What Financial Services Companies Need to Know About AWS

When it comes to the cloud, Amazon Web Services (AWS) is the clear market leader. According to Synergy Research Group, AWS accounted for more than half of the global cloud infrastructure services market in the first quarter of 2018. And that number is only going to grow.

In fact, the CEO of AWS recently stated that only 10% of workloads have moved to the cloud so far, which suggests there’s still a huge opportunity for growth in the AWS ecosystem and cloud computing in general.

For financial services companies, the appeal of AWS is obvious. The cloud platform offers a broad array of services that can be used to build everything from simple websites to complex financial applications.

Why is AWS so popular?

There are a few reasons. First, AWS is incredibly reliable. It has a strong track record of uptime and delivers 99.95 percent availability.

Second, AWS is constantly innovating, adding new features and services at a rapid pace. This means that financial institutions can rely on AWS to stay ahead of the curve and meet the ever-changing needs of their customers. Third, AWS has a massive partner network with experts in every industry. This means that financial institutions can get help and support when they need it.

So what do financial services companies need to know about working with AWS?

Here are just a few things:

1) Security is a top priority for AWS.

Financial institutions can rest assured knowing that their data is safe and secure when stored on AWS. AWS has some of the most stringent security requirements in the world, and it continuously innovates to stay ahead of evolving threats.

AWS’ Strategic Security helps Financial firms gain control and visibility into their AWS environment by providing them with a central location to manage their security policies. AWS’ Security Hub gives Financial firms the ability to see their compliance posture against industry-leading security standards, such as PCI DSS and ISO27001.

NASDAQ is able to achieve greater security by using AWS. With AWS, NASDAQ has been able to quickly identify and respond to potential threats.

2) AWS is compliant with a variety of regulations.

This includes PCI DSS, HIPAA, SOC, and more. Financial institutions can use AWS with confidence knowing that their data will be compliant with all relevant regulations.

In addition to broader security specifications, AWS also helps you comply with SEC and FINRA regulations. Amazon’s Object Lock feature helps you meet SEC & FINRA 17A-4 Compliance. Object Lock provides you with an immutable storage option for your most sensitive data.

Today, FINRA uses Amazon’s EC2 to gain cost efficiencies and the flexibility to scale their environment according to their needs. With Amazon’s pay-as-you-go pricing model, FINRA only pays for the resources they use, which has helped them save 50% on their IT infrastructure costs.

“The scalability, flexibility, and cost efficiency of Amazon Web Services allows us to focus on our mission – protecting investors – rather than managing IT infrastructure,” said Steve Randich, Executive Vice President and Chief Information Officer, FINRA.

3) The AWS platform is constantly evolving.

Financial institutions can rely on AWS to keep up with the latest trends and technologies. In addition, AWS offers a massive library of services and features, so institutions can choose exactly what they need to meet their specific needs.

Technologies like OCR are being delivered via AWS to quickly and accurately identify data in financial documents. Amazon Textract can extract text and data from virtually any document no matter the format or structure.

BDO partnered with Amazon Textract to develop an intelligent document processing (IDP) solution. The IDP solution uses Amazon Textract to automatically extract data from leases, loan applications, and tax documents.

BDO‘s data is then stored in an AWS S3 bucket for easy retrieval and analysis. This solution has helped BDO save time and money while improving accuracy and efficiency.

Wrapped Insurance chose Amazon Textract to develop their product, which helps insurance companies automate the processing of insurance documents. The solution uses Amazon Textract to automatically extract data from PDFs and images. This data is then stored in an AWS DynamoDB table for easy retrieval and analysis.

“Amazon Textract has allowed us to quickly and accurately extract data from a variety of insurance documents. This has helped us save time and money while improving accuracy and efficiency,” said Wrapped Insurance CEO, Michael Wright.

