The Future is a Synthesis — Finding a Framework for Your Advisor Technology

Greetings from the simulation. Just kidding.

We are very much not in a simulation.

But, I think we might just be in a synthesis.

As easy as it is to wish that your firm can achieve your vision with a couple of software choices, more and more advisory firms are changing their posture on technology.

Ten years ago, firms were jumping into CRMs and starting to build their data around Salesforce, Redtail, MS Dynamics, Junxure, and others.

Those days gave way to new tools that advisors began moving between as they seek to provide more advanced client services and analysis.

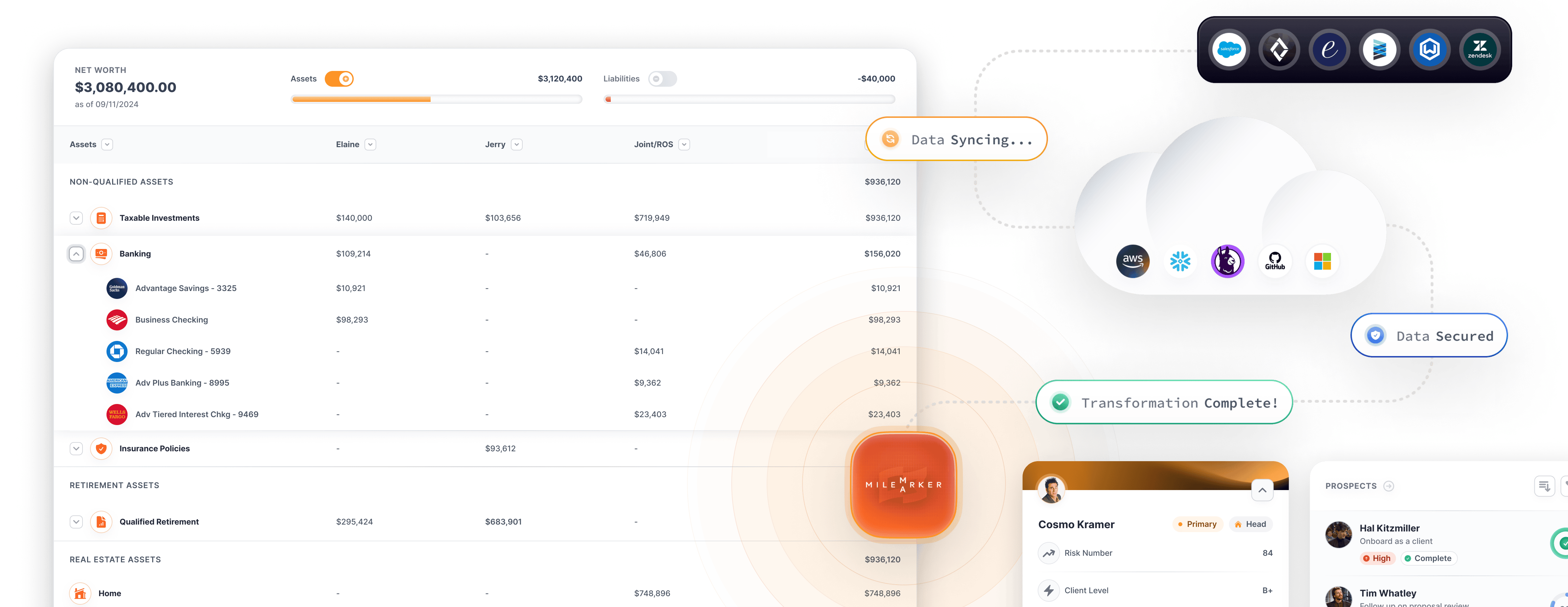

While some technologies are moving toward a most-in-one or all-in-one strategy, firms with any level of complexity are finding significant limitations in choosing any particular platform.

