Milemarker Launches Wealth Data Integration Transformation Platform

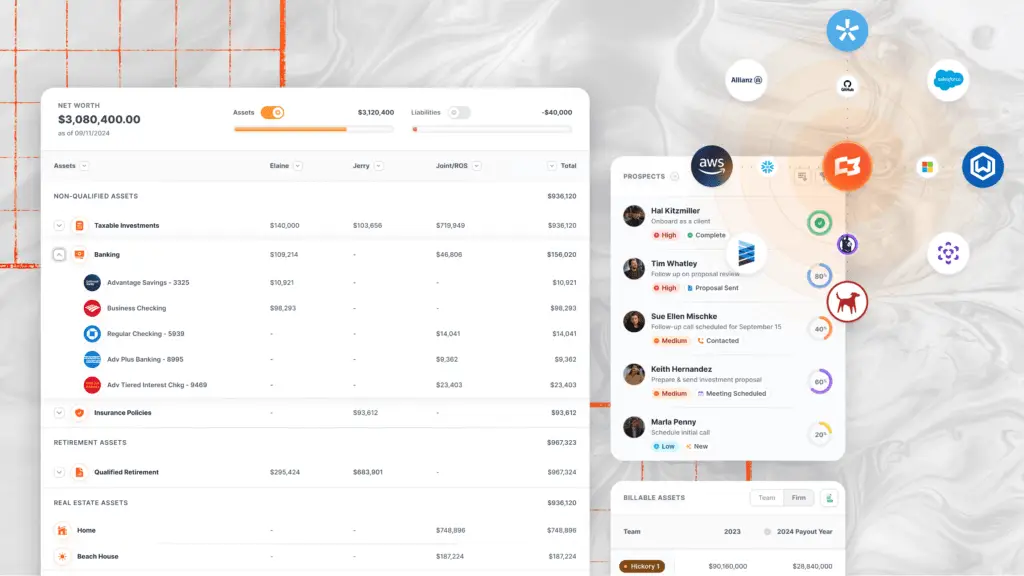

In a significant development for the wealth management industry, fintech company Milemarker has unveiled its new Firm Intelligence platform. This innovative solution aims to transform how financial advisors leverage their existing technology stacks, offering enhanced data integration, process automation, and improved client communication capabilities.

Founded in 2021, Milemarker has quickly established itself as a crucial player in the fintech space, serving advisory firms with assets under management ranging from $250 million to over $200 billion. The company’s latest offering, Firm Intelligence, addresses a critical need in the industry by providing a unified platform that synthesizes data across various systems, streamlining operations and boosting efficiency.

Kyle Van Pelt, CEO of Milemarker, emphasized the platform’s role as ‘connective tissue’ that enables firms to harness data insights for better client management and business growth. This approach is particularly valuable in an industry where mergers and acquisitions are common, as it facilitates the integration of diverse technology systems from acquired businesses.

The launch of Firm Intelligence comes at a time when wealth management firms are grappling with the challenges of rapidly evolving technology. Rather than advocating for continuous investment in new tools, Milemarker’s solution allows firms to maximize the potential of their current tech stacks. This strategy not only proves cost-effective but also aligns with the practical needs of financial advisors who seek to focus more on client service and prospect engagement.

Jud Mackrill, Co-Founder and Managing Partner of Milemarker, highlighted the platform’s ability to help firms invest in their people and processes while extracting more value from existing technology investments. This approach offers a clear return on investment for financial advisors looking to enhance their technological capabilities without the need for constant upgrades.

One of the key features of Firm Intelligence is its ability to consolidate essential data into a single, comprehensive view. This integration can be seamlessly implemented into existing systems or accessed through a branded application that can be privately labeled to match a firm’s branding, offering flexibility in deployment.

The impact of Milemarker’s solution is already being felt in the industry. Laura Hubbell, Chief Information Officer at SignatureFD, praised the platform for providing greater access to crucial business data and automating reports that would have otherwise taken weeks to create manually. This level of automation and data transparency marks a new era for wealth management firms in terms of operational efficiency and decision-making capabilities.

As Milemarker continues to grow, with team members across the United States and a roster of fast-growing advisory firms, the company plans to roll out additional features and enhancements to the Firm Intelligence platform in the coming months. These updates are expected to further solidify Milemarker’s position as a leader in fintech innovation for wealth management.

The introduction of Firm Intelligence represents a significant step forward in addressing the data integration and technology utilization challenges faced by wealth management firms. By enabling advisors to extract more value from their existing tech stacks, Milemarker is not only improving operational efficiency but also potentially transforming the way these firms approach technology investments and client service strategies.

As the wealth management industry continues to evolve, solutions like Firm Intelligence may play a crucial role in helping firms navigate the complex landscape of financial technology, ultimately leading to better outcomes for both advisors and their clients. The platform’s ability to streamline processes, enhance data accessibility, and improve client communication could set a new standard for technology integration in the financial services sector.