Forging the Path Forward: How to Turn Shortcuts Into Express Lanes

Forget the Map—Follow the Shortcut: Why Desire Paths Are Your Firm’s Best Friend

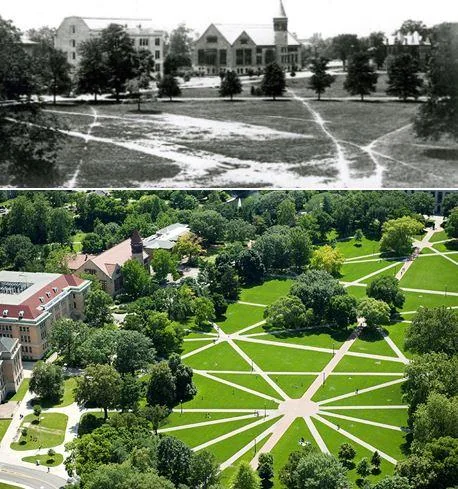

Picture this: A perfectly paved path winding through a park. It’s beautiful, symmetrical, meticulously designed. But, it’s not getting used the way it was intended. People are walking straight through the park instead of staying on the path.

Instead of staying on the paved road, there’s a dusty trail cutting right through the grass—it’s not the planned route, it’s the route people actually take. It’s quicker. More direct. Sure, it’s not what the designers intended, but guess what? The designers got it wrong.

Of course, this isn’t just about parks. It’s about your business. The same thing happens every day in your workflows—whether you want it to or not.

You can spend months (years?) designing the perfect process. You can write (and rewrite) standard operating procedures documents ad infinitum. But your customers, and team? They’re going to find and carve out their own path.

In the world of trails, they call these desire paths.

Ohio State University learned this the hard way back in the early 1900s. Students weren’t following the fancy paved walkways. They were taking shortcuts, walking wherever they wanted to take more direct paths.

Instead of resisting and posting signs or planting shrubs to keep them on the predesigned paths, the university architect, Joseph Bradford met people where they were.

They paved those desire paths, and boom—“The Oval” was born. Function gave way to form and what was once a system of dusty trails has matured into formal, beautiful spaces.

So, what does this mean for you? Your team is already creating their own shortcuts, or attempting to. Your customers are, too. The official process, with all the checks and balances? Yeah, they’re probably skipping over some pieces to get to a minimum viable version of ‘done.’

It’s not rebellion. It’s efficiency. They’re showing you where the path should be.

3 Ways to Embrace Desire Paths in Your Business:

1. Find Your Shortcutters

Ask the people who aren’t following your process why. Don’t judge. Just listen. They’re the ones who’ve found a more direct way, and if you’re ready to receive it, you’ll learn so much.

Early in my career, whenever I had a dissenting client who had strong opinions, I wanted to disengage or fire them. I was running away from the fire.

Later on, though, I realized the path makers are one of the best assets I can have for improving my firm.

2. Talk to the Receivers

It’s not just about the people taking the shortcuts. Ask the ones on the receiving end: Is the current process helping or slowing you down? Odds are, they’ll tell you where necessary work is getting skipped over or where the efficient ‘desire path’ is actually better.

Be careful to listen and empathize, while looking for ways to use automation to fill in what’s necessary so that humans can keep their streamlined processes. Remember to let feedback influence the paths we build, but not wholly define them.

3. Turn Shortcuts into Express Lanes

Don’t fight human nature. Instead of forcing everyone back onto the “paved” path, take the desired path and solution around behavior to automate what humans are refusing to do. Design the process they want to use.

Keep in mind that your team and clients will continue to create new desire paths. The process of refinement isn’t static, it takes time and it takes ongoing iteration. You will always have the ability to tweak it but when it’s done correctly, your organization will be improving all the time.

Here’s the Truth:

Your carefully designed path? It’s a good start. What really matters is the path people choose. And like Ohio State, if you lean into those desire paths, you’ll end up with something better than what you planned.

So, what shortcuts are your employees or customers taking?

And how can you turn those into the express lanes of your business?

Your move.