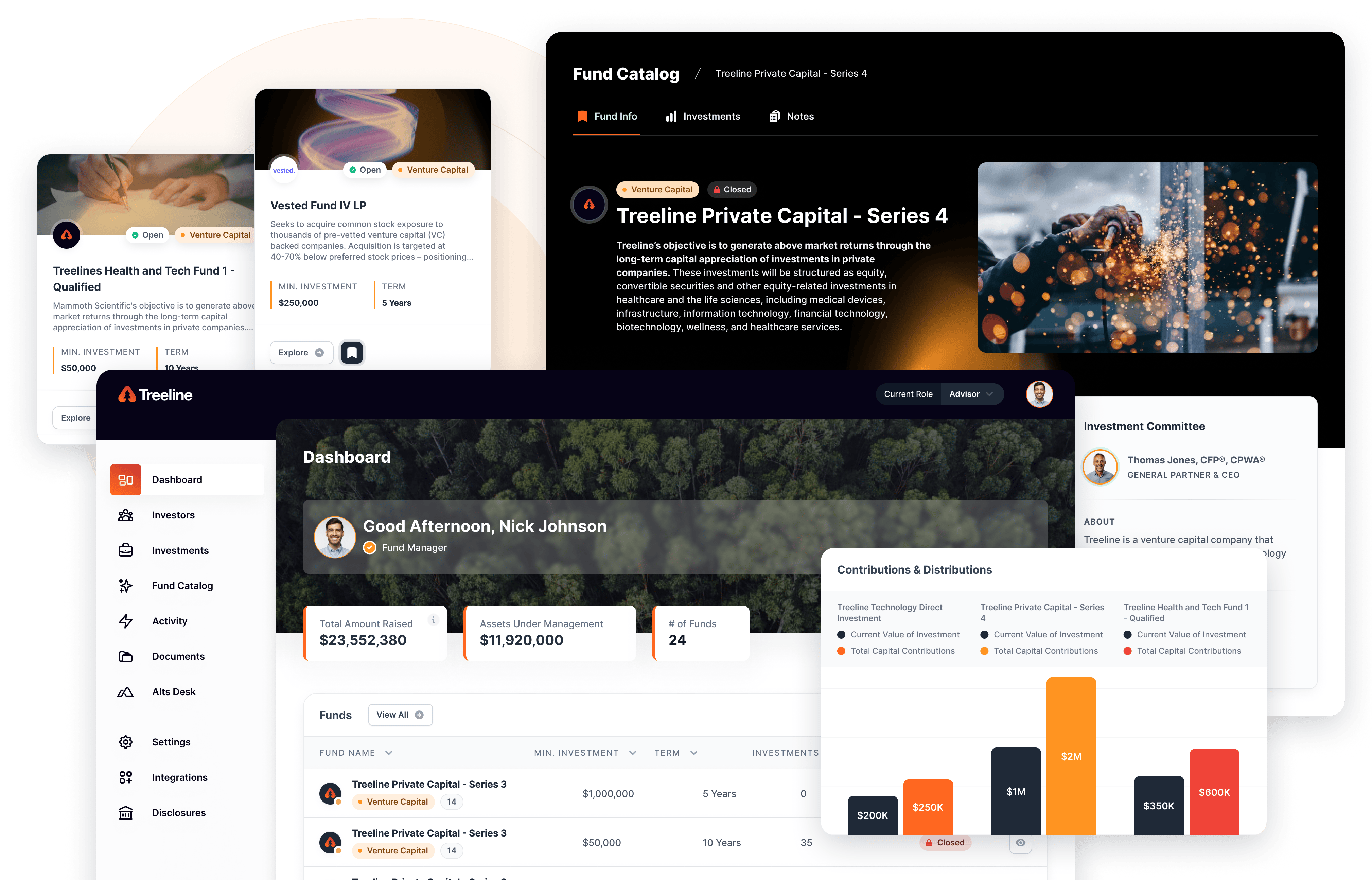

Even in investment management and TAMPS, more and more firms aren’t exclusive to a singular provider, mixing usage of Envestnet, Orion, SmartX and others inside their firms. It’s not uncommon for the firms we serve to be working across investment desks to serve the unique needs of their clients.

