Ownership—What Taylor Swift, Your Advisory Practice, and a Loaf of Sourdough Have in Common

On Wednesday evening, my wife, kids and I gathered in our living room to watch a podcast.

Our guest? Taylor Swift.

Our stage? New Heights with Jason and Travis Kelce.

90 minutes later, I had received one of the clearest business lessons I’ve encountered all year.

The Pattern Disrupt

Taylor Swift used a live sports‑entertainment podcast to announce her 12th studio album, The Life of a Showgirl. No scheduled press release. No staged promo tour. Just a bold, unpredictable moment on a podcast that’s not her own.

That’s her playbook:

- Folklore and Evermore (2020)—both surprise‑dropped with zero lead‑time.

- Midnights (2022)—revealed live at the VMAs, immediately breaking streaming records worldwide.

- The Tortured Poets Department (2024)—smash hits and streaming-first records: over 300 million streams in one day, 1.76 billion in the first week, 4 million album-equivalent units globally.

Like almost all of Ms. Swift business decisions, this launch was no accident—it was a masterclass in disruption.

My family has witnessed her attention to detail firsthand. My wife and daughters attended the Eras Tour in Indianapolis and Cincinnati, where every beat, stage shift, and costume change was choreographed to imprint on memory. Swift shared that she intended for fans to leave those shows feeling full, overwhelmed by the theatrical and some of them described it as a state of “amnesia,” flooded with sensory overload—the template for her design decisions is the endless scrolling feature of social apps. Brilliant. And, mission accomplished.

From Sourdough to Strategy

In the New Heights episode, Swift talked about baking sourdough bread post-tour—and about her biggest business success since leaving the tour. She shared how she regained ownership of her master recordings, paying an estimated $360 million, after a relentless, two-decade drive toward autonomy.

Her journey started with the kind of control you might afford your own 15 year old, not much. She wrote her own songs, recorded her music and retained her publishing rights, but her original recordings, her masters, were owned by others working their way through Big Machine, Scooter Braun, and, eventually, Shamrock Capital. She needed a LOT of money to buy them herself and although she’d attempted to secure them before, she’d never been able to. When she couldn’t broker the deal, she decided to re-record her early albums—Fearless (Taylor’s Version), Red (TV), 1989 (TV)—and asked her fans to listen to her version, minimizing the value of the originals.

But she never lost the desire to truly own everything she’d created.

Riding the tailwind of the $2 billion–grossing Eras Tour, she executed her strategic reclaim—a win celebrated by her, her loyal fan base and artists everywhere.

Why It Matters to Advisors

I’ve advised financial professionals for 21 years, and the analogy is stark:

- Starting out: you own almost nothing—just enough to build on.

- On the rise: autonomy becomes essential.

