Why 2024 is the Year You Will Get Real About Owning Your Data

Hey Siri,

What is a label for the concept of when a critical company promises improvement and then continues to delay that improvement only to paralyze the progress of its customers?

Siri: Vaporware

Unfortunately, our industry has historically had a vaporware problem. And perhaps there were no bad intentions; there simply was a failure in execution.

From custodial M&A paralyzing a giant segment of the industry to large tech companies that have grown to a scale that it takes years to evolve, advisors are tired of vapor.

Unlike any time I have witnessed, advisors are tired of waiting and beginning to take matters into their own hands.

Nearly all of my conversations these days are with firms consistently working through data problems, not with the help of their traditional vendors but with their internal grit and problem-solving.

Consolidation Compounds

With the rapid consolidation occurring, firms must be able to keep, kill, or combine like never before. Redundant systems are doing your firm no favors, and this is often even reflected in redundancy and preference among advisor teams.

Sally loves to use eMoney, but Jerry loves MoneyGuide.

Lenny loves Redtail, but Monique has spent years in Salentica.

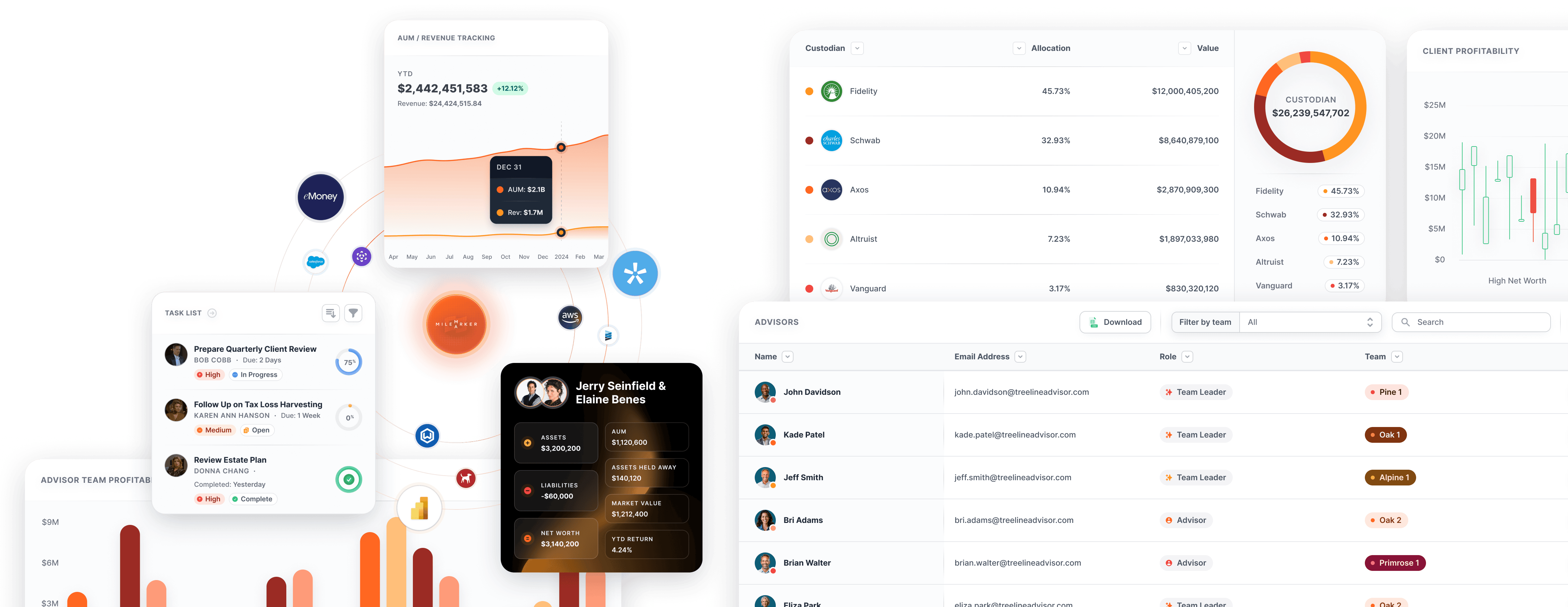

We need to ask macro-level questions about how work needs to get done so the scale can start to happen through a single source of truth and unified insight.

