- Unified Managed Accounts (UMAs)

Understanding Unified Managed Accounts (UMAs)

How Milemarker Facilitates Their Adoption Through Rich Content Management and Integrated Workflows

- Unified Managed Accounts (UMAs)

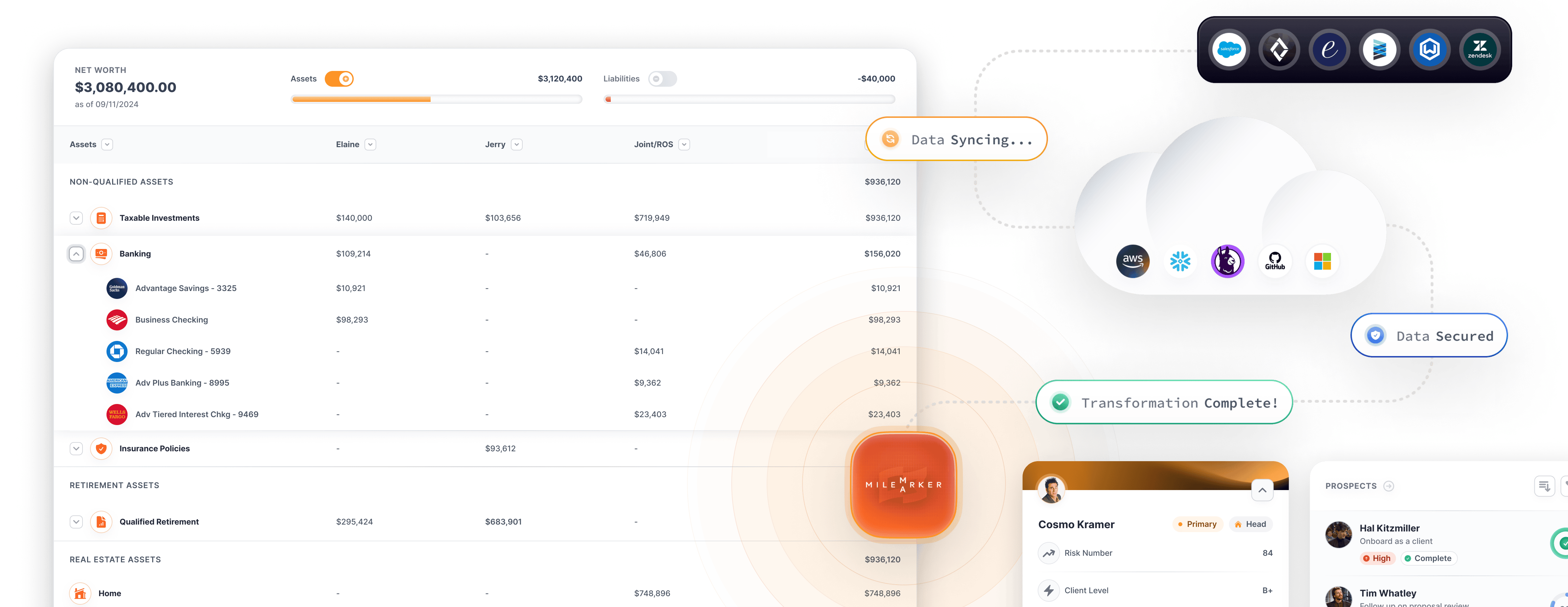

In the evolving landscape of wealth management, Unified Managed Accounts (UMAs) have emerged as a powerful tool for financial advisors and firms. UMAs offer a consolidated platform that integrates multiple investment products and strategies into a single account, streamlining portfolio management and enhancing client experience. However, adopting UMAs can present challenges related to data management, integration, and workflow optimization.

Milemarker steps in to bridge this gap by providing firms with rich content management and seamless UMA integration, coupled with efficient workflows. This article explores what UMAs are, how they work, and how Milemarker supports firms in leveraging UMAs to their full potential.

What Are Unified Managed Accounts (UMAs)?

A Unified Managed Account is a single investment account that combines various asset classes, investment products, and strategies under one umbrella. This includes mutual funds, exchange-traded funds (ETFs), separately managed accounts (SMAs), and alternative investments. UMAs provide a holistic view of a client’s portfolio, making it easier for advisors to manage assets, execute strategies, and report performance.

