Listen to this week’s episode.

Episode 104: On this week’s episode of Next Mile, I speak with Steve Reder, Partner & Head of Wealth Management at RWA Wealth Partners. Steve leads a team of wealth advisors and shapes the advice, guidance, and support clients receive. He also works directly with clients, solving complex financial planning problems and helping to integrate personal financial plans with investment, tax, and estate planning.

We talk about the four pillars of generational wealth planning. Steve explains how RWA Wealth Partners operates as a “boutique firm of consequence,” what that means in practice, and how his team help clients create lasting legacies through financial planning, investment strategy, tax planning, and estate planning. He also shares thoughtful advice on building generational relationships and delivering high-touch, in-house services in a scalable way.

Key Takeaways

Strong client relationships create flexibility and grace, even when mistakes happen. Steve’s own journey began with an advisor who invested deeply in him as a teenager. That kind of trust and emotional connection builds loyalty and long-term impact far beyond any specific financial strategy or return.

Effective family meetings and estate conversations start with storytelling and values—not spreadsheets. Clients are often hesitant to disclose financial details to their children, but when advisors help lead with legacy, life lessons, and shared purpose, families become more engaged, and the next generation is more likely to stay connected to the firm.

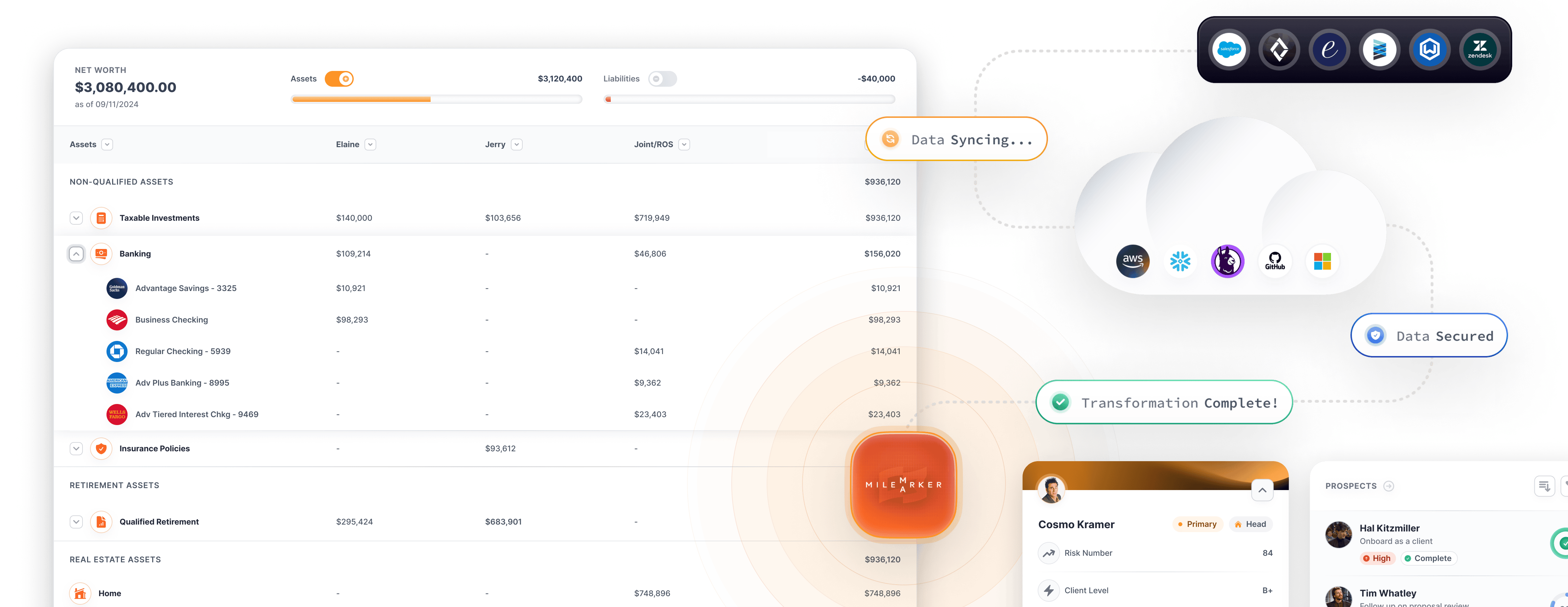

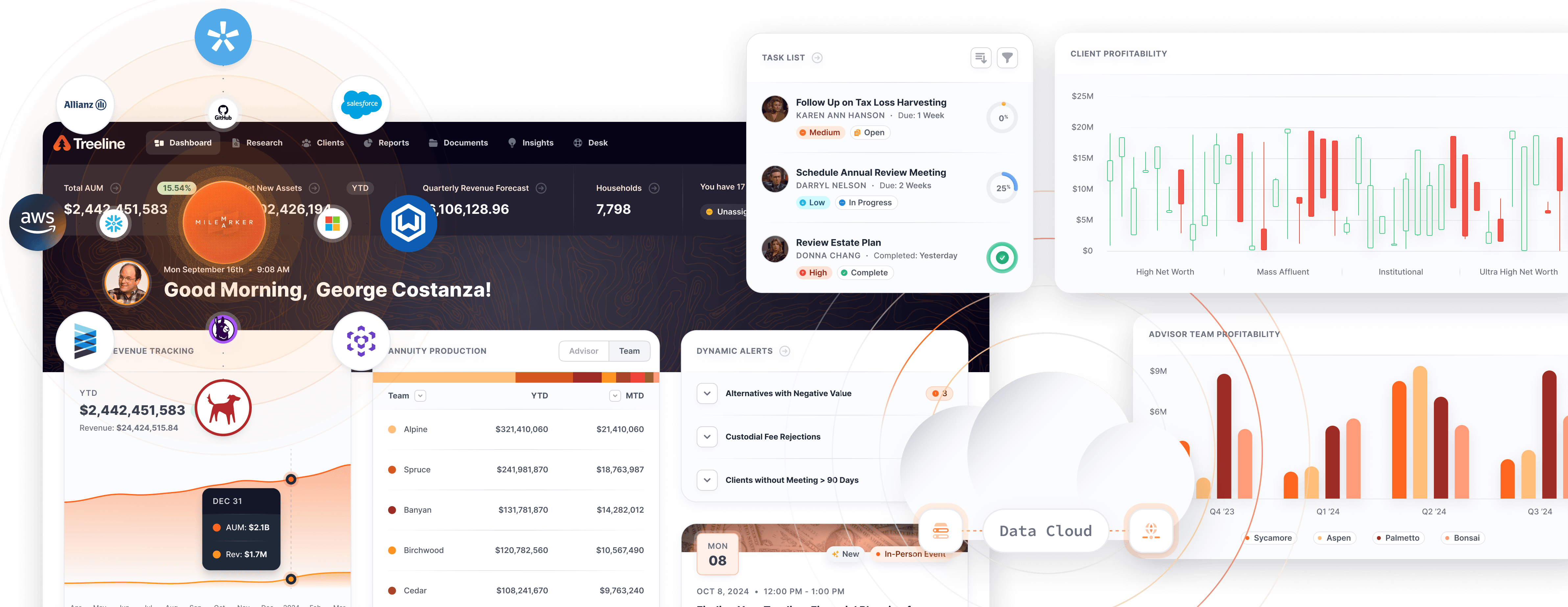

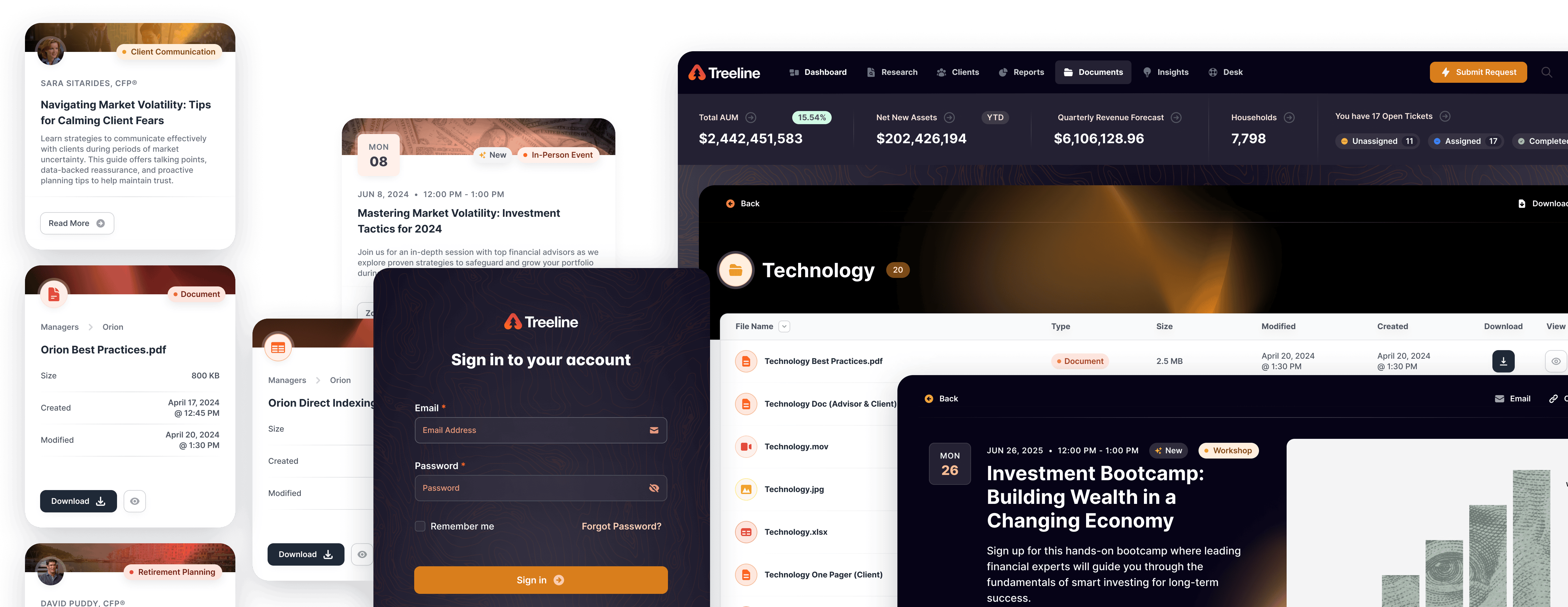

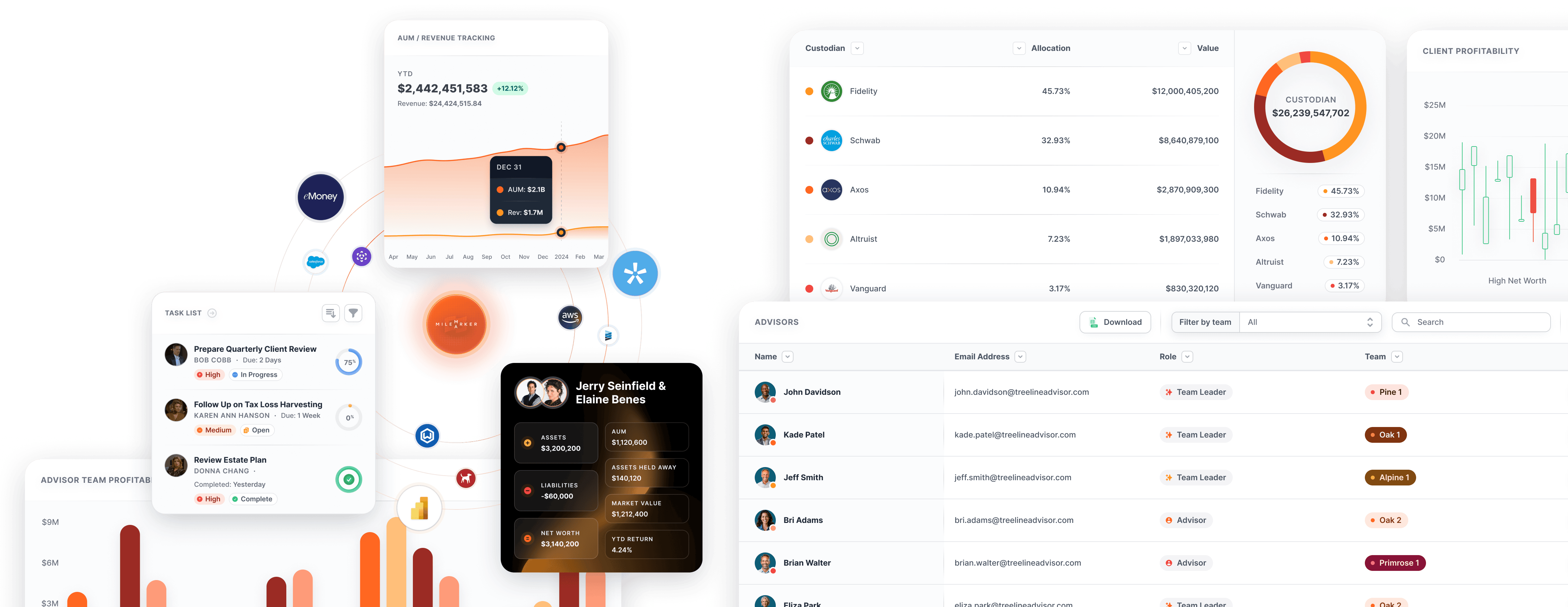

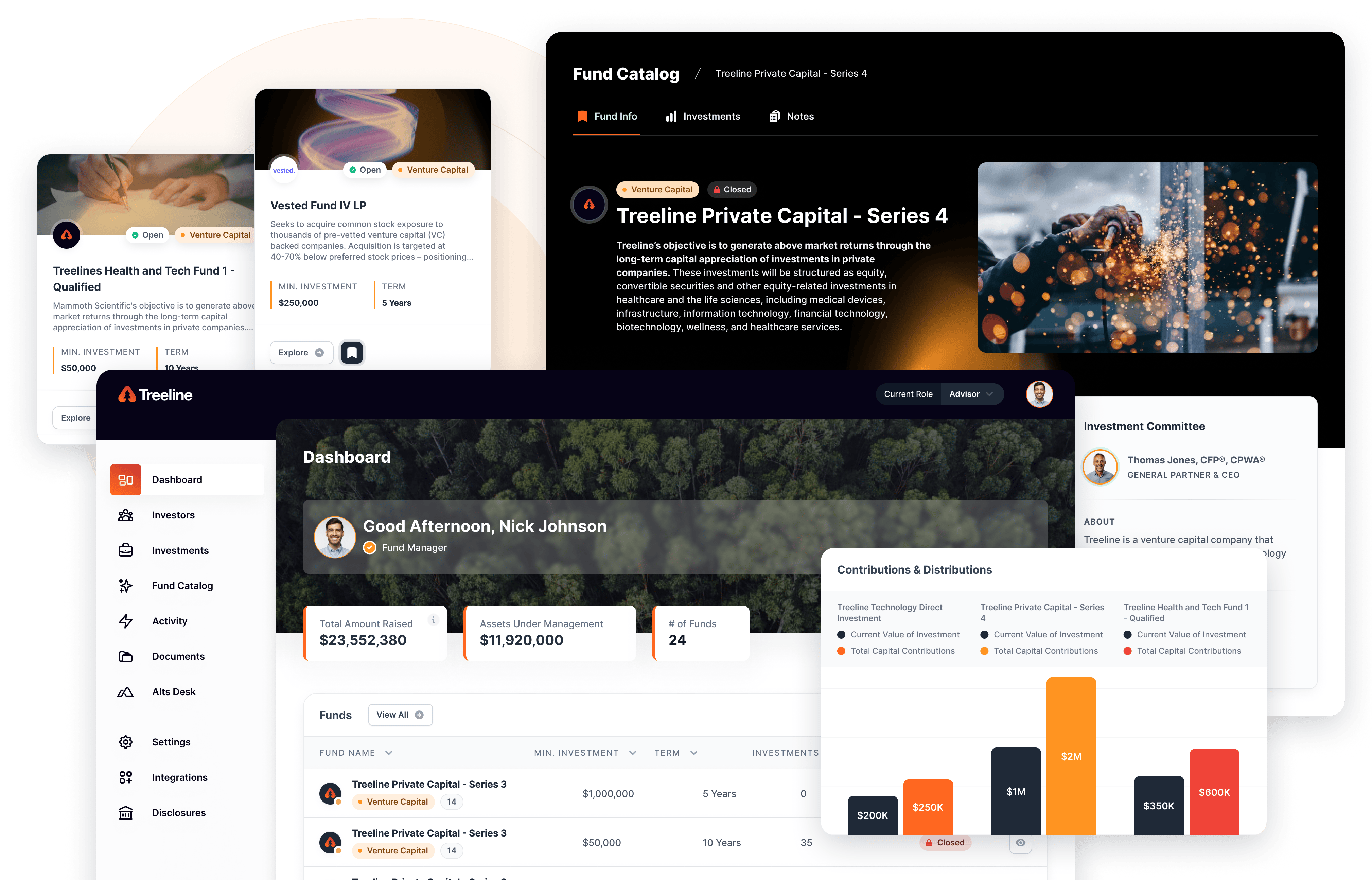

AI and integrated platforms can dramatically boost efficiency, but they must be in service of deeper client interaction. Tools can enhance insight, but human advisors remain irreplaceable—especially in emotionally complex financial decisions. The firms that win will be those that use tech to empower advisors, not diminish their role.

Quotes

“Taking care of someone’s kids is the best relationship builder you can do.” ~ Steve Reder

“One mistake people make is that they position the plan as the value add or the plan as the end product. Helping them reach their goals is the value add, and the advice you give is the value add.” ~ Steve Reder

“You can give the best client experience in the world, but if it’s impossible for the advisors to get it to them, it’s never going to work.” ~ Steve Reder

Links

Connect with our hosts

Subscribe and stay in touch

While there, please don’t forget to Download, Like, and Subscribe.

If you’d like to schedule a time to talk with me about anything we cover on our podcast or Milemarker, click here for 15 minutes.

Kyle Van Pelt