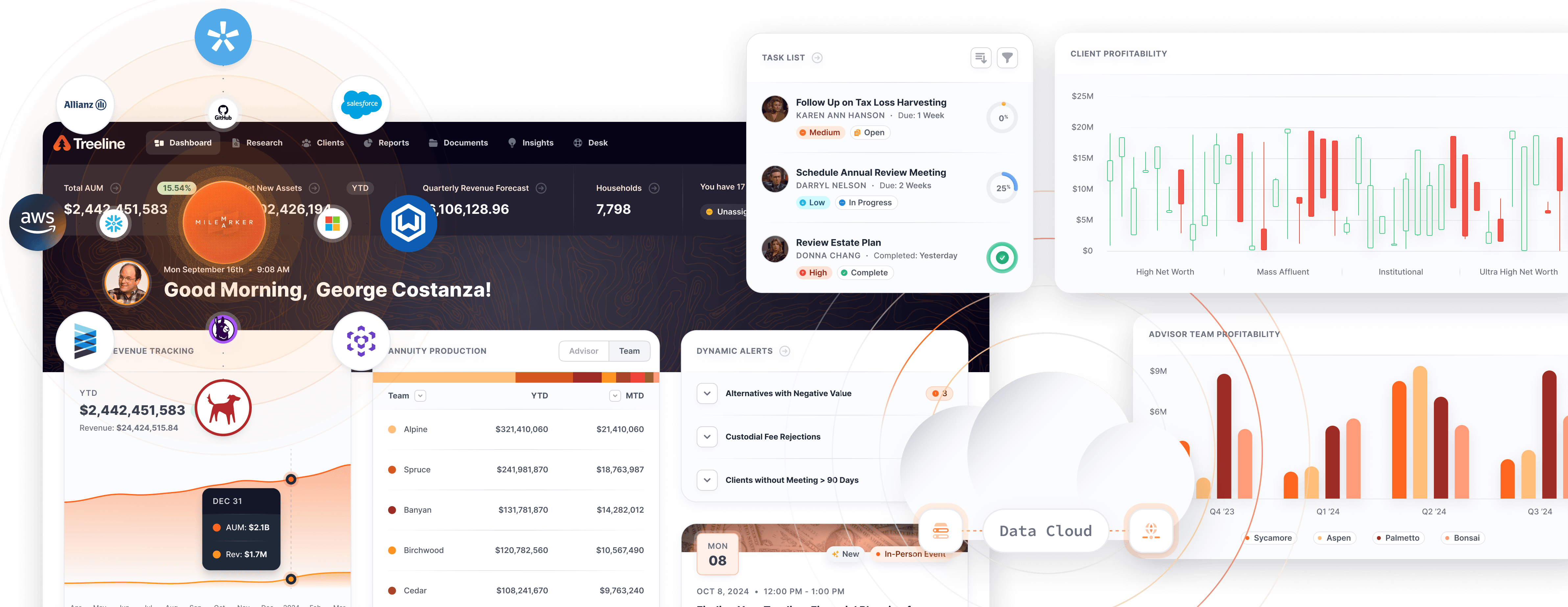

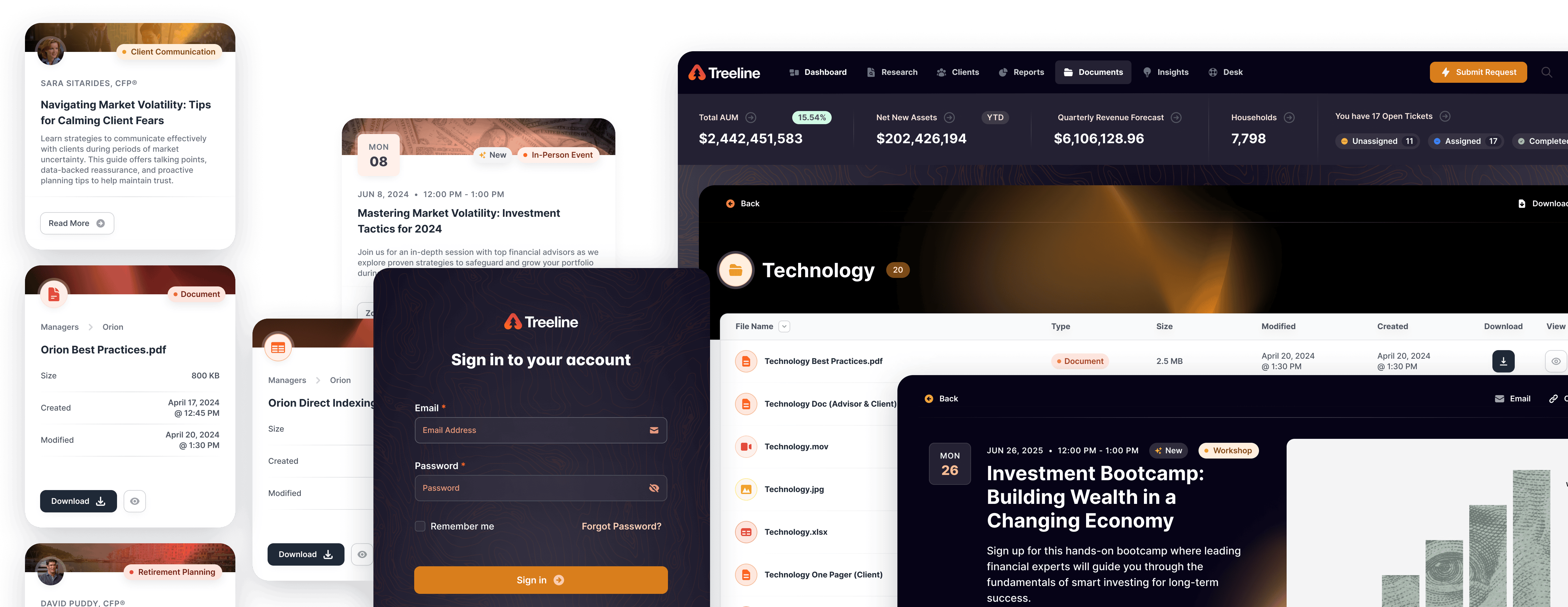

- At your peak: owning your client experience, systems, and data is a force multiplier.