Key Features of UMAs

1. Consolidation: Aggregates multiple investment types into one account.

2. Customization: Allows tailored investment strategies to meet individual client needs.

3. Tax Efficiency: Facilitates tax management strategies across the entire portfolio.

4. Simplified Reporting: Provides comprehensive performance reports in a unified format.

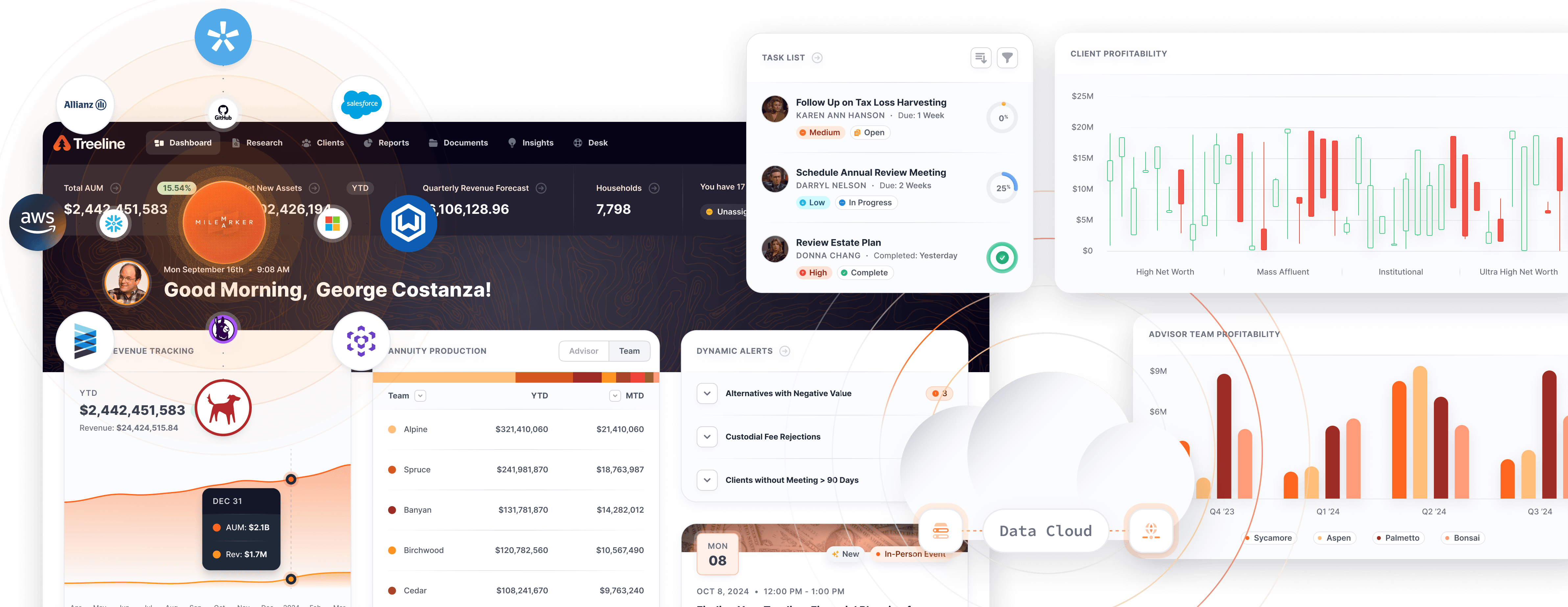

- Firm Intelligence

UMAs function by integrating various investment vehicles into a single account managed through a unified platform. Here’s how the process typically unfolds:

- Firm Intelligence

Efficiency

Streamlines portfolio management by reducing administrative tasks

Transparency

Offers clear insights into holdings and performance

Flexibility

Enables quick adjustments to investment strategies

Client Satisfaction

Enhances the client experience through personalized service and comprehensive reporting.