Running in silos makes this problematic.

Fee Model Free Fall

Most advisory firms are already chalked full of clients below desired thresholds while more is being asked of your teams, and clients are questioning the value of an advisor.

How do you quickly determine the ROI of a client? — not so you can dump the client but so you can be more strategic.

Most firms lack the fundamental data and insight to take strategic action.

Getting Real

As the people on MTV’s Real World used to say, it’s time “to stop being polite, and start getting real.”

But what does that really look like?

Here is how I see reality coming to the firms our team at Milemarker partners with:

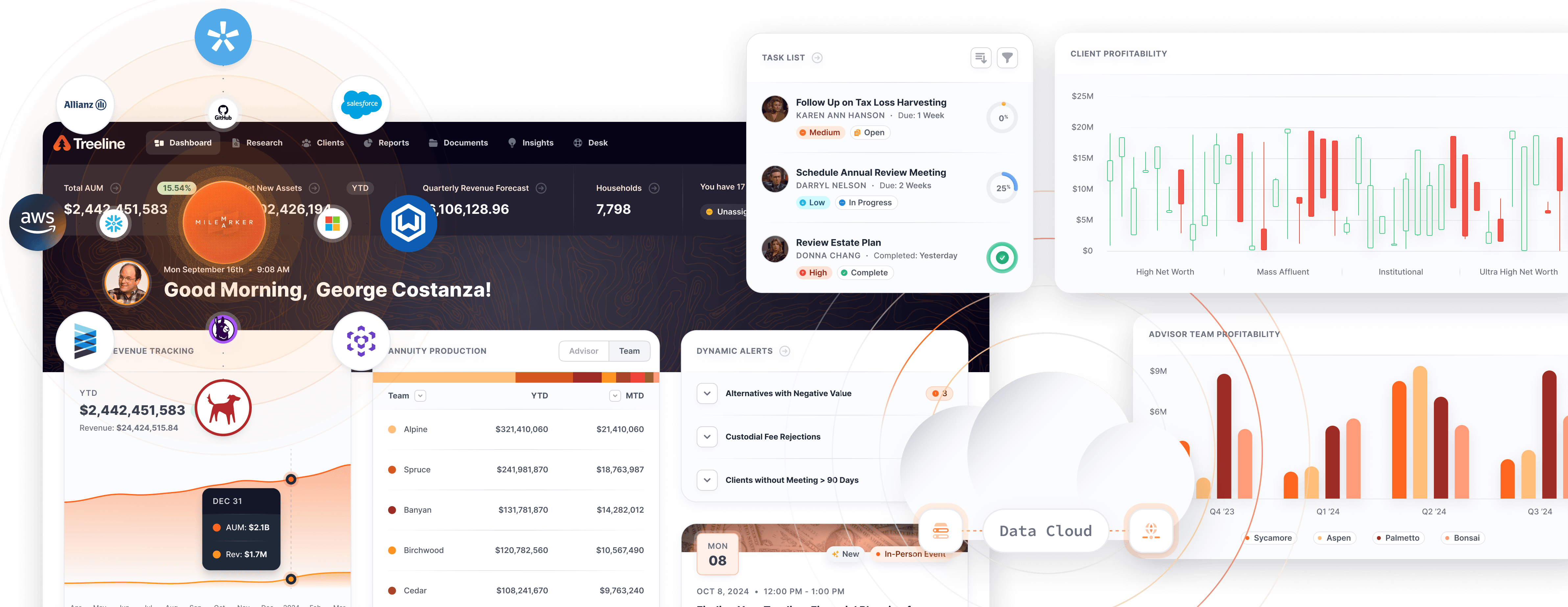

Control: It starts with controlling your destiny, and destiny starts with your data.