Let’s also throw alternatives, direct indexing, and held-away asset management into this equation, to think about just how complex it really is.

The next wave of innovative firms faces a new reality.

Synthesize or die.

Maybe that’s a bit too severe, but your ability to make forward momentum and focus on increasing profitability, advisor efficiency, client value add and scale generally go right out the window if you aren’t mastering your software solutions.

The Critical Path to Synthesis

How do we rethink the advisor technology stack?

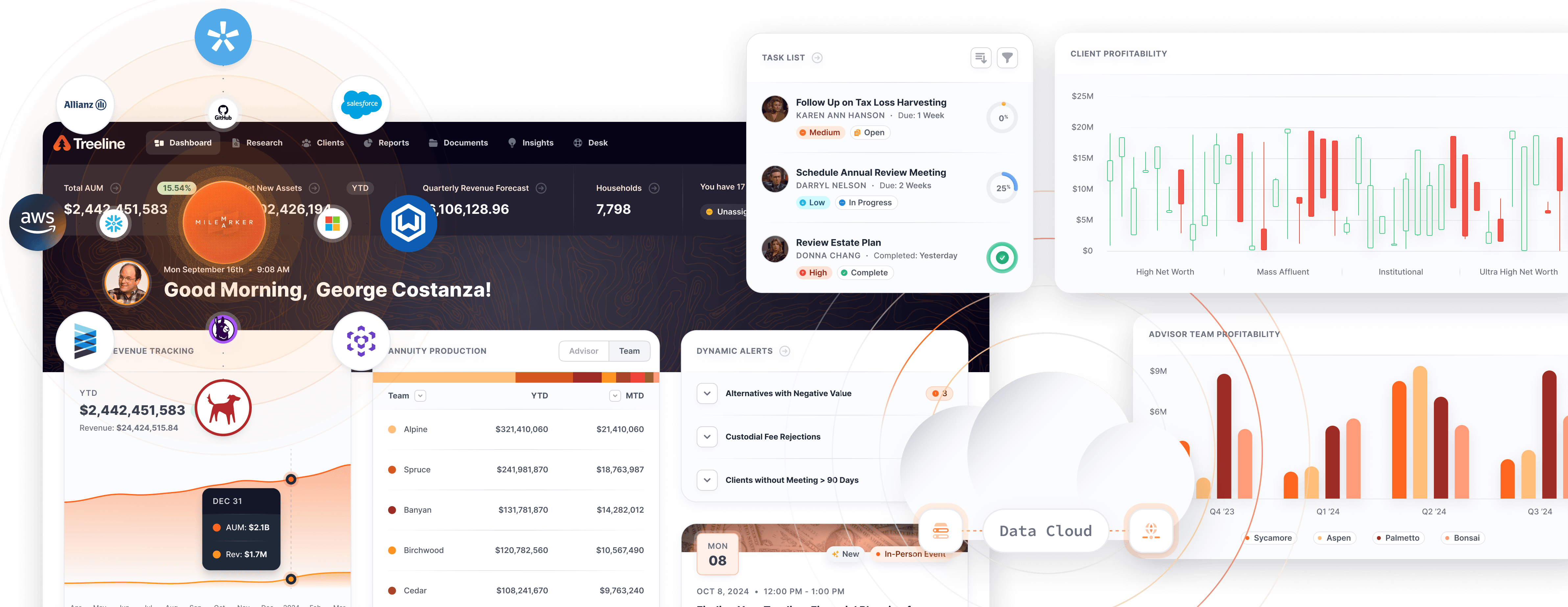

A growing number of firms are adopting a new way of evaluating the nuances of technology. Instead of creating pass/fail results for each piece of their stack, there is a desire to solution toward using the strengths of each software, to piecemeal what’s viable and create workflows around what seems unsolvable.

