Navigating the Landscape of Modern Wealth Management Platforms

What Are Wealth Management Platforms?

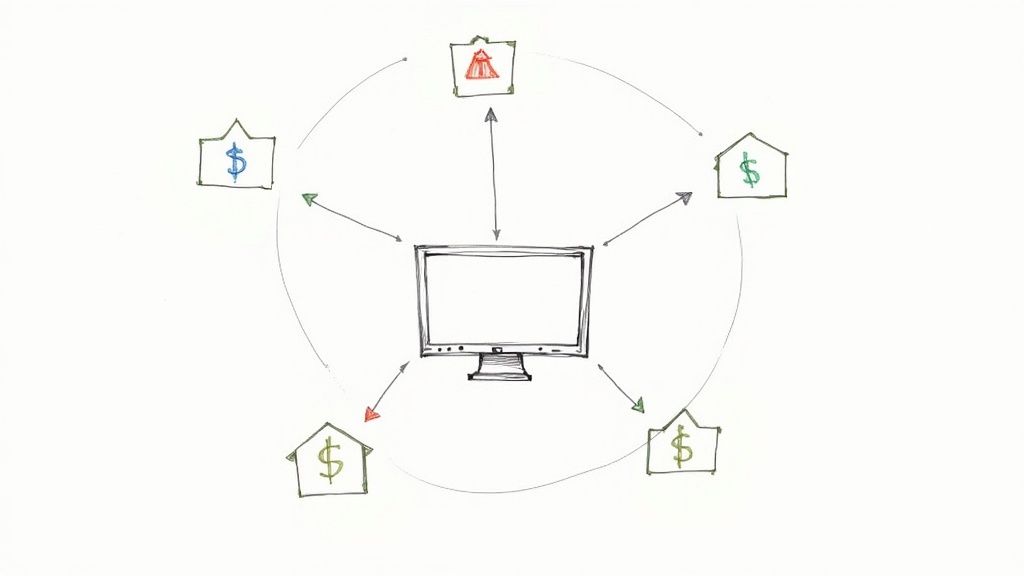

Wealth management platforms are essentially comprehensive software solutions created to simplify and automate the often complex world of financial planning and investment management. Think of them as a central hub for wealth advisors, connecting all the necessary tools and information in one convenient location. This allows advisors to efficiently manage client portfolios, track market trends, produce reports, and communicate effectively, all within a single, unified system. This integrated approach not only saves valuable time but also reduces the risk of errors associated with juggling multiple, separate programs.

This integration is why these platforms have become indispensable for modern wealth management firms. They offer a broad range of functions, from building and adjusting portfolios to performance reporting and client relationship management (CRM). For instance, well-established platforms like Orion, Assetmark and Envestnet offer robust tools for financial advisors to address a wide array of client needs. Furthermore, the emergence of newer platforms like Addepar and Advyzon highlights the increasing demand for more focused and advanced wealth management solutions. This demand is driven by the need for advisors to readily access and analyze increasingly complex investment information, provide truly personalized advice, and efficiently scale their businesses.

Despite these advancements, the wealth management technology landscape presents certain challenges. Many firms have had to invest significantly in general CRM platforms like Salesforce, even though these systems aren’t specifically designed for the nuances of wealth management. As a result, advisors often dedicate valuable time to adapting and customizing these platforms to fit their specific needs. This can be a costly and time-consuming endeavor, diverting resources away from core client services.

The growing need for industry-specific platforms emphasizes the importance of solutions tailored to the unique demands of wealth management. These specialized platforms are vital for several reasons. They offer in-depth analytics and reporting designed for intricate investment strategies, present streamlined workflows reflecting industry best practices, and enable seamless integration with other vital financial tools. These features empower advisors to deliver more effective and personalized financial guidance to their clients. Essentially, wealth management platforms have become the foundation of modern financial planning, offering the infrastructure needed to navigate today’s market complexities and deliver optimal results for clients.