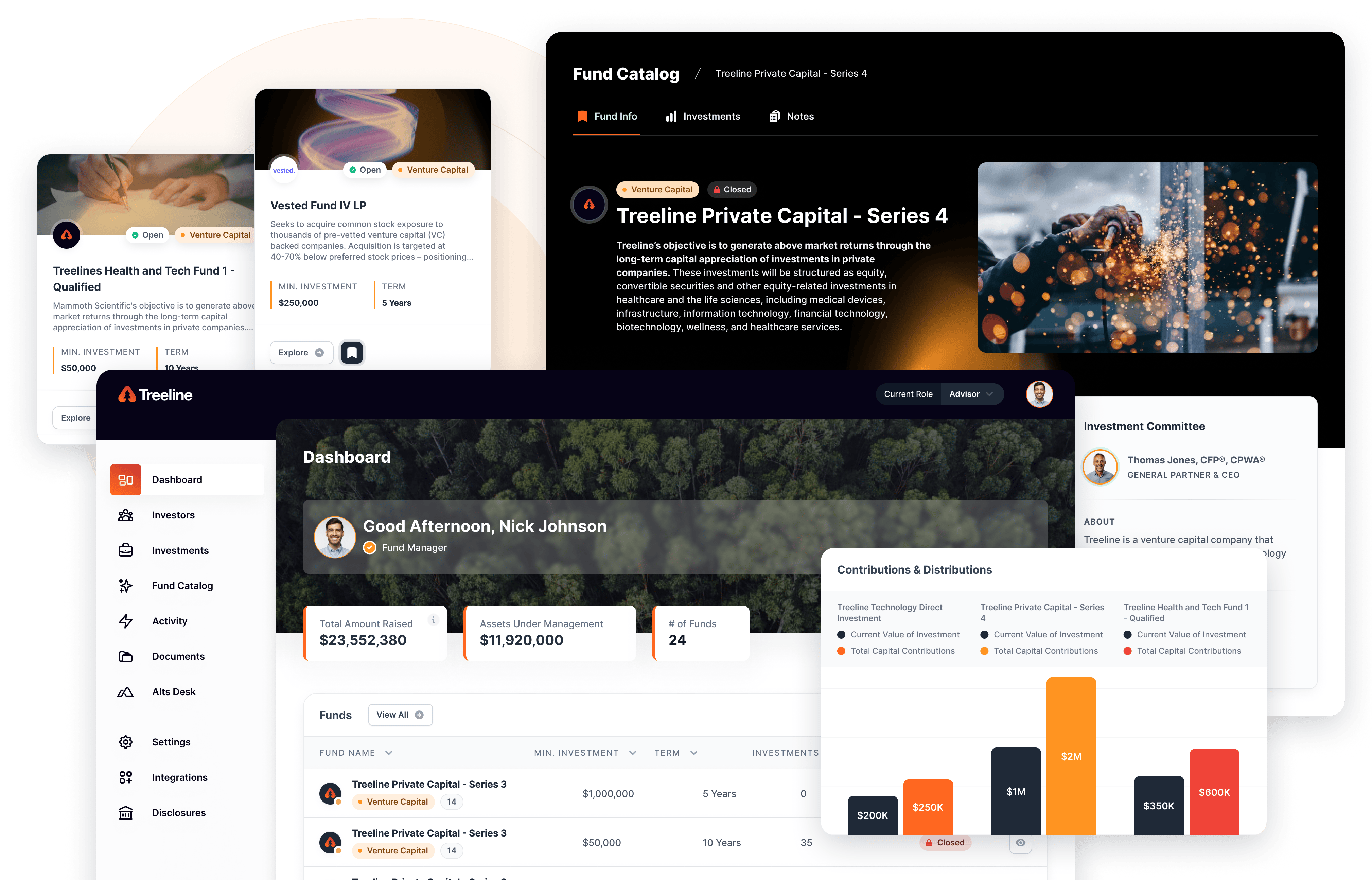

4) The options to build on top of AWS are vast.

Financial institutions can get help and support from experts in every industry who are familiar with AWS. This means that they can get up and running quickly and easily, without having to learn all the ins and outs of the platform themselves.

Goldman Sachs uses AWS to power its digital transformation.