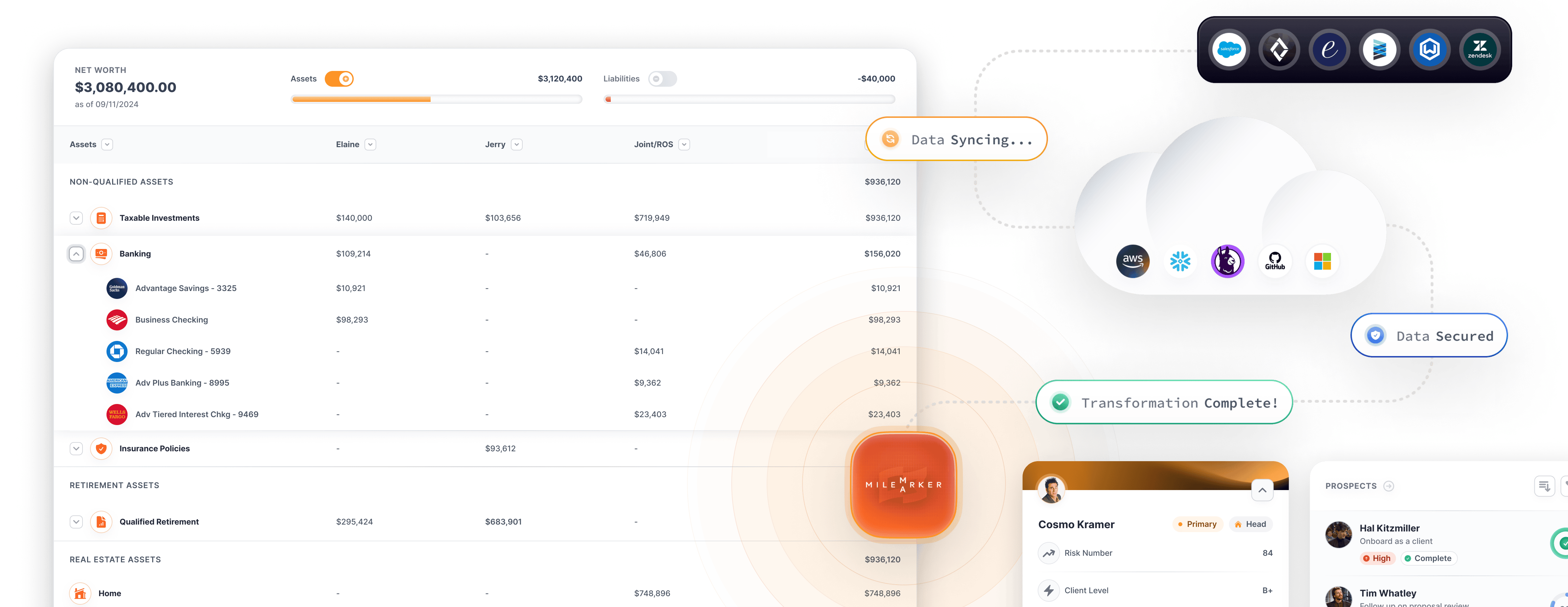

Coordination: The nerds will call this ETL (Extract, Transform, and Load), but it’s where the magic happens. You can bring the logic you likely have in some overly complicated spreadsheet and bring it to life in an automated fashion.