Key Features and Benefits

Having explored the growing importance of dedicated wealth management platforms, it’s vital to understand the core features that make them so valuable. These features, when combined effectively, provide substantial benefits to both advisors and their clients. This powerful combination distinguishes robust platforms from generic alternatives. One key differentiator, for example, is the range and depth of functionality, which we’ll delve into below.

Essential Features of Leading Wealth Management Platforms

Truly effective wealth management platforms offer more than basic CRM features. They offer a suite of integrated tools specifically created for the complexities of financial planning. This targeted approach is fundamental for optimizing advisor workflows and improving client relationships. Some crucial features include:

- Portfolio Management: Imagine having a real-time, 360-degree view of all client holdings, performance metrics, and asset allocation. This level of insight, provided by sophisticated portfolio management tools, is essential for strategic decision-making. These tools allow for efficient portfolio construction, rebalancing, and risk assessment, ensuring alignment with each client’s unique objectives.

- Financial Planning: These platforms frequently go beyond investment management by incorporating financial planning modules. This enables advisors to develop comprehensive financial plans covering retirement planning, tax strategies, estate planning, and more, facilitating a holistic wealth management approach.

- Client Relationship Management (CRM): Building and maintaining strong client relationships is crucial in wealth management. Integrated CRM features help advisors track client interactions, manage communications, and personalize services. Automated reminders for important dates or tailored performance reports, for instance, can significantly enhance client engagement.

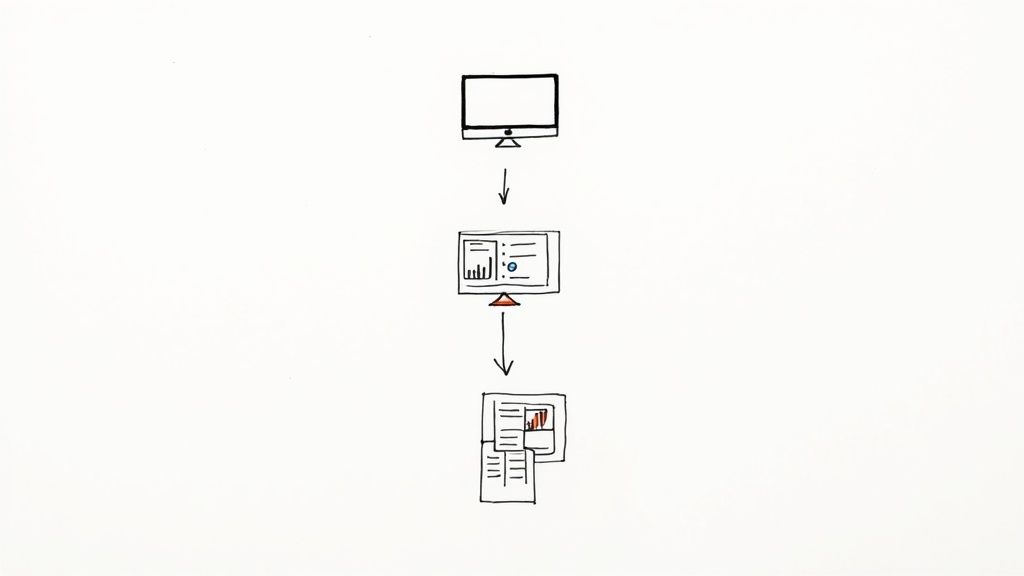

- Reporting and Analytics: Data-driven insights are paramount in finance. Wealth management platforms provide advanced reporting and analytics that generate valuable insights into portfolio performance, market trends, and client progress. This empowers advisors to optimize strategies and quickly identify areas for improvement, demonstrating their value to clients.

- Compliance and Risk Management: Navigating the regulatory environment is a vital part of wealth management. Robust platforms offer built-in compliance tools and risk management features. This helps advisors adhere to industry regulations, mitigate potential risks, and maintain the highest ethical standards, protecting both the advisor and the client.