The company has been at the forefront of digital transformation, and it’s using AWS to power that transformation. Goldman Sachs uses AWS for a variety of workloads, including data analytics, application development, and disaster recovery.

Charles Schwab is one of the largest financial institutions in the United States. The company has been a long-time user of AWS, and it relies on the platform for a variety of workloads, including data warehousing, application development, and disaster recovery. Charles Schwab also values the partner ecosystem that AWS provides.

“AWS provides an excellent partnership ecosystem, which is critical to our success,” said Joe Martinetto, Chief Information Officer at Charles Schwab. “We have built deep relationships with key technology partners like RedLock and Splunk that help us accelerate our use of AWS and deliver value to our clients.”

5) AWS offers a pay-as-you-go pricing model.

This means that financial institutions only pay for the resources they use, which can save them a lot of money over time.

Plaid is a financial services company that provides APIs to help developers build financial applications. The company has seen incredible growth, and it’s using AWS to power that growth.

Plaid uses AWS for everything from its web app to its data processing pipeline. In addition, the company relies on AWS Lambda to process data in real-time.

Today, AWS powers some of the most incredible tools across financial services. From data-driven insights to automated fraud detection, AWS is helping financial institutions transform the way they do business.

Insurance and investment companies like AXA are using AWS to reinvent the customer experience. They built an interactive chatbot using Amazon Alexa and Amazon Polly that allows customers to get real-time answers to their questions, 24/7.

Or take a company like BBVA, which created an end-to-end digital mortgage experience using a variety of AWS services. Customers can now apply for a mortgage entirely online, and they can track their application status in real-time.

This process is not only more convenient for customers, but it’s also more efficient for BBVA, which has seen a 30 percent reduction in processing times.

Going to the Cloud

As your firm is looking to get started with AWS or cloud computing in general, there are some key things you need to assess. Here are three factors that are critical to success when moving to AWS.

1) Migration

Migrating your workloads to AWS can be a daunting task. There are a few approaches you can take, and it’s important to assess which one makes the most sense for your organization.

One approach is to lift and shift your workloads to AWS. This means taking your existing applications and running them on Amazon EC2 instances. Another approach is to re-architect your application so that it’s designed for the cloud.

2) Security

Security is always a top concern for financial institutions. When you move to AWS, you need to make sure that your data is secure. AWS provides a variety of features and services to help you secure your data, including Amazon CloudTrail, Amazon GuardDuty, and Amazon Macie.

3) Compliance

Financial institutions are subject to a variety of compliance regulations. When you move to AWS, you need to make sure that you’re compliant with all relevant regulations. AWS provides a number of features and services to help you comply with regulations, including AWS Config and Amazon Inspector.

Once you have made the move to AWS, how do you know your company is taking full advantage of its power?

Here are five AWS features that every financial institution should be using.

1) Amazon EC2:

Amazon Elastic Compute Cloud (Amazon EC2) is a web service that provides resizable compute capacity in the cloud. It’s a popular choice for financial institutions because it’s easy to use and it’s very scalable.

2) Amazon S3:

Amazon Simple Storage Service (Amazon S3) is an object storage service that offers industry-leading scalability, data availability, security, and performance. Financial institutions use Amazon S3 to store data for a variety of applications, including analytics, archiving, and backup.

3) Amazon DynamoDB:

Amazon DynamoDB is a fully managed NoSQL database service that offers fast and predictable performance. Financial institutions use DynamoDB to power applications that require high throughput and low latency, such as fraud detection and real-time analytics.

4) Amazon Redshift:

Amazon Redshift is a fully managed data warehouse service that offers fast performance and scalable storage. Financial institutions use Redshift for a variety of applications, including data warehousing, business intelligence, and analytics.

5) Amazon QuickSight:

Amazon QuickSight is a fully managed business intelligence service that makes it easy to visualize data and gain insights from your data. Financial institutions use QuickSight to build dashboards and perform ad-hoc analysis.

If you’re a financial institution looking for a reliable, innovative cloud platform, Amazon Web Services is a clear choice. Contact Milemarker today to learn more about how we can help you make the most of the power of AWS!