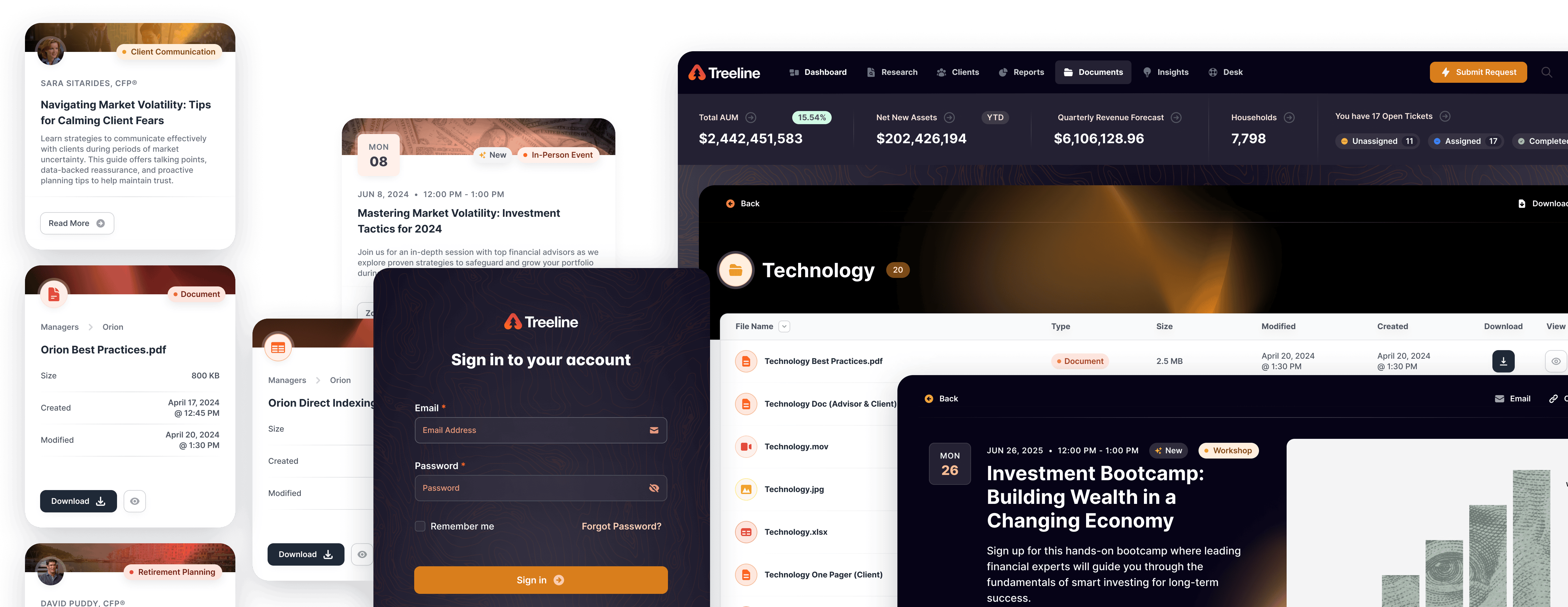

Collaboration: One of the most fundamental aspects of becoming data-driven is hopping in the car together – the right people in front of the correct data at the right time.

Cloud Computing: The reality is that once you know your data and have automated it, you now need to stratify that data and turn it into a more streamlined experience. This doesn’t need to happen for everyone, but we find this nearly every time. Subjective data merits a subjective experience.

Action: I’m out of words that start with C. I tried. Once you have the answers, you need streamlined action through firm, advisor, and team-specific workflows that give your single source of truth a single point of action.

How is your firm getting real with data this year?

Sam Altman on the Future of Companies

Sam Altman is calling for one person, billion-dollar companies at some point in the future.

I’m curious what this concept prompts as you think about our industry and how AI can transform your scale even at a much smaller scale.

For what it is worth, Instagram was a 10-person, billion-dollar company when it sold to Facebook (now Meta) on April 9, 2012. They, to this day, are most definitely in rare air.

