Citywire Review: RIAs Shift Focus from AUM to Holistic Metrics of Success

Recap of Andrew Forech article: “Schwab study says RIAs are looking for indicators of success beyond AUM”

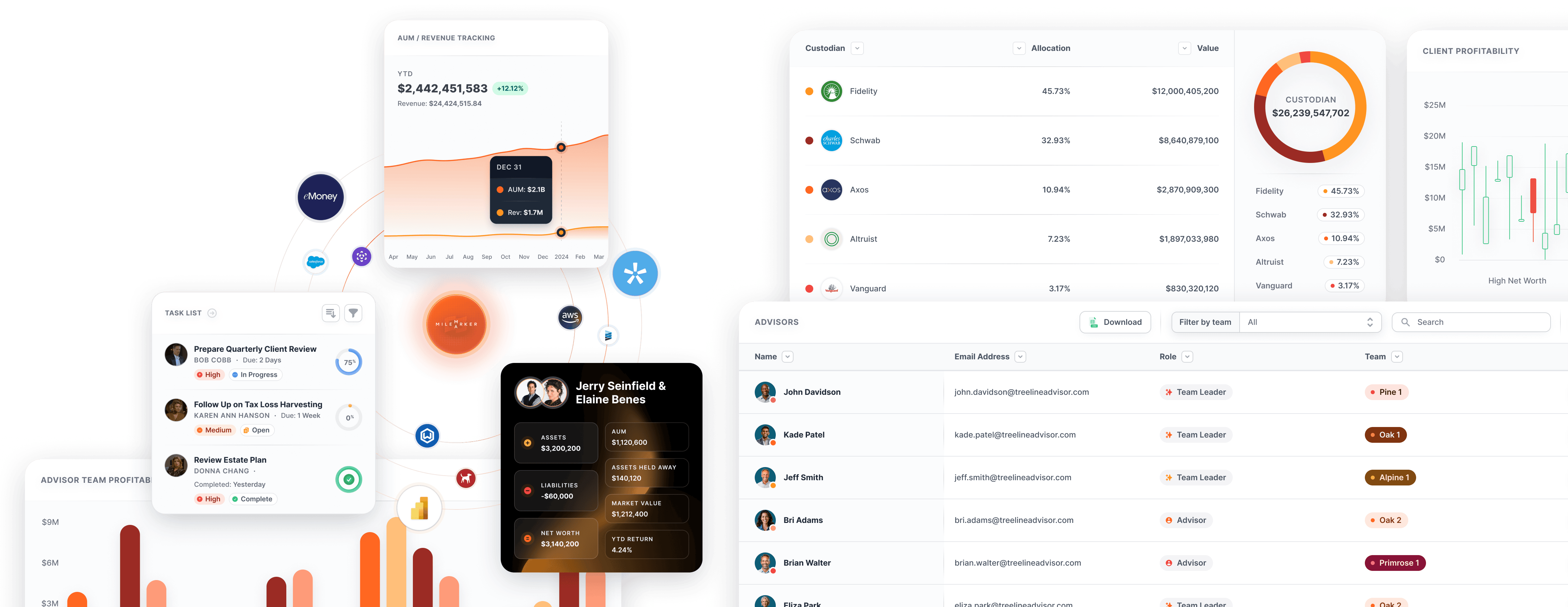

As the financial landscape evolves, registered investment advisors (RIAs) are expanding their indicators of success beyond assets under management (AUM). Schwab Advisor Services’ Independent Advisor Outlook Study reveals that RIAs now consider the number of clients, diversity of services, and staffing levels as crucial success factors. This shift in perspective reflects an increasingly sophisticated industry approach that prioritizes adaptability and resilience.

Key Insights:

- AUM limitations: Schwab Advisor Services COO Jon Beatty notes that AUM is heavily influenced by uncontrollable market movements, making it a misleading indicator of year-over-year growth. RIAs can better navigate fluctuating markets by focusing on client growth and diversifying services.

