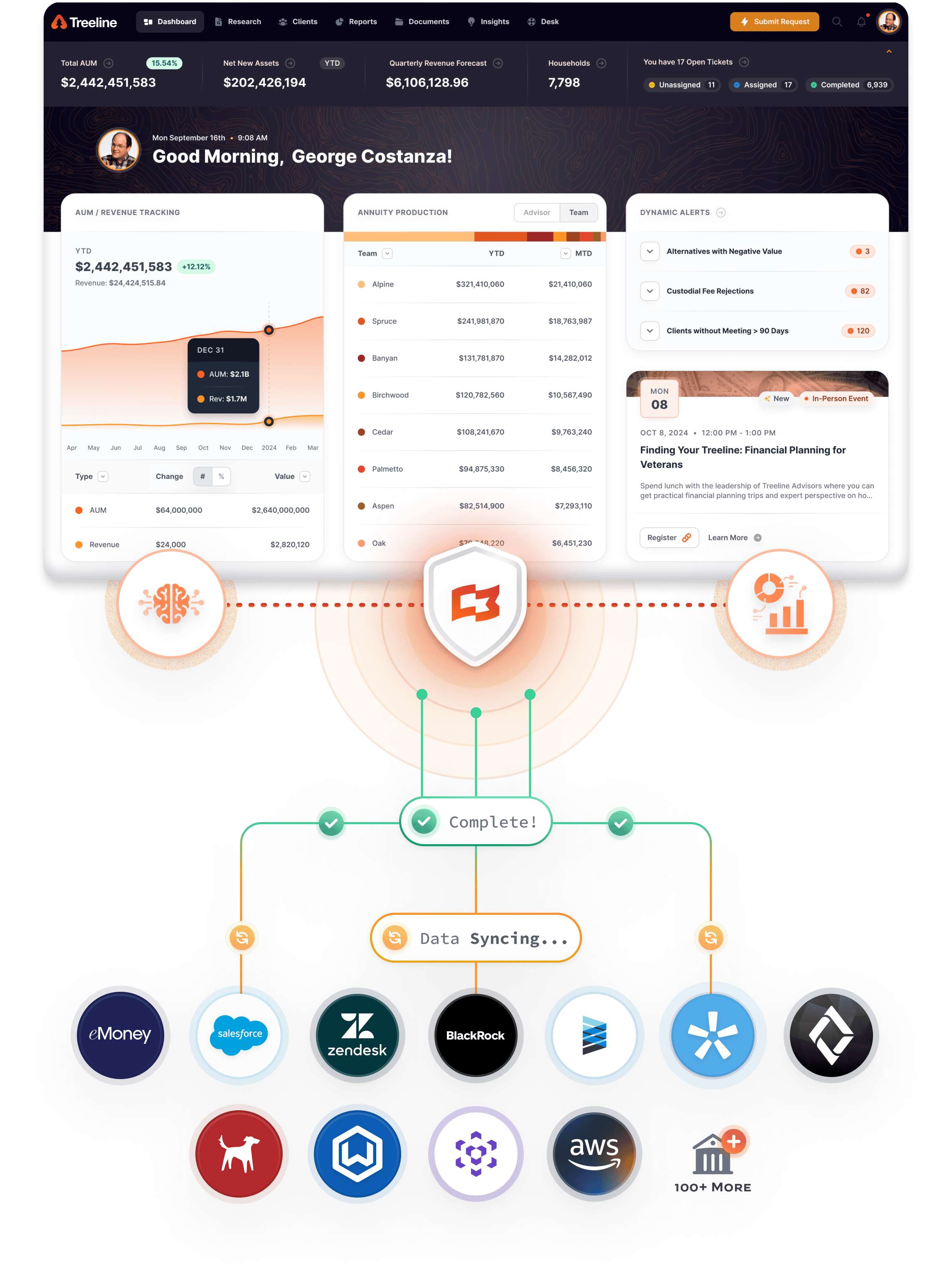

“With our new platform, you can build workflows, automate processes, integrate systems and communicate with clients and prospects in a way that allows you to take action on your own terms,” he said.

In a nutshell, Firm Intelligence enables advisory firms to consolidate their data into a single data warehouse. Firms can integrate it into their systems or use a branded application that can live on their domain and be entirely privately labeled to their brand, he said.

“Nine times out of 10—or really more like 10 times out of 10—advisory firms feel like they checked the box on having a data warehouse but not made it where it is a tangible addition to their ROI,” said Mackrill.

Mackrill and Milemarker use the phrase “synthesizing data” when discussing how the platform makes data available across an advisory firm’s many systems.

While an advisory firm coming to Milemarker with no existing data warehouse might likely be set up with Amazon’s AWS, the company also works with Azure and Google Cloud to host data. He said Milemarker has partnered with Snowflake as its data platform management and analysis tool of choice to maximize the computing power available with AWS.

“It is going to enable wealth management firms to maximize the potential of their current tech stacks,” said Mackrill, adding that Milemarker serves advisory firms managing assets ranging from $250 million to over $200 billion.

He said many of these firms, which are often growing through mergers and acquisitions and have quite heterogeneous tech stacks, use Milemarker to consolidate data and fill the integration gap by building workflows and creating broader data connectivity.

Asked how the Firm Intelligence platform differs from the business intelligence tools Milemarker had provided in the past, his answer was simple.

”The fundamental difference is scale—with the new platform, we are reducing the time to insight,” he said, adding, “We’re seeing firms understand the actual profitability of clients for the first time.”

“The beauty is that our customers know their businesses pretty well but this is giving them better insights more quickly than they might have ever gotten on their own,” he said.

When asked about cost, Mackrill said Milemarker still does not provide pricing information to the media or publish cost information on its website, citing the great variation between installations and engagements.

Following the platform’s launch, Mackrill said Milemarker would roll out several new features and enhancements over the coming months but could not provide any specifics.