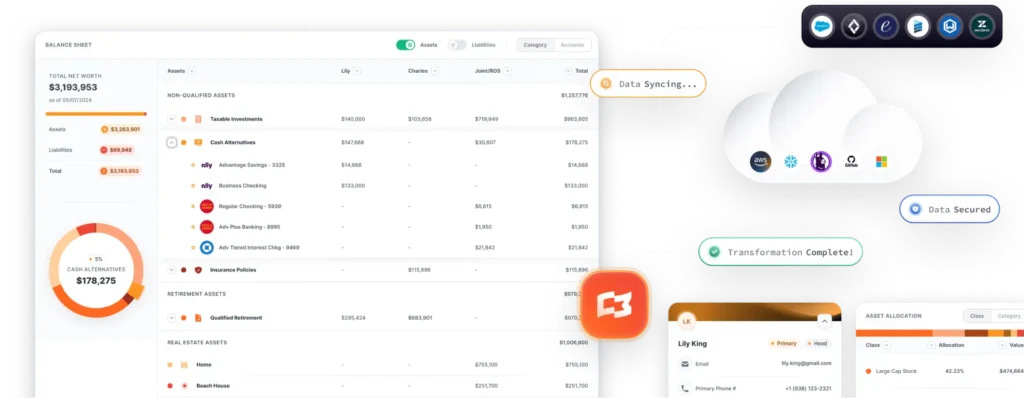

Transforming Wealth Management with Data Warehousing and Data Lake Solutions

In today’s data-driven world, wealth management firms are inundated with vast amounts of data from diverse sources. Managing this data efficiently is crucial for making informed decisions, enhancing client experiences, and staying competitive. Data warehouse solutions, data lake solutions, cloud data warehouse solutions, and data cloud solutions have emerged as essential tools for firms aiming to harness the power of their data. This article delves into the importance of these solutions, how to identify the need for them, and the transformative benefits they offer.

Understanding Data Warehouses and Data Lakes

Before exploring the benefits, it’s vital to understand what data warehouses and data lakes are and how they differ.

Data Warehouse

A data warehouse is a centralized repository that stores structured data from multiple sources. It is designed for query and analysis, enabling organizations to generate reports and insights that drive business decisions. Data in a warehouse is cleaned, transformed, and organized to support efficient querying.

Data Lake

A data lake, on the other hand, is a storage system that holds vast amounts of raw data in its native format, including structured, semi-structured, and unstructured data. It allows for more flexibility, as data can be stored without a predefined schema and processed as needed. The data lake is commonly associated with bigquery

Data Cloud Solutions

Data cloud solutions refer to cloud-based platforms that provide scalable and flexible storage and processing capabilities for cloud data warehouse solutions and data lakes. Leveraging the cloud eliminates the need for on-premises infrastructure, reduces costs, and enhances accessibility.

Identifying the Need for Data Warehousing Solutions

Recognizing the signs that your wealth management firm requires a data warehouse or data lake is the first step toward transformation.

Signs You Need a Data Warehouse

- Data Silos: If your data is scattered across multiple systems, leading to inconsistencies and inefficiencies.

- Reporting Delays: Difficulty in generating timely reports due to data being spread out or hard to access.

- Inaccurate Insights: Making decisions based on incomplete or outdated information.

- Scalability Issues: Existing systems cannot handle the growing volume and variety of data.

- Regulatory Compliance Challenges: Struggling to meet compliance requirements due to disorganized data.

The Benefits of Data Warehousing Solutions

Implementing a data warehouse offers numerous advantages that can revolutionize your firm’s operations.

Establishing a Single Source of Truth

A single source of truth ensures that everyone in the organization works with the same data, leading to consistent and accurate information. This centralization eliminates discrepancies caused by data silos and enhances trust in the data used for decision-making, data governance.

Enhanced Decision-Making

With all data centralized and readily accessible, analysts and decision-makers can generate insights more efficiently. Warehousing solutions provide the tools needed to perform complex queries and analytics, leading to better strategic decisions.

Improved Efficiency and Productivity

Centralized data storage reduces the time spent searching for information across different systems. Employees can focus on analysis rather than data gathering, improving overall productivity.

Better Control Over Systems and Technologies

A unified data infrastructure allows for better governance and control over the data lifecycle. Firms can standardize processes, enforce data quality rules, and ensure compliance with industry regulations using data governance.

Scalability and Future-Proofing

Data solutions offer scalability, allowing firms to handle increasing amounts of data without significant infrastructure investments. This scalability ensures that the data infrastructure can grow with the pallet firm.

Redefining User Experience

By providing seamless access to data and insights, firms can enhance the experience of both employees and clients. Customized reports, dashboards, and analytics tools improve user engagement and satisfaction.

Impact on Business Operations

Implementing a data warehouse can fundamentally change the way wealth management firms operate.

Streamlined Operations

Centralizing data simplifies processes across departments. Operations become more streamlined as data flows smoothly between systems, reducing errors and redundancies.

Enhanced Client Services

With better data insights, firms can offer personalized services to clients. Understanding client behavior and preferences enables tailored strategies and improved client relationships.

Competitive Advantage

Firms that leverage warehousing solutions gain a competitive edge by making data-driven decisions faster than competitors who rely on outdated systems.

Choosing the Right Data Solution

Selecting the appropriate solution depends on your firm’s specific needs.

Factors to Consider

- Data Types: Determine whether you need to store structured data (data warehouse), unstructured data, or both.

- Use Cases: Identify what you aim to achieve—advanced analytics, real-time reporting, machine learning, etc.

- Scalability Requirements: Consider future data growth and the need for scalable solutions.