Advantages of Using Specialized Platforms

The benefits of using a purpose-built wealth management platform extend throughout a financial advisory practice. These advantages justify the investment and contribute to lasting success. While platforms like Salesforce offer some helpful functions, they often lack the specialized tools needed for optimal performance in wealth management. This often results in firms using dedicated platforms like Orion or Envestnet experiencing noticeable improvements in efficiency and client satisfaction compared to those relying on adapted generic solutions.

The rise of platforms like Addepar, as previously mentioned, reflects the industry’s increasing recognition of this need for specialization. This growth isn’t simply a trend; it’s a direct response to the growing complexities within wealth management. Clients expect more sophisticated advice, and advisors require powerful tools to deliver it effectively. This necessitates access to in-depth analytics, efficient workflows, and seamless integration with other key financial tools – all hallmarks of dedicated wealth management platforms. Investing in these platforms ultimately translates into improved client outcomes, greater operational efficiency, and enhanced business growth, solidifying their position as essential tools for any advisor seeking success in today’s dynamic financial market.

Top Platforms Comparison

Building on the features and benefits discussed, selecting the right wealth management platform is a critical decision. This choice can significantly affect a firm’s efficiency, client satisfaction, and ultimately, its profitability. The market offers a variety of options, each with its own strengths and weaknesses. Understanding these nuances is vital for making an informed decision. This comparison will examine some of the leading platforms, highlighting their key features and target audiences.

Orion: A Robust Solution for Comprehensive Wealth Management

Orion offers a comprehensive suite of tools designed for financial advisors. Consider it a central command center for managing all facets of a wealth management practice. It provides strong portfolio management capabilities, enabling advisors to build, monitor, and adjust client portfolios effortlessly. Orion’s reporting features, for example, allow advisors to create custom performance reports, providing clients with clear and insightful overviews of their investments. Moreover, its integrated CRM functionality simplifies client communication and relationship management. This unified approach empowers advisors to personalize their service and foster stronger client relationships.

Envestnet: Powering Scalability and Data-Driven Insights

Envestnet is another prominent player in the wealth management platform arena. Its strength lies in its capacity to connect vast amounts of asset management relationships and data and provide sophisticated analysis. Imagine having access to a vast repository of investment research and market intelligence all within a single platform – that’s the power of Envestnet. Its data aggregation features allow advisors to consolidate client information from various sources, presenting a holistic view of their financial situation. This, in turn, supports more informed decision-making and personalized financial planning. This robust data infrastructure is particularly valuable for larger firms looking to scale their operations effectively.

Addepar: Addressing the Need for Specialized Solutions

While established platforms like Orion and Envestnet serve a broad range of advisors, the growth of Addepar demonstrates the increasing demand for more niche solutions built around deep expertise in areas of reporting — specifically that of private placement data. These platforms are designed to address the specific needs of certain client segments or investment strategies. Addepar, for instance, is recognized for its advanced analytics and reporting capabilities, serving ultra-high-net-worth individuals and family offices. This targeted approach empowers advisors to choose a platform precisely aligned with their business model and client base.

Salesforce: A Generic Solution with Wealth Management Limitations

As mentioned previously, many wealth management firms have adopted Salesforce despite its limitations as a generic CRM platform. This highlights the disparity between general-purpose solutions and the specific needs of the wealth management industry. While Salesforce does offer robust CRM capabilities, it often lacks the specialized tools and integration options needed for effective portfolio management, financial planning, and reporting. This can result in workflow inefficiencies and increased manual effort. It’s akin to forcing a square peg into a round hole – it can be done, but it requires extra effort and isn’t optimal. This reinforces the importance of selecting a dedicated wealth management platform designed specifically for the intricacies of financial advising.

Choosing a wealth management platform is a strategic decision with long-term consequences. Factors like firm size, client demographics, investment approaches, and budget all contribute to determining the best fit. By carefully considering these factors and evaluating the strengths of each platform, advisors can select a solution that empowers them to deliver exceptional client service and achieve sustainable growth. Investing in the right technology is essential for navigating the complexities of today’s financial landscape and building a successful future.

