Every Month-End Is Groundhog Day

Board Meeting Tuesday. Need Revenue By Office.

Export from Schwab. Export from Fidelity. Pull data from Orion. Check Black Diamond. Download from billing system. None of the numbers match.

Advisors call:

"Why is my revenue different from last month's report?"

You think:

"Because I'm still figuring out which system is right."

Spend three days reconciling.

Find calculation errors. Fix what you can. Present approximations.

You're Not Reporting Revenue. You're Managing Confusion.

What You Get

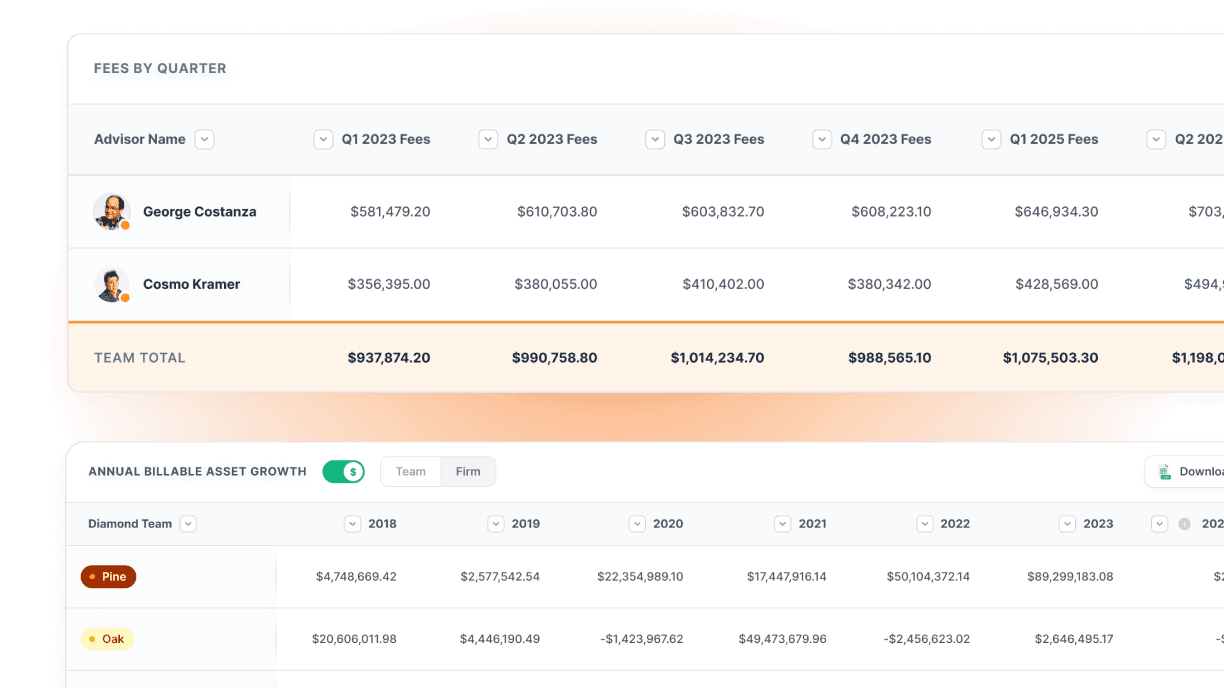

Unified Revenue Dashboard

Real-time revenue across all portfolio accounting systems

Multi-custodial data unified & reconciled automatically

Automated fee calculations with transparent methodologies

Any-angle analysis by advisor, office, client tier, product line

Orion, Black Diamond, Addepar data unified seamlessly

Cross-platform revenue validation & error detection

Performance fee calculations with complete transparency

Historical trending across all portfolio systems

Real-time revenue visibility for every advisor

Detailed breakdowns of fee calculations & sources

Historical performance & revenue trending

Self-service access to reduce revenue inquiries

Automated cross-validation across portfolio systems

Custodial data verification and error flagging

Billing platform synchronization and accuracy checks

Complete audit trail for every revenue calculation

Billing & Payout Automation

Connect any billing platform for automated reconciliation

Advisor payout calculations with complete transparency

Client billing accuracy with detailed fee breakdowns

Exception management for billing discrepancies

Month-End Reports

Click & Present

Advisor Questions

"Check Your Dashboard"

Revenue Accuracy

Exact Numbers, Every Time

Payout Disputes

Eliminated Through Transparency

REAL RESULTS

As firms grow, operations naturally get messy with disconnected systems. Milemarker’s™ seasoned team cuts through that chaos and simplifies the complex with nimble technology. They empower firms to focus on growth and client service instead of manual processes to cover technology gaps.

Lacey Shrum

Founder Smart Kx

Built For

Complex Revenue Structures

Multi-Portfolio System Support

Handle Orion, Black Diamond, Addepar, and any portfolio accounting system with unified reporting.

Advisor Compensation Integration

Connect revenue reporting directly to compensation calculations with complete transparency and accuracy.

Multi-Entity Revenue

Different fee structures across offices, brands, or business lines with unified oversight and reporting.

Client Billing Automation

Generate client-ready fee reports from unified portfolio and custodial data automatically.

Advanced

Revenue Features

Cross-System Validation

Automatic reconciliation between portfolio systems & custodians

Error detection & flagging for manual review

Data quality scoring & improvement recommendations

Historical accuracy tracking & trend analysis

Advisor Revenue Intelligence

Individual advisor dashboards with real-time revenue tracking

Fee calculation transparency & methodology explanations

Historical performance & growth trend analysis

Self-service portal reduces operational inquiries

Billing Platform Integration

Connect to any billing system for automated reconciliation

Invoice accuracy validation against portfolio data

Client billing transparency with detailed fee breakdowns

Automated payout calculations with advisor visibility

Exception Management

Automatic detection of revenue anomalies across systems

Portfolio accounting discrepancy identification & resolution

Custodial data validation & error correction workflows

Complete audit trail for every revenue adjustment

Why This Matters to Leadership

Every inaccurate revenue report costs you credibility. Every advisor question about their numbers costs you operational time.

As a leader, you need revenue intelligence that advisors trust.

Get Revenue Reporting That Creates Confidence.

Stop Reconciling Portfolio Systems Manually.

Stop Explaining Why Advisor Numbers Changed.