- Budget Constraints: Evaluate costs associated with on-premises versus cloud solutions.

On-Premises vs. Cloud Solutions

- On-Premises: Offers more control but requires significant upfront investment and ongoing maintenance.

- Cloud Solutions: Provide flexibility, scalability, and cost savings through a subscription model.

Implementation

Successfully implementing a data warehouse requires careful planning.

Best Practices

- Define Clear Objectives: Establish what you want to achieve with your data solution.

- Data Governance: Implement policies to ensure data quality and compliance.

- Choose the Right Technology: Select tools and platforms that align with your needs.

- Stakeholder Engagement: Involve all relevant parties, including IT, management, and end-users.

- Phased Implementation: Roll out the solution in stages to manage risks and make adjustments.

Maximizing Benefits

- Training: Ensure staff are trained to use new systems effectively.

- Continuous Improvement: Regularly review and optimize data processes.

- Leverage Advanced Analytics: Use analytics tools to extract deeper insights from your data.

Real-World Examples

To truly understand the transformative power of data warehousing solutions and data cloud solutions, let’s explore real-world examples of wealth management firms that have embraced these technologies. Companies like UBS and Morgan Stanley have turned to platforms like Snowflake to revolutionize their data strategies. These case studies highlight the maximized benefits and tangible outcomes of implementing such cloud data warehouse solutions.

UBS: Enhancing Data Agility with Snowflake

UBS, a leading global wealth management firm, sought to improve its data agility and cloud data warehouse solutions capabilities. By adopting Snowflake’s Data Cloud, UBS aimed to consolidate its data silos and accelerate decision-making processes.

- Challenge: UBS faced difficulties with data fragmentation across multiple legacy systems, leading to inefficiencies and delayed insights.

- Solution: Implemented Snowflake’s scalable and flexible data platform to centralize data storage and processing.

- Benefits:

- Improved Efficiency: Reduced time to access and analyze data from days to minutes.

- Enhanced Analytics: Enabled advanced analytics and machine learning applications.

- Scalability: Leveraged cloud scalability to handle increasing data volumes without significant infrastructure investments.

Reference:

Morgan Stanley: Driving Innovation through Data Centralization

Morgan Stanley, another giant in wealth management, recognized the need for a modern data infrastructure to support innovation and client services.

- Challenge: The firm dealt with complex data environments that hindered its ability to deliver timely insights and innovative solutions.

- Solution: Adopted Snowflake’s Data Cloud to unify data sources and empower analytics teams.

- Benefits:

- Single Source of Truth: Established a centralized repository for all data, ensuring consistency and accuracy.

- Enhanced Client Experiences: Leveraged data insights to develop personalized client services.

- Operational Efficiency: Streamlined data operations, reducing costs and resource requirements.

Reference:

Western Union: Modernizing Data Architecture

While not a wealth management firm, Western Union offers financial services that parallel the data challenges in wealth management. Their case illustrates the maximized benefits of data cloud database warehousing solutions.

- Challenge: Needed to modernize legacy data warehouses to support real-time analytics and global operations.

- Solution: Migrated to Snowflake’s cloud-based data platform.

- Benefits:

- Real-Time Insights: Achieved real-time data processing capabilities.

- Global Accessibility: Provided seamless data access across international teams.

- Cost Reduction: Lowered total cost of ownership by eliminating on-premises infrastructure.

Reference:

BlackRock: Leveraging Data for Investment Insights

BlackRock, a global investment management corporation, demonstrates how data cloud solutions can enhance investment strategies.

- Challenge: Required a robust platform to manage vast amounts of investment data securely and efficiently.

- Solution: Implemented Snowflake’s Data Cloud to consolidate data sources and improve analytics.

- Benefits:

- Enhanced Security: Ensured data compliance and security across all operations.

- Advanced Analytics: Enabled sophisticated analytics for better investment decisions.

- Scalability and Performance: Handled large data volumes with high performance.

Reference:

Lessons Learned from Industry Leaders

These examples illustrate how leading firms have maximized the benefits of data warehousing solutions:

- Data Centralization is Key: Establishing a single source of truth eliminates data silos and inconsistencies.

- Scalability Enables Growth: Cloud-based solutions like Snowflake provide the flexibility to scale data operations seamlessly.

- Enhanced Analytics Drive Decisions: Advanced analytics capabilities lead to better insights and competitive advantages.

- Improved Client Services: Access to real-time data allows firms to offer personalized and timely services to clients.

- Operational Efficiency Reduces Costs: Streamlined data processes result in cost savings and resource optimization.

Embracing the Future with Data Cloud Solutions

Wealth management firms that adopt cloud data warehouse solutions position themselves for sustained success. By learning from the experiences of UBS, Morgan Stanley, and others, organizations can:

- Accelerate Digital Transformation: Modernize legacy systems to meet current and future data demands.

- Foster Innovation: Empower teams with the tools and data they need to innovate.

- Enhance Regulatory Compliance: Leverage built-in security and compliance features to meet industry regulations.

- Achieve Competitive Advantage: Utilize data as a strategic asset to outperform competitors.

Conclusion

The journey of wealth management firms like UBS and Morgan Stanley underscores the transformative impact of embracing data warehousing and data cloud solutions. By leveraging platforms like cloud data warehouse solutions, these organizations have not only solved their immediate data challenges but have also set the foundation for innovation, scalability, and enhanced client experiences.

Take inspiration from industry leaders—invest in robust data solutions to unlock your firm’s full potential and drive success in the ever-evolving world of wealth management.

Related Posts

How Entrepreneurs Can Prepare, Plan, and Protect Their Wealth