Security and Privacy Measures

With wealth management platforms becoming the central repository for sensitive financial information, security and privacy are absolutely essential. These platforms, including those offered by companies like Orion and Envestnet, must implement robust safeguards to protect client information and maintain trust. This isn’t just a technical requirement; it’s fundamental to operating within the financial industry. These measures give advisors the confidence to utilize these platforms, knowing their clients’ data is secure.

A security breach can have devastating repercussions, severely damaging a firm’s reputation and causing significant financial loss. Therefore, understanding the security measures employed by these platforms is vital. For instance, features like multi-factor authentication and data encryption are essential for preventing unauthorized access. Regularly scheduled security audits and penetration testing also play a crucial role in identifying and addressing vulnerabilities before they can be exploited. This proactive approach to security distinguishes dependable platforms.

Furthermore, the emergence of platforms like Addepar has heightened the focus on data security across the industry. This focus is understandable, given the increasing complexity and sensitivity of the data being handled. These platforms often incorporate advanced security features, such as biometric authentication and blockchain technology, to further protect client information. This commitment to security innovation is crucial for staying ahead of ever-evolving cyber threats. Even with platforms like Salesforce, which are not purpose-built for wealth management, firms need to invest in additional security layers to ensure client data is protected to the same level as dedicated platforms. This often means substantial investment in third-party security tools and integrations.

Data privacy is another critical aspect of wealth management platforms. Regulations like GDPR and CCPA dictate strict protocols for handling personal information. Platforms must comply with these regulations, providing users with control over their data and ensuring transparency in data collection and usage. For example, platforms should have clear data retention policies and offer users the ability to access, modify, and delete their data. This empowers clients and builds trust in the platform. Moreover, platforms should implement thorough data anonymization and pseudonymization techniques to enhance user privacy further, adding an extra layer of protection and making it more difficult for unauthorized individuals to identify and misuse sensitive data. Ultimately, choosing a wealth management platform requires careful consideration of its security and privacy features. Advisors must actively evaluate the measures in place, rather than relying solely on the platform’s assurances, to confirm they meet the highest industry standards. This due diligence is paramount for safeguarding client data and building a sustainable and trustworthy practice.

Integration Capabilities

Connecting separate systems is a critical aspect of modern wealth management. Therefore, wealth management platforms must offer robust integration capabilities. This seamless connectivity enables advisors to utilize a suite of tools without the burden of manual data entry and reconciliation. For instance, a platform might integrate with a CRM, a portfolio management system, and a financial planning tool, creating a single, unified view of the client’s financial life. This interconnectedness enhances efficiency and provides a superior client experience.

Streamlining Workflows Through Integration

A wealth management platform’s ability to integrate with other financial tools directly influences an advisor’s daily workflow. It’s like an orchestra: each instrument plays its individual part, but the conductor, in this scenario, the wealth management platform, brings everything together in harmony. This integration can automate tasks, reduce errors, and allow advisors to focus on what truly matters: building client relationships and providing strategic guidance. This means less time on administrative duties and more time on valuable client interactions. For example, integrating with a custodian allows for automatic updates of client holdings, eliminating manual data entry. Integrating with financial planning software can also pre-populate client data into financial plans, saving time and effort.

Key Integrations for Wealth Management Platforms

Certain key integrations are essential for maximizing the value of wealth management platforms. Recognizing this, platforms like Orion and Envestnet offer numerous integration options to meet the diverse needs of advisors, ensuring they have access to all the necessary tools. Integrating with CRM systems like Salesforce (despite its limitations in wealth management) facilitates client interaction and communication management. However, relying solely on Salesforce for wealth management can hinder seamless data flow and create the need for workarounds. This is where platforms like Addepar demonstrate their value. These newer platforms often prioritize in-depth integration with specialized industry tools, improving workflow efficiency and providing more focused functionality. This could include integrations with risk analysis tools, performance reporting software, and document management systems. This extensive range of integration options allows advisors to tailor their technology stack to their specific needs and preferences. By integrating with these various tools, wealth management platforms create a central hub for all client data and financial activities, enhancing efficiency and allowing advisors to offer a more comprehensive and personalized service. This results in improved client outcomes and a more efficient and profitable practice.