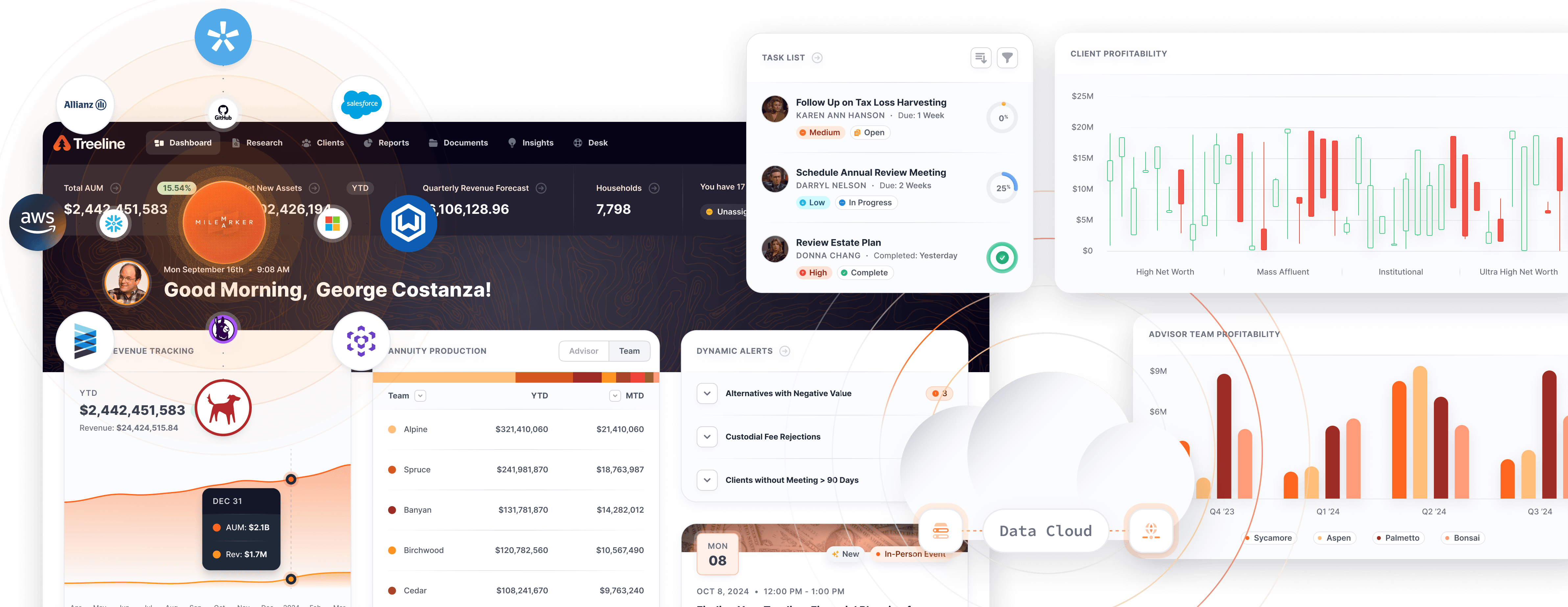

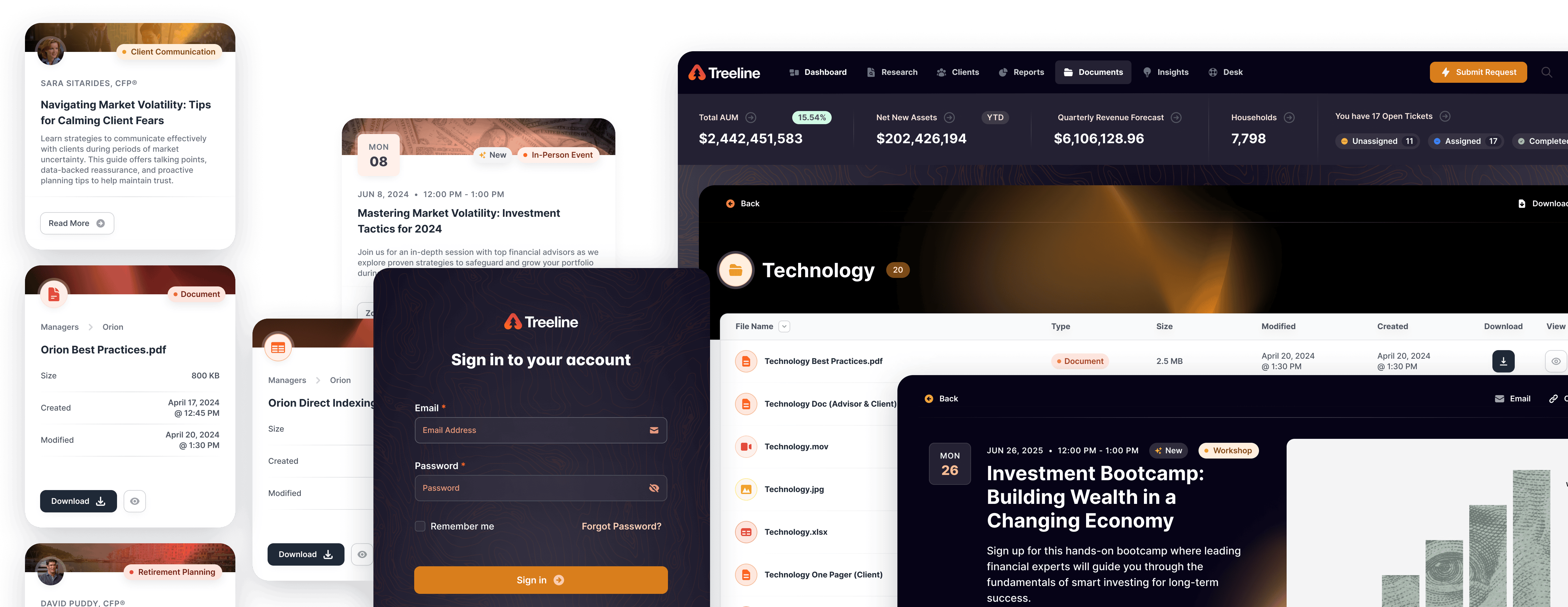

- Expanding services: Many RIAs are adding secondary lines of business, such as tax accounting, planning, trust services, and banking services. This strategy can attract new clients and diversify revenue streams.