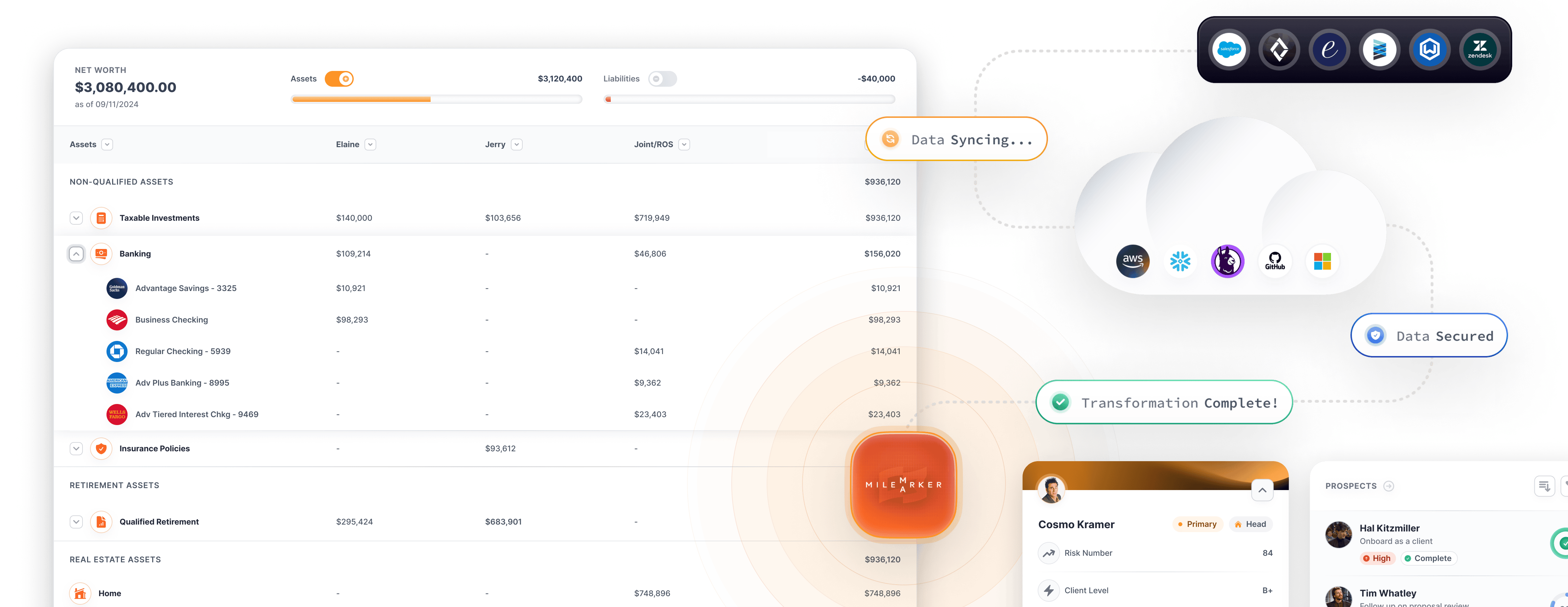

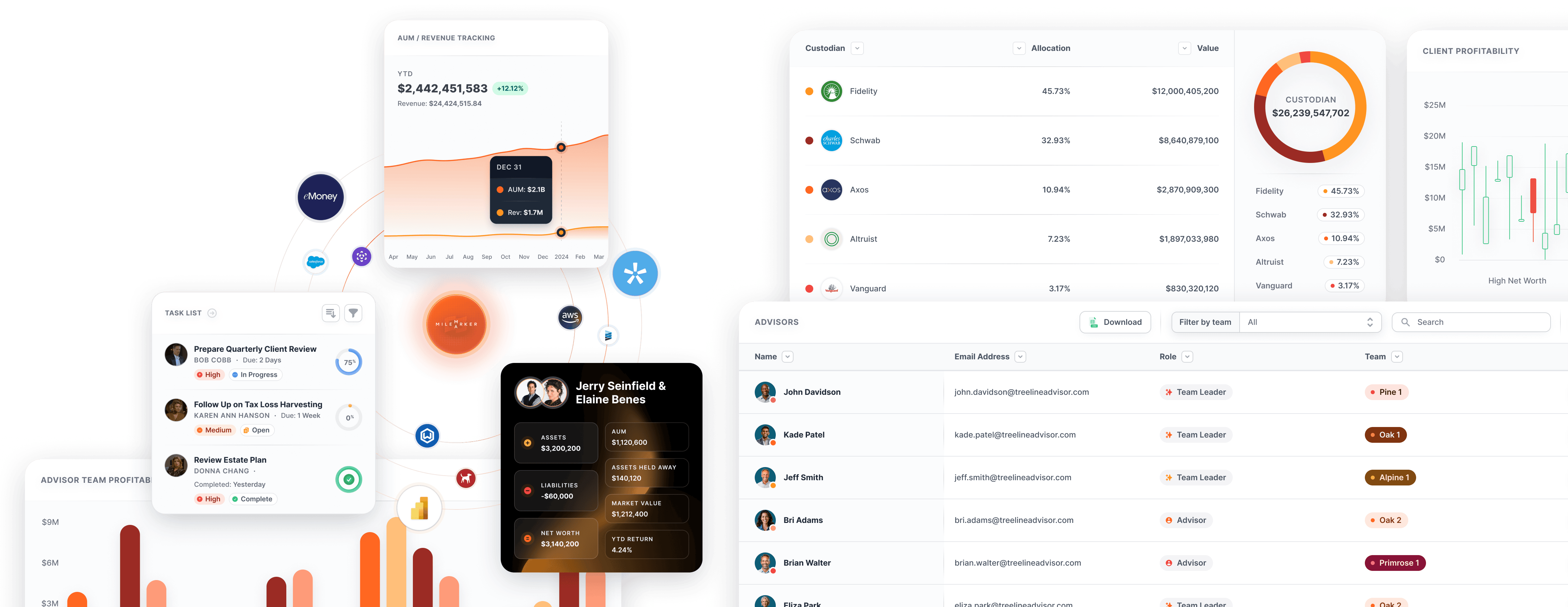

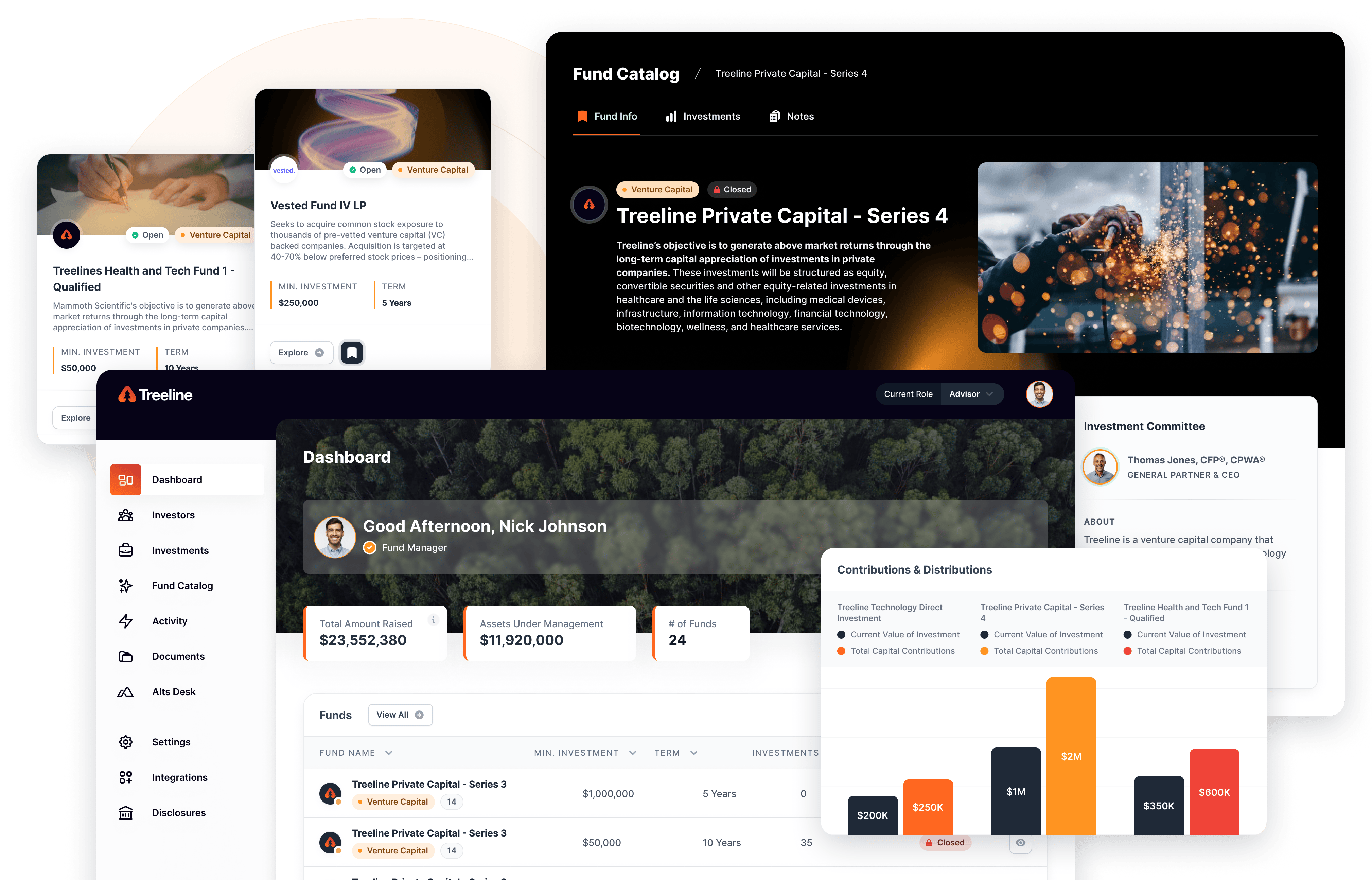

We’re entering a new era. AI and data are redefining the playing field. At Milemarker, our focus is giving advisors their version of “master control”—tools and data they fully own and use to turbocharge service and growth.

The Trap of Total Ownership

Here’s the catch:

- Own nothing? You’re at someone else’s mercy.

- Own everything? You bury yourself in complexity.

The smart play: own what matters. Partner for the rest. That balance is where growth—and transferability—happens.

Your “Master Recording”

Swift’s true masters are a 286 song catalog, including one 10 minute long magnum opus. What’s yours?

What’s the one asset—system, data stream, client touchpoint—you must own to deliver elite-level service?

I’d love to hear your answer—hit reply and tell me.