- Firm Intelligence

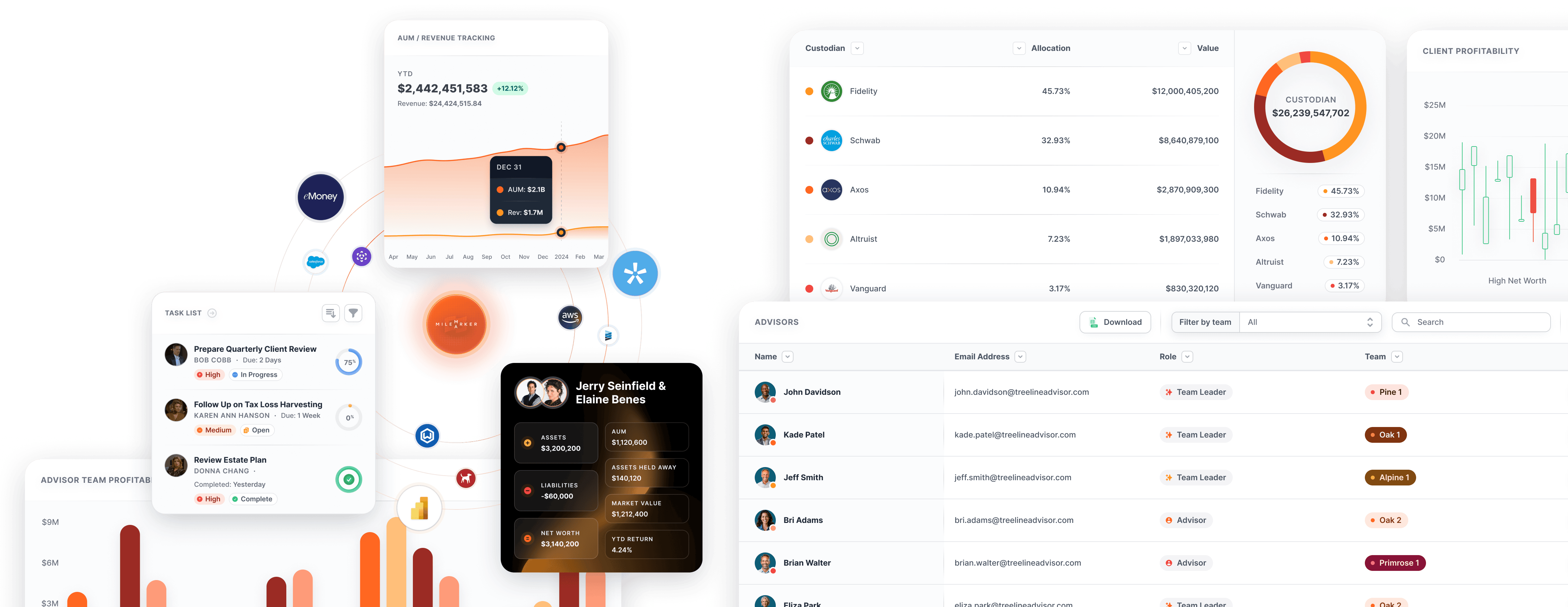

While UMAs offer significant advantages, firms often face hurdles in adopting them:

Data Integration

Combining data from multiple sources can be complex

Technology Limitations

Legacy systems may not support UMA functionalities.