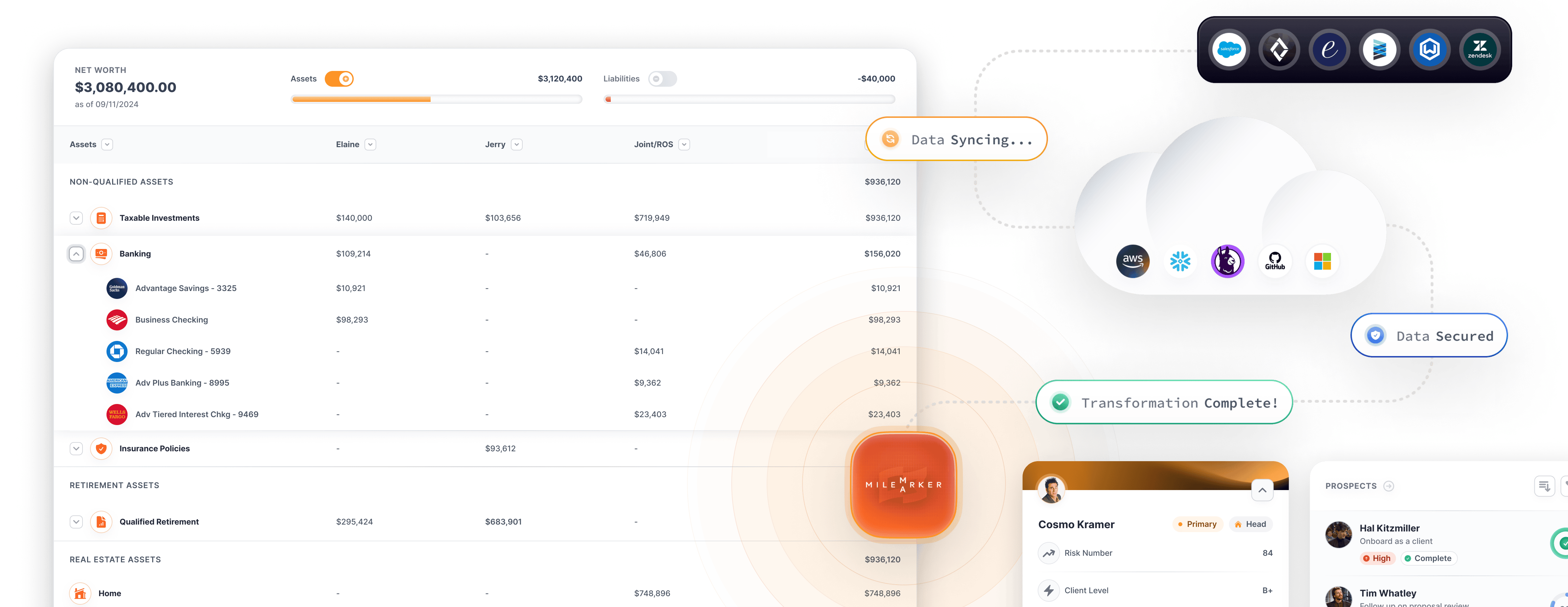

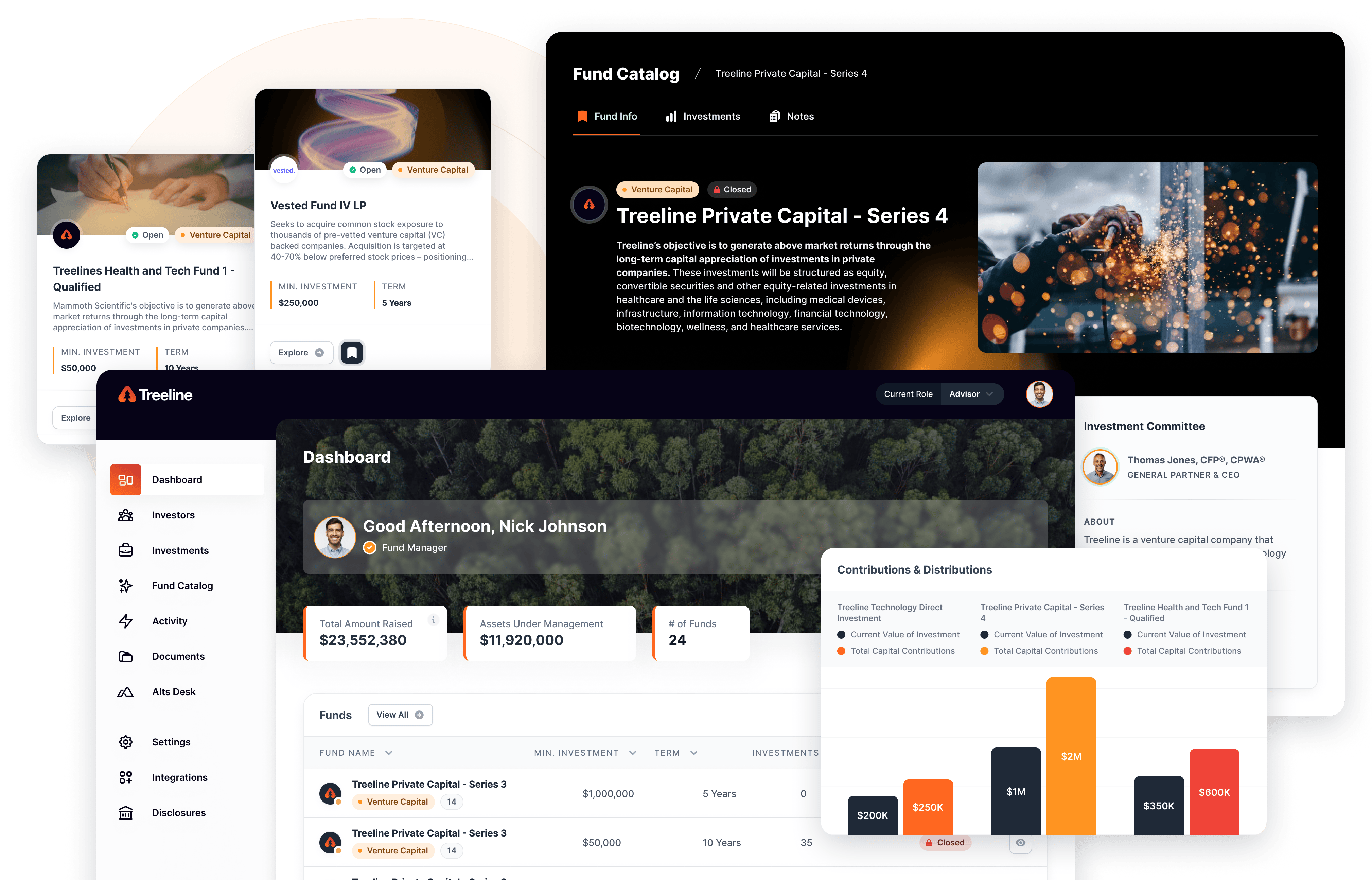

- Operational complexity challenges: As firms grow and diversify, operational complexity can become a significant obstacle. Beatty warns that “complexity fatigue” can hinder growth and maintaining internal culture. To counter this, he suggests that RIAs should aim for “smart growth” by using data analysis and automation tools to improve efficiency and maintain personalized client services.

- The bionic advisor: Embracing data and automation can create a “bionic advisor” that combines the human intellect with the efficiency of technology. Beatty believes that firms that invest in data and automation will excel in delivering highly personalized services to their clients.