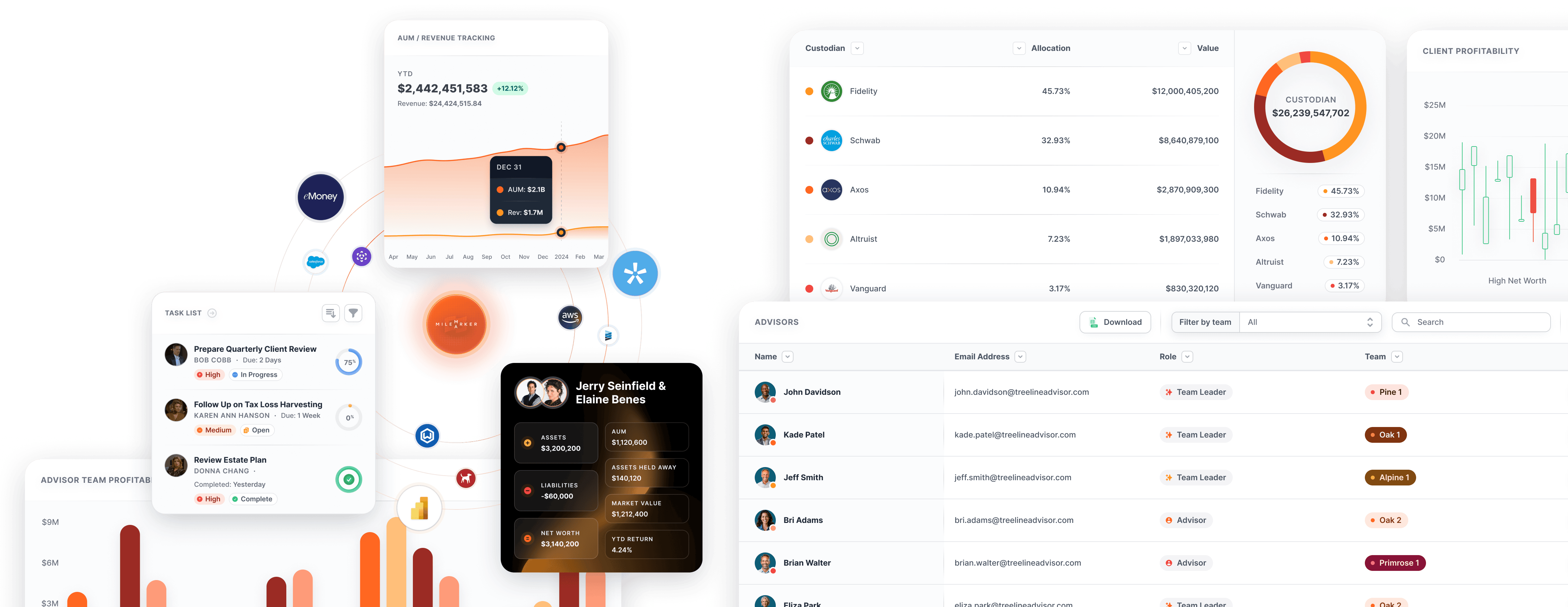

Thankfully, that which is unsolvable is shrinking. Once you begin to gather data from the various systems and synthesize it into one view that delivers the operational insight, compliance detail, and more needed to run efficiently — you don’t have to login to all of the your different systems.

Synthesizing data allows you to choose which pieces of information genuinely matter for your executive team, advisors and operations teams to drive value not just to the bottom line, but ultimately to the clients you serve.