Future Trends and Innovations

The wealth management platform landscape is in constant flux. Building upon current offerings from established companies like Orion and Envestnet, and the innovative approaches of platforms like Addepar, we’re seeing a clear movement toward more personalized, data-driven, and integrated solutions. This progress is driven by evolving client expectations and continuous technological advancements. Understanding these emerging trends is crucial for both advisors and the firms that support them to remain competitive and deliver the best possible service.

Hyper-Personalization and AI-Driven Insights

One of the most significant trends is the shift toward hyper-personalization. Clients now expect tailored solutions aligned with their individual circumstances and aspirations, rather than generic advice. This requires wealth management platforms to harness the power of artificial intelligence (AI) and machine learning to analyze extensive data sets and deliver highly customized insights. Imagine a platform anticipating a client’s needs before they even express them, proactively suggesting adjustments to their portfolio based on anticipated life events or market fluctuations. This degree of personalized guidance represents the future of wealth management. Moreover, AI can automate routine tasks, allowing advisors to focus on fostering stronger client relationships and providing more strategic advice. This transition towards higher-value services will be essential for advisor success in the coming years.

Enhanced Data Aggregation and Visualization

With the ever-increasing volume and complexity of financial data, efficient data aggregation and clear visualization are becoming increasingly vital. Wealth management platforms must seamlessly integrate with multiple data sources to provide a holistic overview of a client’s financial picture. This data must also be presented in a user-friendly and intuitive format, allowing advisors and clients to quickly understand key insights and make well-informed decisions. Think of it as a personalized financial dashboard, offering a real-time snapshot of performance, risk, and progress toward financial goals. This enhanced transparency empowers clients to take control of their financial future and strengthens the advisor-client bond.

The Rise of Embedded Finance and Open Banking

Embedded finance and open banking are poised to transform the wealth management industry. Embedded finance seamlessly integrates financial services into non-financial platforms, offering clients convenient access. For instance, clients might be able to access financial planning tools and investment advice directly through their banking app or even a retail platform. This integration simplifies the wealth management experience and expands its reach to a broader audience. Open banking enables secure sharing of financial data between institutions via APIs. This enhanced data sharing allows wealth management platforms to gather more complete client information, enabling more personalized and effective advice. These interconnected trends will collectively promote a more integrated and client-centric approach to wealth management.

Addressing the Salesforce Gap

The continued use of platforms like Salesforce within wealth management underscores the need for purpose-built solutions. While Salesforce plays a valuable role in general CRM, its limitations within the specific context of wealth management create the need for ongoing adaptation and customization. This often requires integrating numerous other tools and platforms, increasing complexity and potentially escalating costs. The future of wealth management platforms will likely involve solutions that integrate the core CRM functionality of systems like Salesforce with specialized tools and integrations for efficient portfolio management, financial planning, and reporting. This integrated approach will streamline operations, allowing advisors to focus on providing exceptional client service. Additionally, platforms like Addepar, recognizing the need for specialized solutions, are pushing the boundaries of wealth management technology. Their advancements in areas like data aggregation, analytics, and reporting are setting new industry standards and paving the way for further innovation.

The evolution of wealth management platforms is an ongoing process. By embracing these emerging trends and continuing to invest in innovation, the industry can empower advisors to provide exceptional service and help clients achieve their financial goals. This continuous improvement and adaptation are crucial for success in today’s increasingly complex and competitive market.

Ready to experience the future of wealth management? Explore Milemarker’s comprehensive platform designed to empower RIAs and IBDs with the tools and insights they need to thrive. Learn more about Milemarker and how we’re changing the game.