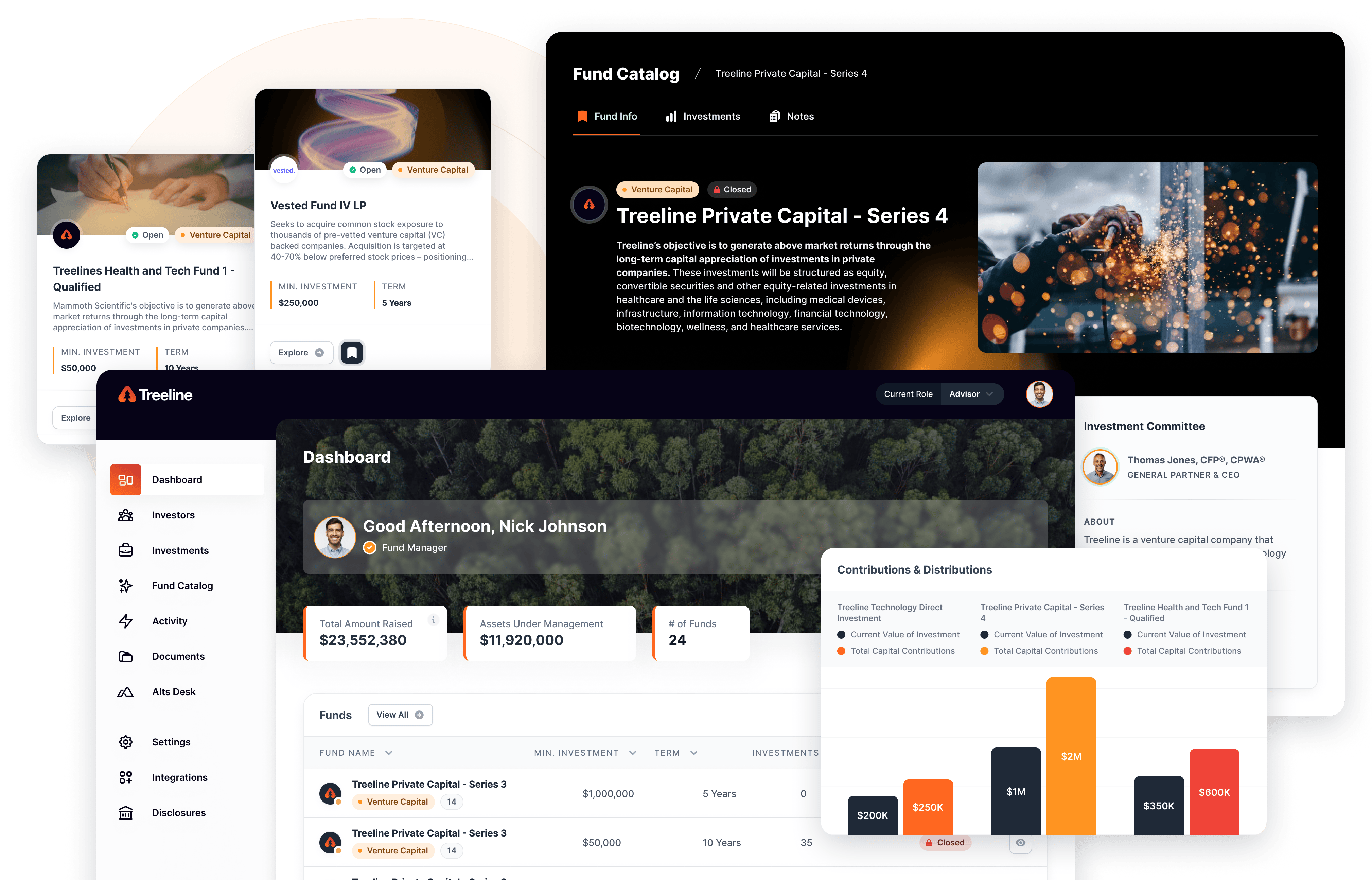

A Neurosurgeon’s Journey into Private Investments with Matt McGirt

My friend Dr. Matt McGirt joined Steve Zuschin on the Alternative Universe this week to discuss his journey to building a venture fund. This path is a big reason that I am bullish on the future of Alts and the importance of streamlining the investor experience.

This episode is also a really good look into the psychology of an ideal client regarding the value they look for from their advisor and how unique funds can dramatically impact client experience.