Screenshots and Sharpies

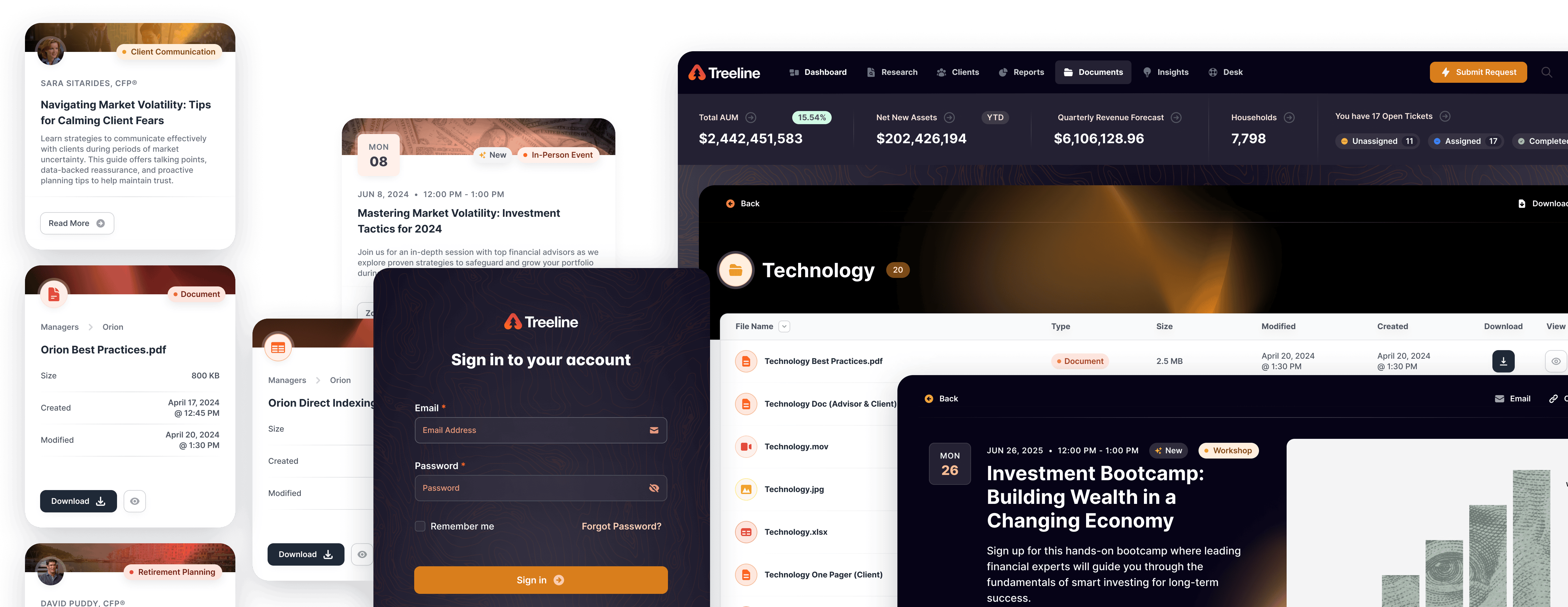

One of the best exercises to begin your own synthesis project is for a non-technical leader to print out each primary screen your advisors interact with weekly. Then interview your advisors to get a sense of what matters to them, what’s missing, and hear how they wish they could work.

Use a sharpie, highlighter, or your preferred pen and start to circle, underline, and note the data points that are must-haves, nice-to-haves or not necessary at all.

You will likely find some exciting surprises.

You may also gain some critical insight into the non-industry-specific information that should be part of this conversation. Unlocking this information will help you solidify your unique firm identity.

Your Synthesis Scrapbook

Using your findings, hand draw or use Keynote, Slides or PowerPoint to sketch out the views and workflows your team wishes they had.

Ask yourself what the best delivery mechanism should be and how you can deliver the most value.

Perhaps your advisors won’t log in to something, but they would love an email daily.

Or maybe your internal ops team is back in the office and they could really benefit from a large dashboard they can all see that highlights crucial data that helps them understand queues, service demands, and daily priorities.

Being able to synthesize your technology will make this (and so many other possibilities) a reality.

What is your synthesized view of the future?

How are you taking steps to make the most of your technology and systems?