Workflow Inefficiencies

Manual processes can slow down operations

Compliance and Regulation

Navigating the regulatory landscape requires meticulous attention

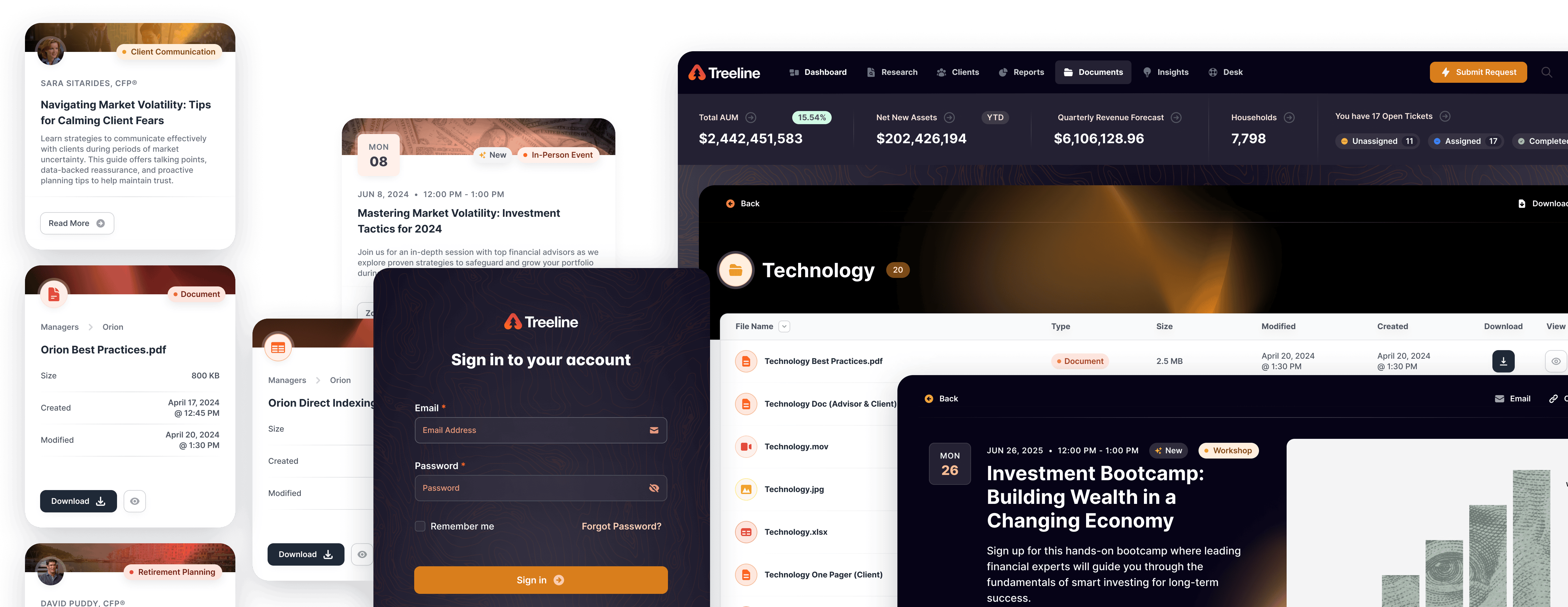

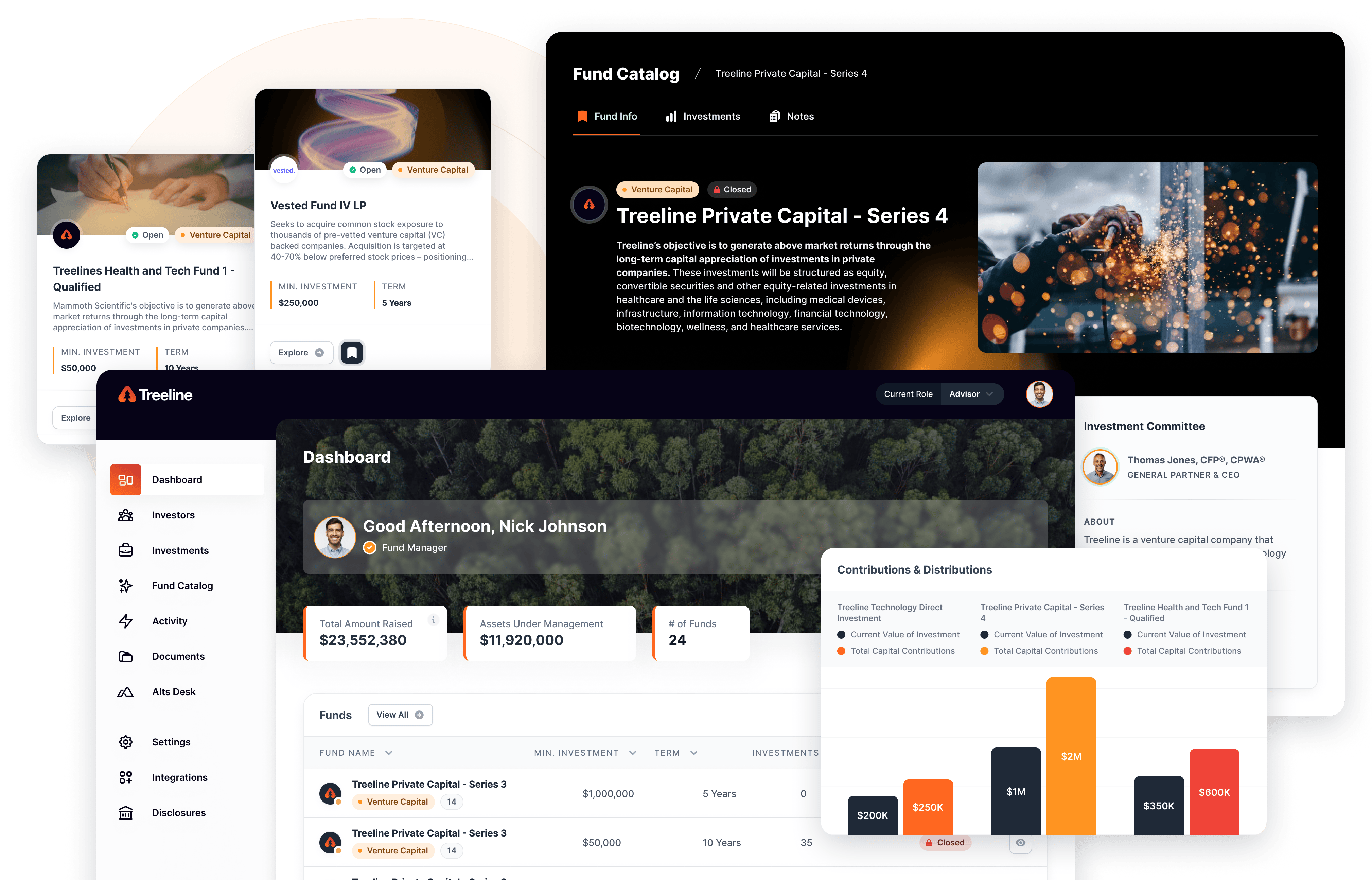

How Milemarker Supports Firms in Adopting UMAs

Milemarker specializes in assisting firms to overcome these challenges by providing solutions that integrate rich content management with UMA platforms, all coupled with efficient workflows.